Live

- Where to Buy Instagram Followers - Real & Active

- BJP releases ‘charge sheet’ against BJD govt

- District Nodal Officer Venkataramana announced the intermediate results

- She team that stopped child marriages

- Medical devices sector needs separate rules, says industry body AiMeD

- Andhra Paper declares lockout

- Opposition INDIA bloc working on 'one year, one PM' formula: PM Modi

- Delhi HC quashes FIR for outraging woman's modesty, orders man to assist Traffic Police for a month as settlement

- 'Apologise to families of farmers who committed suicide in Vidarbha', Amit Shah dares Sharad Pawar

- SC Collegium recommends appointment of a permanent judge in Chhattisgarh HC, extension of term of two judges

Just In

Beijing impact-QT replaces QE. After six years of QE, prepare for QT! Faith in the power of \"quantitative easing (QE)\" has prompted central banks, led by the U.S.

After six years of QE, prepare for QT! Faith in the power of "quantitative easing (QE)" has prompted central banks, led by the U.S. Federal Reserve, to pump trillions of dollars of stimulus into the global financial system to cushion the impact of the 2007-08 market crisis and recession.

This supply of liquidity continues to flow. The European Central Bankhas taken the baton from the Fed and is leading the way with its 1 trillion euro ($1.1 trillion) bond-buying programme that will run through September next year. The Bank of Japan is also buying large quantities of bonds.

But a counter flow - call it "quantitative tightening (QT)" - is gathering force as China sells foreign exchange reserves to protect its economy and markets from the recent surge of capital out of the country. Other emerging markets are following suit.

Analysts at Citi estimate that global FX reserves have been depleted at an average pace of $59 billion a month in the past year or so and closer to $100 billion over the last few months. A source at another large global bank said emerging market central banks may have sold up to $200 billion of FX reserves this month alone, of which $100-$150 billion likely came from China.

