Live

- Extreme weather may pose risk to inflation: RBI

- TDP candidate assures to provide concession on power tariff

- BS Maqbool Urges Voters to Support Good Governance in Election Campaign

- Chief Minister makes YSRCP’s stance clear on Vizag Steel Plant

- YSRCP Candidate files Nomination for Eluru Parliament constituency

- TDP MLA Candidate Accuses YCP of Inciting Religious Fanaticism in Kadiri District

- Kalyandurg TDP candidate richest in Anantapur district

- This poll will end 5 years of ‘demonic rule’, says Pawan

- Nai Brahmins recognized in YCP government, Visakha west MLA candidate Adari Anand Kumar assures support

- India Alliance Holds Meeting in Eluru to Ensure Success of Sharmilamma Bus Nyay Yatra

Just In

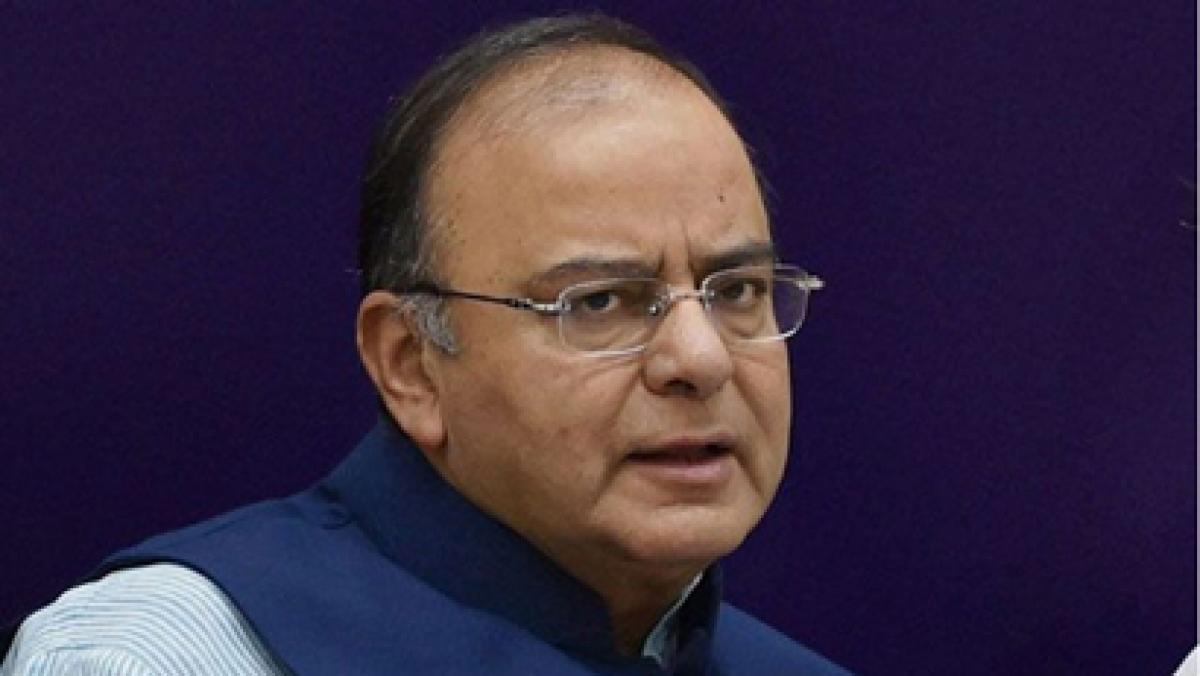

India\'s Finance Minister Arun Jaitley presented the Union Budget for 2016 -17 in Parliament.

India's Finance Minister Arun Jaitley presented the Union Budget for 2016 -17 in Parliament. Here are live updates from the session...

Agenda for next year is to undertake transformative measures based on 9 pillars for India: Jaitley

Next financial year will cast an additional burden due to implementation of 7th Pay Commission and OROP: FM

Govt is launching a new initiative to provide cooking gas to BPL families with state support

We must strengthen firewalls against risks through structural reforms; rely on domestic market so that growth does not slow down: FM

Farm, rural sector, infra, social sector to have more Government expenditure: FM

Our external situation is robust, CAD has declined to $14.4 bn this year, will be 1.4% of GDP at the end of fiscal: Arun Jaitley

CPI inflation has declined to 5.4%: Jaitley

We have to have a prudent fiscal policy, raise domestic demand, carry out reforms: Jaitely

Foreign exchange reserves are at highest ever level: FM

FM: The growth of GDP has accelerated to 7.6%

We have converted difficulties and challenges into opportunity: Jaitley

However, Indian economy has held its ground firmly despite global crisis, Arun Jaitley says.

