Live

- DEO suspends teacher accused of sexual assault

- PM ‘cursing’ Congress out of despair: Maharashtra Cong Chief

- Applications are invited for Junior Colleges Scheme District Scheduled Castes Development Officer Ramlal

- A nomination was filed on the second day for the Nagar Kurnool parliamentary seat

- SP Gaikwad inspected the Telangana Amarnath Saleswaram Jatara yatra arrangements

- Rahul Gandhi's decision to contest from Wayanad shows 'lack of confidence': BJP President Nadda

- IPL 2024: Delhi bowlers will go after all of SRH’s top-order batters, says head coach Ricky Ponting

- At Amroha rally, PM Modi sends out ‘meaningful’ message for Muslims and Hindus

- Tripura records highest 79.83 pc voter turnout in Northeast

- The government has to clear the confusion

Just In

Tobacco FARMERS draw applause for adopting modern farming techniques

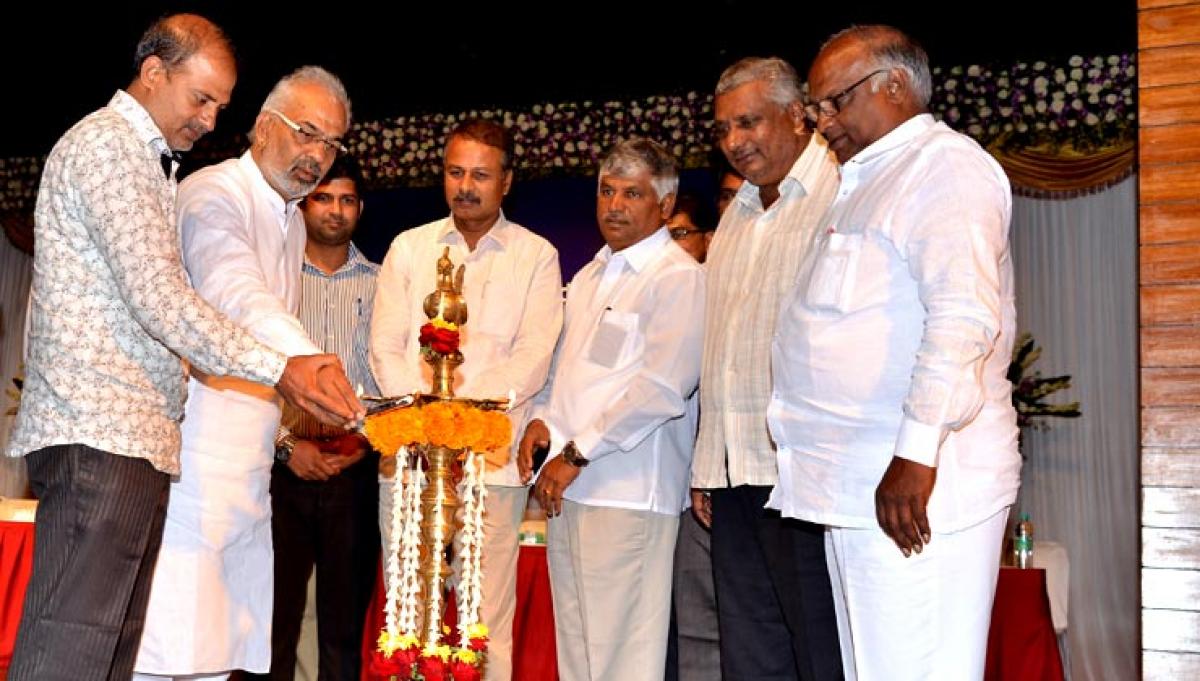

Tobacco FARMERS Draw Applause For Adopting Modern Farming Techniques. The Tobacco Institute of India (TII), today hosted the ‘16th’ TII TobaccoFarmers award’.The Tobacco Institute of India instituted these awards in 1999 with a view to felicitate and encourage..

Bengaluru: The Tobacco Institute of India (TII), today hosted the ‘16th’ TII TobaccoFarmers award’.The Tobacco Institute of India instituted these awards in 1999 with a view to felicitate and encourage the cigarette leaf tobacco farming community for its effort in adopting modern and scientific farming practices, which would help improve yields, produce improved varieties and make Indian tobaccos competitive in the global market. More importantly, through these awards, TII expresses its unstinted support to the cigarette tobacco farmers and acknowledges their significant socio-economic contribution to the country's economy.

The event took place in the presence of Honourable Members of Parliament Shri R Dhruvanarayana, Shri PratapSimha and Shri C S Puttaraju along with the Members of the Legislative Assembly - Shri K Venkatesh, Shri H P Manjunatha and Shri A Manju. Shri Bipin Bihari Chowdary -Director, Auctions of the Tobacco Board, Bengaluru and Dr. D Damodar Reddy - Director of Central Tobacco Research Institute represented their respective organisations.

The event took place in the presence of Honourable Members of Parliament Shri R Dhruvanarayana, Shri PratapSimha and Shri C S Puttaraju along with the Members of the Legislative Assembly - Shri K Venkatesh, Shri H P Manjunatha and Shri A Manju. Shri Bipin Bihari Chowdary -Director, Auctions of the Tobacco Board, Bengaluru and Dr. D Damodar Reddy - Director of Central Tobacco Research Institute represented their respective organisations.

The FCV Tobacco growers of Karnataka, Andhra Pradesh and Telangana are largely dependent on the Legal Cigarette Industry in the country. However, the cumulative impact of successive years of sharply escalating taxes and extreme tobacco control regulations continue to penalize the tax-paying, compliant legal industry causing sharp decline in volumes and leading to shift of consumption to non-cigarette tobacco product forms and contraband cigarettes which do not use domestic tobacco.

The FCV Tobacco growers of Karnataka, Andhra Pradesh and Telangana are largely dependent on the Legal Cigarette Industry in the country. However, the cumulative impact of successive years of sharply escalating taxes and extreme tobacco control regulations continue to penalize the tax-paying, compliant legal industry causing sharp decline in volumes and leading to shift of consumption to non-cigarette tobacco product forms and contraband cigarettes which do not use domestic tobacco.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com