Live

- Cong wants to rob inheritance rights of common people: Anurag Thakur

- Revanth’s tall promises are ‘near impossible’ to achieve: Eatala

- Vote judicially to decide PM to make India developed: Kishan

- ‘Anwesha’ offers quality education to ST and SC students

- Congress targeting nationalists to divide country: Dr Laxman

- BJP ‘charge sheet’ accuses BJD govt of rampant corruption

- Delhi court reserves orders on bail petition of Kavitha for May 6

- Konda Vishweshwar Reddy holds rally in Tandur

- Revanth fielding dummy candidates to benefit BJP: KTR

- KTR takes part in road show to boost cadre morale

Just In

Even as the Reserve Bank of India made it clear that one can withdraw upto Rs 2.5 lakh for wedding purposes, reports are coming in that banks are not abiding by the rule.

Even as the Reserve Bank of India made it clear that one can withdraw upto Rs 2.5 lakh for wedding purposes, reports are coming in that banks are not abiding by the rule.

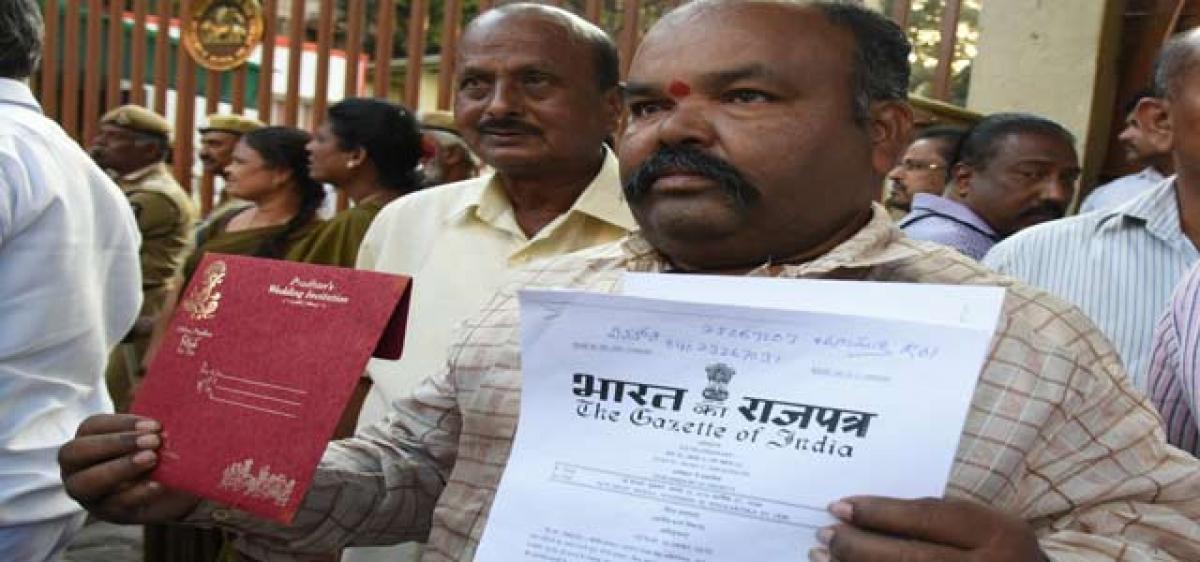

In one such story, Mehdipatnam-based Narasimhulu recently faced rejection from a local Andhra Bank branch.

Narasimhulu went to withdraw funds to meet the expenditure of his brother’s wedding that is slated on November 25. However, to his shock, bank officials were only allowing him a maximum of Rs 24,000.

Contesting the same, Narasimhulu presented to the officials, a copy of Gazette Notification by the Government, which he claims was given to him by the local RBI staff.

A recent harrowing incident to a local brought out the catch in the RBI’s statement that allows for withdrawing `2.5 lakh for weddings

The notification dated November 18 provides that a customer can withdraw upto Rs 2.5 lakh in case of wedding expenses.

However, the bank expressed their helplessness to release funds. The officials said that they had not received intimation from their higher-ups and refused to honour the Gazette Notification, which is binding on them.

They said that they are following the maximum withdrawal limit set by the Union government, which is Rs 24,000.

There’s a catch in the said notification, which many like Narasimhulu are not aware of and continue to make rounds around banks.

According to local RBI officials, the Gazette Notification provides for the release of the said fund for wedding expenses, subject to conditions prescribed by the RBI.

The conditions include that the customers can only withdraw the amount if such sums were present in their respective accounts as of November 8, 2016.

Withdrawals are allowed only if the account has full “Know Your Customer” complied and the date of marriage should fall before December 30, 2016. Further, withdrawals can be done only by either of the parents or the person getting married.

“Even in this case only one of them will be permitted to withdraw,” said a local RBI offical.An application in specific format giving details of name of the person withdrawing, amount, PAN, address, names of bride and groom and their identify proofs, addresses of the couple, date of marriage and such is required.

In addition, a declaration to the effect that either of the parents is not withdrawing funds twice or from multiple branches of the same or different banks should be given.

That apart, evidence of the wedding should be shown by presenting invitation card, copies of receipts for advance payments already made, such as marriage hall booking, advance payments to caterers and the like.

It should also accompany the list of persons to whom the payments are to be made along with a declaration from them claiming that they do not have a bank account.

Banks are asked to keep proper record of all these documents for further verification by authorities concerned, the sources clarified.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com