Finance minister Arun Jaitley presents Union Budget for the next fiscal in Lok Sabha.

India has been hailed as the bright spot and that India's growth is extraordinarily high, Arun Jaitley pointed out.

Arrangements made for pulses procurement: FM @arunjaitley

35,984 allocated for Agriculture in 2016-17: FM

Will undertake more spending to boost rural economy, protect poor, re-infuse capital into banks: FM

Arun Jaitley: Rural Sadak Yojana allocation at Rs 19,000 Cr for Financial Year 2017

A dedicated irrigation fund worth Rs 20,000 crore to be set up under NABARD: FM on #Budget2016

Unified agri-platform to be dedicated to the nation on the birth anniversary of BR Ambedkar

Allocation of Pradhanmatri Gram Sadak Yojna to be increased to Rs 19,000 crore: Jaitley

Govt will undertake 9-point reforms including steps to ensure ease of business in governance, fiscal discipline to ensure benefits for people

Nominal premium and highest ever compensation in case of crop loss under the PM Fasal Bima Yojana has been recorded

65 eligible habitats to be connected via 2.23 lakh kms of road. Current construction pace is 100 kms per day: FM

A unified agriculture market e-platform will be dedicated to the nation on the birthday of Dr. B.R. Ambedkar: Arun Jaitley

A dedicated irrigation fund worth Rs 20,000 crore to be set up under NABARD

5 lakh acres to be brought under organic farming over a three year period

We will enact a law to confer benefits on deserving sections on Aadhar platform

Govt to provide incentive for deepwater gas exploration

Rs 35,984 allocated for agriculture

Aim to double the income of farmers in five years. Rs. 35,984 crores total allocation for farmers' welfare

300 rural clusters to be set up under Shyama Prasad Mukherji Rurban Mission

Rs 38.5 crores allocated to MNREGA:

Govt committed to achieve 100% village electrification by 1 May 2018

Record agri credit target of Rs 9 lakh crore in 2016-17 set

6 crore additional households to be covered under #DigitalLiteracy scheme in next 3 years

Highest-ever amount Rs 38,599 crore allocated for #MGNREGA in FY17

Sensex rises by 30.11 points, at 23,184.41

Digital Literacy Mission Scheme to be implemented in Rural areas

Govt will launch a new health protection to provide health cover of over Rs 1 lakh

Rs 38,500 cr allocated for MNREGA in 2016-17, the highest ever if entire amount is spent.

Rs 2.87 lakh crore will be given as grants-in-aid to village panchyats and municipalities to boost rural economy.

Govt to spend Rs 850 crore in a few years on animal husbandry, cattle and livestock breeding: FM.

We have decided to embark upon massive mission to provide an LPG connection in the name of women members of poor households

States will be encouraged to take up decentralised procurement of foodgrains

Rs 9,000 crores allocated to Swaccha Bharat Abhiyaan

Appreciation for 75 lakh middle class and lower middle class for willingly giving up LPG Subsidy

A National Dialysis Services Program to be introduced under National Health Mission

New 3,000 stores to be opened under the Jan Aushadhi Scheme in 2016-17

A Digital depository for school leaving certificates

We have decided to setup a Higher Education Finance Company, an amount of Rs 1000 Crores to be initial allocation

1700 crores for Pradhan Mantri Kaushal Vikas Yojana

Govt. will pay EPF contribution of 8.33% for all new employees for 1st three years

National Skill Development Mission has imparted training to 76 lakh youth. 1500 Multi skill training institutes to be set up: FM

A higher education financing agency to be set up with a fund of Rs 1000 crores

1500 Multi skill training institutes will be set up: Finance Minister Arun Jaitley #UnionBudget2016

Govt will launch a new health protection scheme which will provide health cover upto Rs 1 lakh per family: Arun Jaitley

Govt promises statutory backing for Aadhaar in the coming year #BudgetWithTP

55,000 crore for roads and highways: FM

Govt to provide Rs 500 crore for Stand Up India scheme: FM

85% of stalled road projects back on track: FM

We will interlink state employment exchanges with national service career platform: FM

#Entrepreneurs will be able to operate buses on various routes, subject to efficiency and safety norms: FM

Retail trade is largest service sector employer in country. Many more jobs are created in this, provided the regulations are simplified: FM

Digital literacy scheme for rural India: FM

One cr youth to be skilled over next three years

62 new Navodaya vidyalayas to be opened in next two years.

