Live

- Director Tharun Bhascker ventures into lead role opposite Eesha Rebba

- Scary first look of Sunny Leone’s ‘Mandira’ unveiled

- Nara Rohith’s ‘Prathinidhi 2’ trailer promises gripping political drama

- Revere farmers who grow our food: Zoho's Sridhar Vembu

- Former Minister Ponguru Narayana Promises Development for Nellore City

- Mekapati Vikram Reddy welcomes TDP, BJP, and Janasena leaders into YSRCP fold

- Protesters lay siege to K’taka HM’s residence demanding punishment for MCA student’s killer

- TDP leader Pattabhiram says false cases booked in attack on YS Jagan's case

- Relationship: Enhancing your parents’ mental well-being

- Daily Forex Rates (20-04-2024)

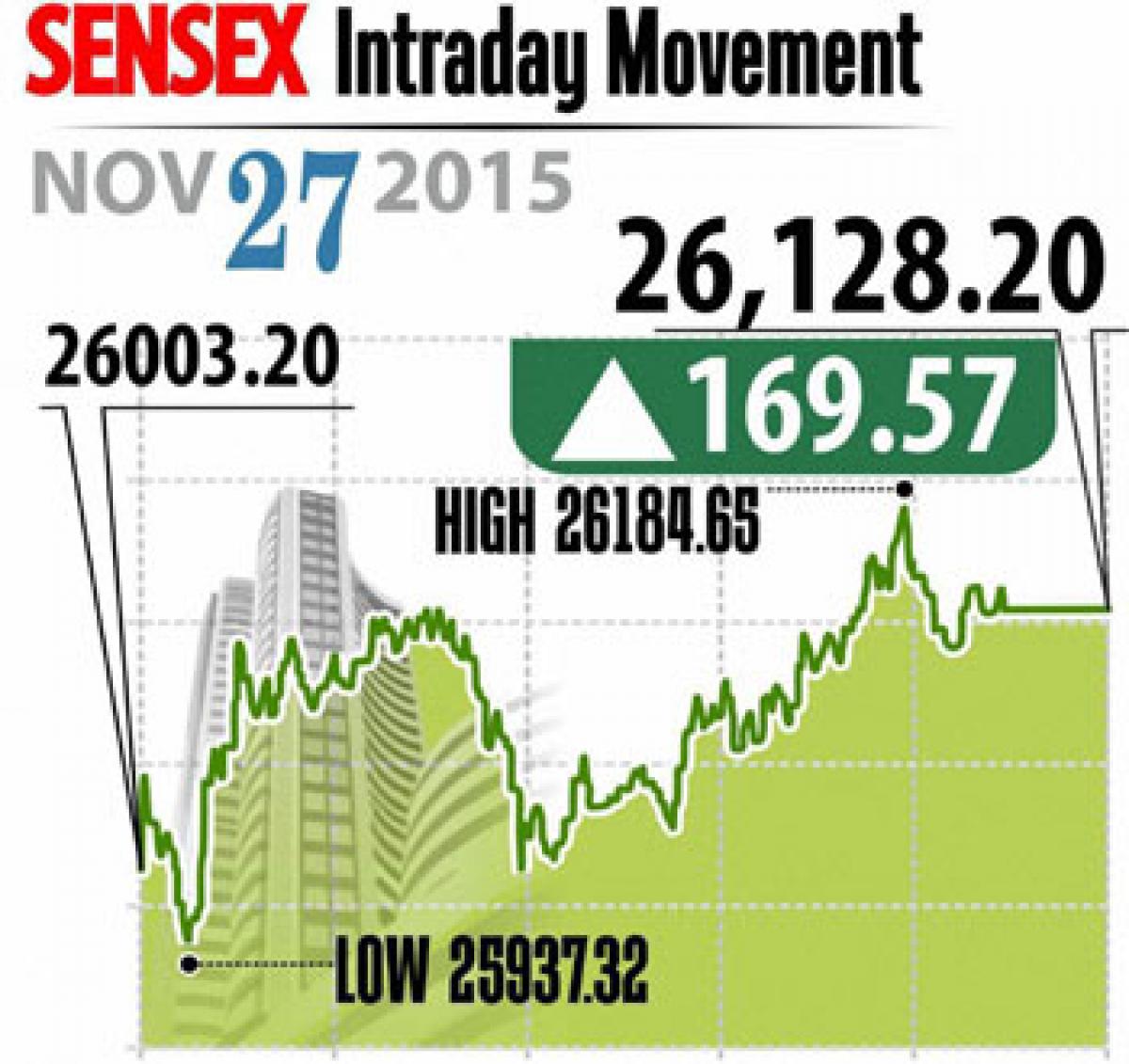

.jpg) Mumbai: The Indian stock markets outperformed global bourses on the first day of December F&O series, following buying spree on select sectors including banks, metal and capital goods.

Mumbai: The Indian stock markets outperformed global bourses on the first day of December F&O series, following buying spree on select sectors including banks, metal and capital goods.