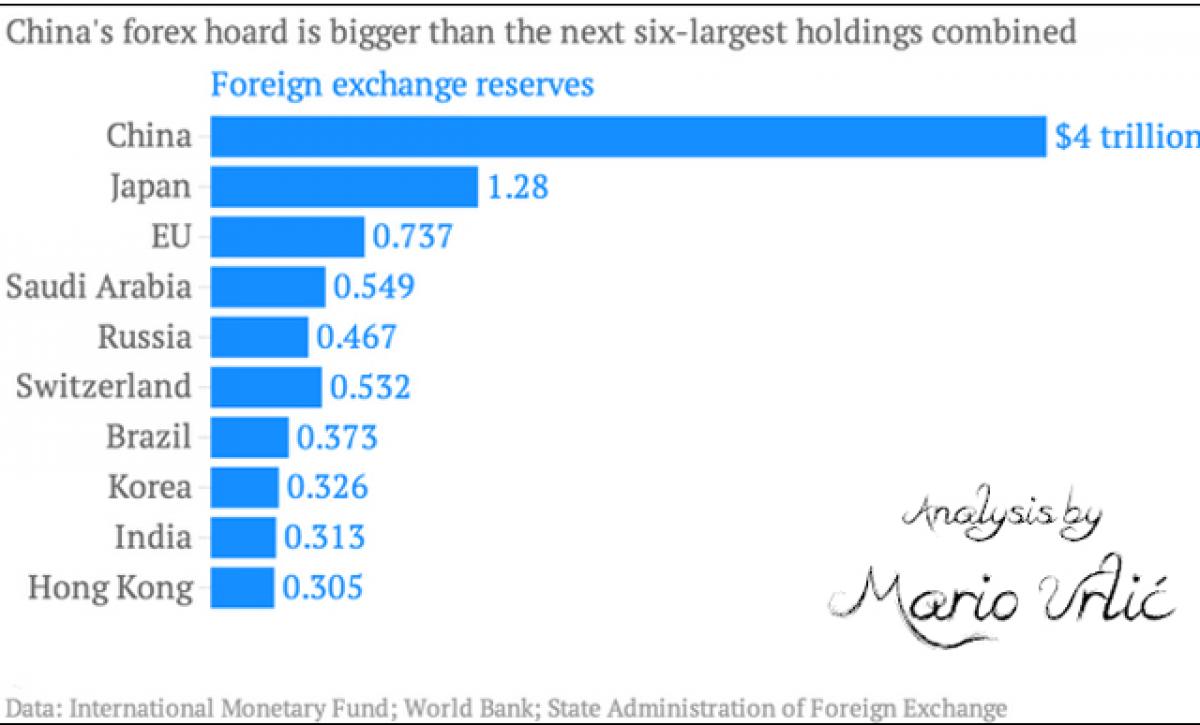

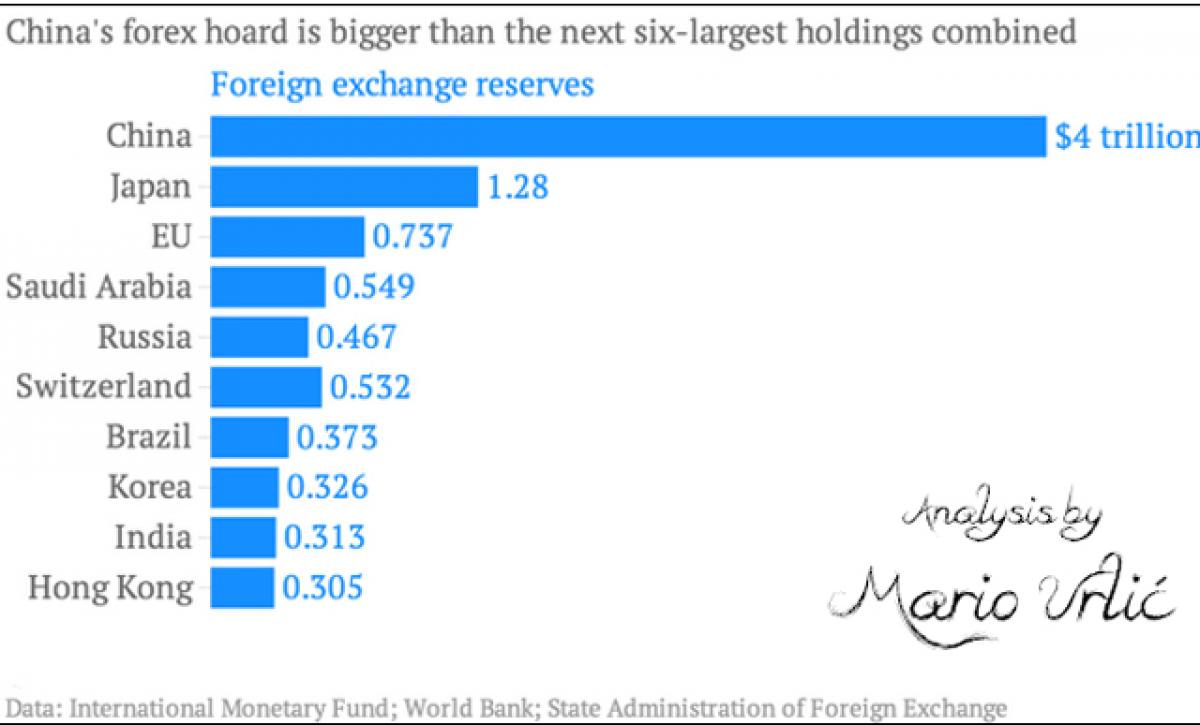

"The potential for more China outflows is huge," said George Saravelos, currency analyst at Deutsche Bank in London. "The bottom line is that markets may fear QT has much more to go." China is by far the world';s biggest holder of FX reserves, most of which is in dollar-denominated assets like U.S. Treasury bills and bonds.

At the end of June it had $3.69 trillion compared with around $150 billion at the turn of the millennium. But that has fallen steadily from a peak of almost $4 trillion a year ago. Some of that is down to exchange rate fluctuations as the dollar has risen, but an increasingly important driver recently is outright selling.

It's difficult to know with certainty how much and which assets specifically China has sold, because the currency and asset composition of its reserves is not disclosed. Using International Monetary Fund currency reserves data as a proxy, around two thirds will be in dollars. U.S. Treasury data show that China holds $1.27 trillion of U.S. bills and bonds, but analysts agree it is substantially more than that.

The implications of China and others selling off their Treasury holdings are potentially huge. Yang Zhao, Chief China Economist at Nomura, estimates that the People's Bank of China sold close to $100 billion of FX reserves in July, and again in August. "After three percent depreciation the PBOC tried to defend the renminbi and they started to intervene very aggressively. So I would say in August it would (also) be very close to $100 billion," Yang stated.

Plunging commodity prices and fears over growth prospects, particularly in China, have sparked a rush for the emerging market exits. Figures from CrossBorder Capital, a research and money management firm in London, suggests capital flight from emerging markets in the past year is almost $1 trillion, of which more than $750 billion has come out of China. But fears of intensifying global "currency wars" have been stoked by China's devaluation of Yuan earlier this month, renewed slides across global EM exchange rates.

By JAMIE MCGEEVER

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com