If shopping malls are kept open all 7 days of the week, why not small and medium shops? asks FM Arun Jaitley

3000 crore rupees earmarked for nuclear power generation: FM

Initiatives being introduced to reinvigorate infrastructure sector through PPP

A new policy for management of assets of public enterprises

This will create an impetus to farmers, provide vast employment opportunities: FM

FM announces new credit rating system for infrastructure projects

Govt to incentivise gas production from deep sea and other yet to be utilized sources

100% FDI in the marketing of food products produced and manufactured in India

Shopping malls to be allowed to open on all seven days of week; a model shops and establishment bill to be circulated to states

85 pc of stuck road projects have been put back on track; highest ever contracts awarded in current fiscal.

Govt will continue to take measures to support the export sector, says FM

Will incentivise Gas production from deep sea & other deep sources which are yet unutilised

There are 160 airports and airstrips which can be revived

Motor Vehicles Act to be amended to enable entrepreneurship in the road transport sector

10 public and 10 private educational institutions to be made world-class. Digital repository for all school leaving certificates and diplomas. Rs. 1,000 crore for higher education financing

Hub to support SC/ST entrpreneurs

Total rural sector allocation Rs. 87,769 crore.

Rs. 2.87 lakh crore for gram panchayats as per recommendation of 14th finance commission.

Four schemes for animal welfare.

Dept of Disinvestment to be renamed as Dept of Investment and Public Asset Management: FM

A public utility resolution of disputes bill will be introduced during 2016-17: Arun Jaitley

Senior citizens will get additional healthcare cover of ₹30,000 under a new scheme: FM

Abolition of permit law will be our medium-term goal in public transport.

25,000 crore for recapitalization of public sector banks: FM

More number of benches of Security Appellate Tribunal to be introduced by amending SEBI Act

New Financial Data Management Centre to facilitate integrated data analysis: FM Arun Jaitley

Number of measures to be undertaken to deepen corporate bond market: FM

Rs 1,000 crore allocated for new EPF (Employees' Provident Fund) scheme

Markets react to Budget: Sensex falls more than half a percent, Nifty loses nearly 40 points

Allocation of 25000 crore for recapitalization of public sector Banks

Target of disbursement under #MUDRA increased to 1,80,000 crore

Will introduce targeted delivery of subsidy benefits via Aadhar to benefit the poor and vulnerable

Govt will open up road transport sector in passenger segment

Public money should reach poor without any leakage: Arun Jaitley

FM says the govt plans to double farmers income in five years

A Fund of Rs 900 Crores started for stabilising market crisis of pulses

160 airports and airstrips can be revived at a cost of Rs 50-100 crore each

We are confronted with stress assets prob in public sector banks which is legacy of past,hv already taken many steps in this regard: Jaitley

A Bill to amend the Companies Act to be introduced in the coming session for the Ease of doing business

2,000 km of state highways to be converted into national highways: Arun Jaitley

RBI Act to be amended to give statutory backing for monetary policy: FM

Fiscal deficit at 3.9% in 2015-16 and at 3.5% in 2016-17; no deviation from fiscal deficit roadmap: FM

Fiscal targets to be adhered to without compromising public spending: good move again

More no. of benches of Security Appellate Tribunal to be introduced by amending SEBI Act to reduce pendency:FM

Plan and non Plan classification of Budget will be done away with from Fiscal 2017-18

A bill on targeted delivery of financial services using Aadhar to be introduced

Classification of expenditure as plan and non-plan to be done away with.

Amendment to the Companies Act to ensure speedy registration and boost start-ups.

Direct Benefit Transfer for fertiliser subsidy.

