Live

- Hyderabad: Mishap on ORR claims two lives

- Anjuman Agiary bags INTACH Heritage Award

- Health dept issues heat advisory for citizens

- Congress, BRS candidates roll out aggressive campaign in Cantonment

- Mahindra University signs MoU on sustainability practices

- Dr Lakshmi puts off campaign to save mother and child

- Violence mars polls in Manipur

- Israeli missile hits Iran

- Women voters become a deciding factor in Nellore

- Congress eyes opening of account in Prakasam

Just In

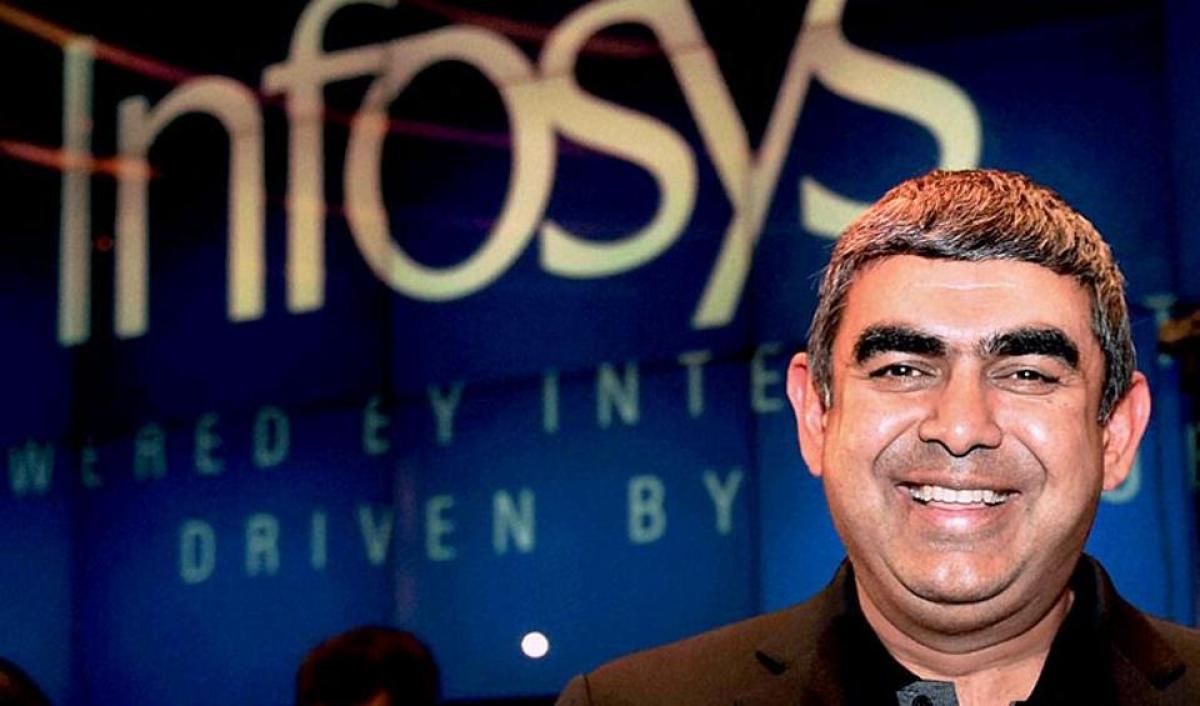

Former Infosys CFO Mohandas Pai on Monday flayed Executive Vice-Chairman Vishal Sikka for blaming co-founder N R Narayana Murthy for the crisis in the company to cover up his \"bad performance.\"

Former Infosys CFO Mohandas Pai on Monday flayed Executive Vice-Chairman Vishal Sikka for blaming co-founder N R Narayana Murthy for the crisis in the company to cover up his "bad performance."

"Yes, true. He (Sikka) wanted to leave from February by his own admission. He is covering up his own failure to reach the target by blaming Narayana Murthy," he told PTI in an e-mail interview.

He stated this in response to a question if Sikka put the entire blame on Murthy to cover up his "bad performance".

Sikka's resignation has plunged Infosys into crisis with the company facing several issues, including a suitable replacement as CEO.

Sikka had resigned following months of acrimony with Murthy, citing "malicious" and "personal attacks" on him, though he did not name Murthy for his exit.

The board of the $10 billion firm blamed him for "continuous assault" through "factually inaccurate" and "already-disproved rumours" for the sudden resignation

"despite strong Board support".

Replying to a query, Pai said that Sikka's appointment as Executive Vice Chairman of Infosys is a governance issue and added it had created a confusing lineup, with the company already boasting of a Chairman (R Seshasayee) and a Co-Chairman (Ravi Venkatesan).

"Yes, the company has a Chair, a Co-Chair, an executive Co-Chair, an acting CEO. A very confusing lineup," he stated.

Earlier in an interview with another media outlet, Pai had said the employment agreement was only disclosed in the Securities and Exchange Commission filing, and he did not recall it had been approved by shareholders.

Asked if the Infosys Board had any power to bar Narayana Murthy's re-entry into the company, Pai said nowhere in the world did any board make such an 'absurd' and 'untenable' statement about a promoter-shareholder.

"Nowhere in the world did any board make such a statement about a promoter-shareholder. It is absurd and untenable and beyond their brief," he said.

Moreover, shareholders decide on directors, though boards appoint them, but they are not final authority.

"Shareholders decide who will be directors. True, boards appoint them, but they are not the final authority," he said.

Asked whether the incumbent CEO should be from inside or outside the company, Pai said, "A person who values company's culture, not an arrogant self-proclaimed reformer. As Peter Drucker said - company culture eats strategy for breakfast."

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com