Live

- BJP releases ‘charge sheet’ against BJD govt

- District Nodal Officer Venkataramana announced the intermediate results

- She team that stopped child marriages

- Medical devices sector needs separate rules, says industry body AiMeD

- Andhra Paper declares lockout

- Opposition INDIA bloc working on 'one year, one PM' formula: PM Modi

- Delhi HC quashes FIR for outraging woman's modesty, orders man to assist Traffic Police for a month as settlement

- 'Apologise to families of farmers who committed suicide in Vidarbha', Amit Shah dares Sharad Pawar

- SC Collegium recommends appointment of a permanent judge in Chhattisgarh HC, extension of term of two judges

- U20 Men's football nationals: Telangana, Sikkim earn full points with easy win

Just In

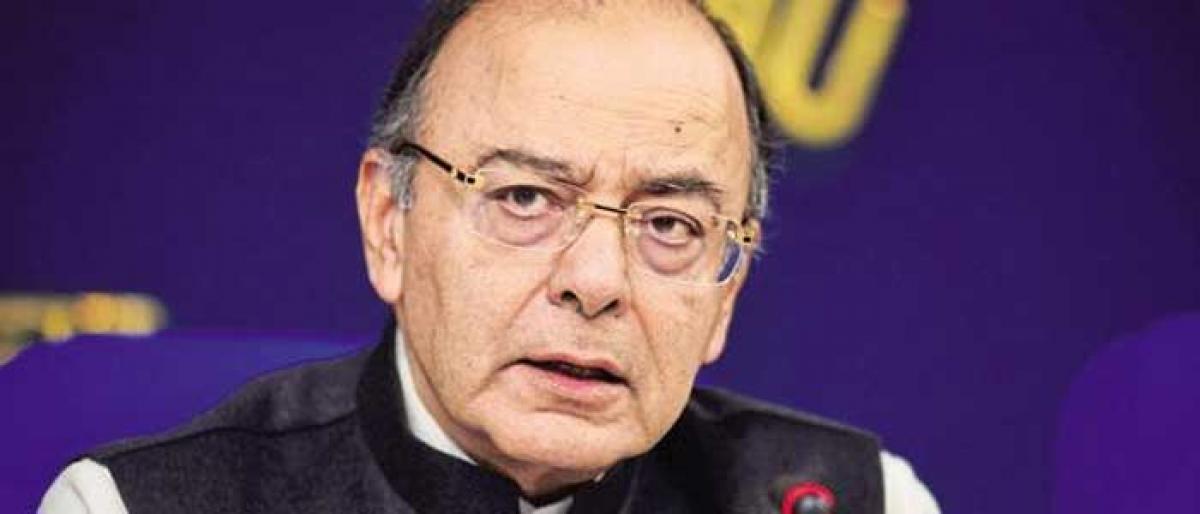

It is time the Finance Minister needs to begin to think of strategies to counter the negative impact of a tax war on business taxation. Perhaps, he also needs to start thinking of alternative tax instruments which could be gainfully utilised to boost tax revenues as the Big Day approaches

It is time the Finance Minister needs to begin to think of strategies to counter the negative impact of a tax war on business taxation. Perhaps, he also needs to start thinking of alternative tax instruments which could be gainfully utilised to boost tax revenues as the Big Day approaches. This will be the last full-year budget for the BJP-led NDA Government before the next General Elections and its last chance to sustain the push it has given to the economic reforms.

In his Budget, the Finance Minister is expected to propose cutting corporate income tax rate by one to two percentage points, as part of a broader strategy to attract higher investment, push growth and generate more jobs. In the 2015-16 Budget, Jaitley had laid a road-map to bring down corporate tax rate to 25 per cent, which is yet to be implemented. He had, in fact, gone ahead and stated that the prevailing tax rate was higher in the country compared to those in other key Asian economies, making Indian industry uncompetitive.

He knows this process of reduction has to be necessarily accompanied by rationalisation and removal of various kinds of tax exemptions and incentives for corporate taxpayers, which incidentally account for a large number of tax disputes. The effective collection of corporate tax is about 23 per cent in the country which only means that we are losing out on both counts. A regime of exemptions has led to pressure groups, litigation and loss of revenue. In 2015-16, the estimated tax revenue lost to exemptions was Rs 76,858 crore and this was projected to increase by another Rs 10,000 crore nearly the next year.

Given that there exist a range of tax incentives, there is limited room to reduce the headline tax rate due to revenue considerations in the country, in fact. The fact is that while the headline tax rate is only 30 per cent, coupled with various cesses and surcharges, the actual headline rate is almost 35 per cent. But, companies use the services of professionals to bring their tax liability down, close to the effective rate of 23 or 24 per cent. This has led to a situation where despite being a high tax economy, India ends up with low revenues owing to tax incentives.

It should be noted that proposals relating to business income taxation have the potential to start a huge international tax war, as the low headline corporate tax rate may spark competitive rate reductions across the world. This could have tremendous consequences for the investment environment in emerging economies, particularly in India.

The Economic Survey 2016-17 highlighted that India should generate jobs that are formal and productive, provide more bang-for-the-buck in terms of jobs created relative to investment, have the potential for broader social transformation, and can generate exports and growth. A reduction in the tax rates will reduce the cost of credit from the banking system over time and also reduce the cost of capital and make the job-intensive sectors more competitive. Labour-intensive industry also benefits thus. The key to arresting jobless growth is lowering corporate tax rate.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com