Amendmends to boost Asset Reconstruction Companies to manage NPAs of public sector banks.

Accelerated depreciation to be capped at 40%: Arun Jaitley

For tax payers earning below Rs 5 lakh, ceiling on tax rebate increased by Rs 3,000- FM Arun Jaitley

Relief will amount to Rs 3000 per annum; 1 cr tax payers to benefit.

Tax rebate for those under Rs 5L per year, tax rebate on rent up from Rs 24,000 to Rs 60,000 per annum

Tax proposals to provide relief to small taxpayers through rebates-FM Jaitley

Relief to those in rented houses: deduction raised from 24,000 to 60,000 Rs. under Section 88G - FM

FM: It is time to review working of FRBM Act - Committee to be constituted to study the Act

Govt acknowledges the role of tax payers in Nation building: FM

Presemtive income tax scheme to be extended to all professionals with income of Rs 50 lakh with a presumption of 50 per cent profit.

Income tax rate for companies with low turnover - Rs 5 crore an annum - lowered

Consolidation roadmap for public sector banks to be spelt next year; govt open to reducing its stake in PSBs below 50 pc.

Corporate income tax: FM arunJaitley announces incentives for new manufacturing companies and relatively small enterprise companies

Govt to increase ATMs, micro-ATMs in post offices in next three years

Suitable changes to be made in customs and excise duty rates to boost Make In India: FM

Sensex plunges nearly 300 points, Nifty over 100 points as Finance Minister presents taxation proposals in Budget 2016-17

100% deduction for profits of undertakings from housing projects in cities during Jun '16 - Mar '19: FM

Service tax exempted for general insurance schemes under Niramayi Swasthya Bima Yojana: FM

Earlier: 12%, Now on : 15% - surcharge on income tax for those with incomes exceeding 1 crore per annum: FM

The govt introduces a new cess - Krishi Kalyan Cess - even though none of existing ones get used

Service Tax exemption for services under the Deen Dayal Gram Jyoti Yojana: FM

Companies incorporated after March 1st 2016 to be taxed at 25%+ Surcharge

Service tax exemption for construction of affordable housing upto 60 sq.m: FM

Small petrol/LPG/Diesel cars to have extra pollution cess!

#Budget2016 #Environment #Pollution Infrastructure cess of 1 per cent on #petrol, LPG and CNG #cars @arunjaitley

Arun Jaitley: Excise duty on tobacco increased by 10-15%, except for beedi #Budget2016

New measures to ensure tax compliance of transgressors introduced. Focus on bringing back black money to the books: FM

Limited tax compliance window from June 1st to September 30th for declaring undisclosed income

#CleanEnergy cess to be renamed to #CleanEnvironment cess, increased from 200 to 400 rs/ton of coal

Declarations to have immunity from prosecutions: FM Jaitley

#Budget2016 #Environment Infrastructure cess of 2.5 per cent on #diesel #cars

Committed to a stable taxation regime, says FM

Govt plans to spend Rs 19.78 lakh crore in 2016-17 - Rs 5.5 lakh crore under plan head, Rs 14.28 lakh crore under non-plan head.

Revenue deficit target improved from 2.8 pc to 2.5 pc in current fiscal.

Levy of heavy penalty for non-payment of tax has led to high litigation. arunJaitley proposes to modify scheme for penalties

Penalty to be 50% of tax in income under-reporting cases, 200% in misreporting of facts: FM

Scope of e-assessment to be expanded to 7 mega cities, to simplify compliance for taxpayers: FM

#Environment #SUVs, luxury cars to be more expensive

FM introduces one-time dispute resolution scheme for retro tax cases, payment of tax arrears to lead to waiving of penalty and interest.

Plan to use technology in taxation dept in a big way: Jaitley

We have a dream to see a more prosperous India and a vision to transform India

I accept suggestion from Rahul Gandhi on providing relief to differently-abled people: FM Jaitley

Income tax dept will expand e-sahyog to assist small taxpayers

Proposal for Govt. will pay interest rate of 9% over 6% if delay is more than 90 days: FM

Arun Jaitley: No changes have been made to existing income tax slabs #Budget2016

Net revenue gain of RS. 19,610 crores due to surplus from indirect taxes: Arun Jaitley

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com