Live

- Gold rates in Visakhapatnam slashes, check the rates on 19 April 2024

- Filing of nomination commences

- Gold rates in Vijayawada slashes, check the rates on 19 April 2024

- Adireddy Srinivas files nomination

- Hyderabad: 42 candidates file nominations on first day

- Sharmila accuses CM of living in ivory tower

- Gurumoorthy appears to be ahead of pack

- CM bus yatra draws huge crowds

- From a doctor to a politician, Thanuja Rani looks forward to serve society

- Hyderabad: ‘Modi govt contributed Rs10 lakh cr for TS development in a decade’

Just In

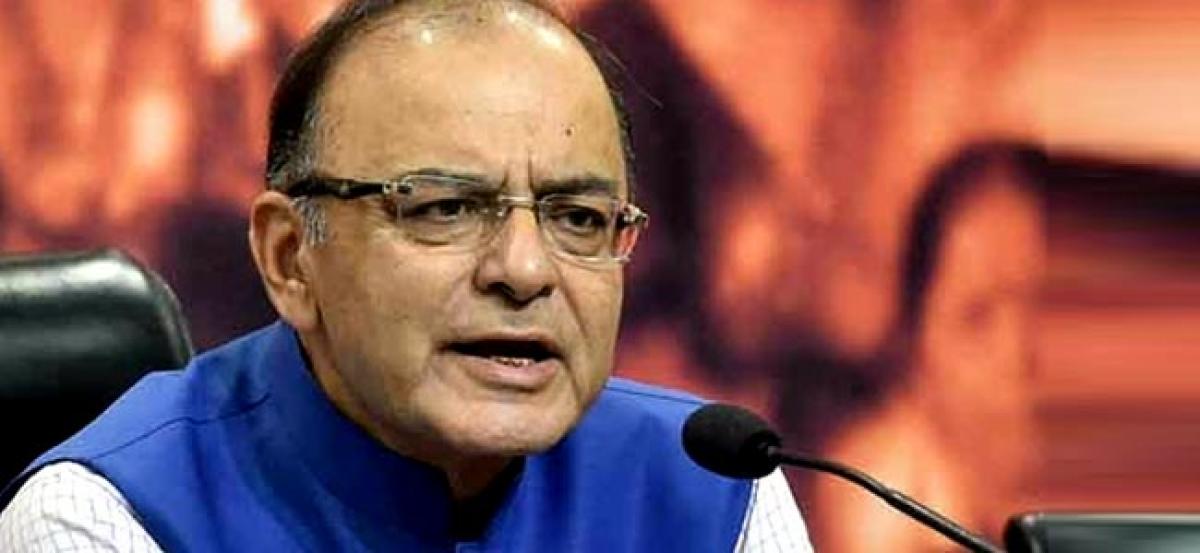

Five sets of draft rules relating to registration, payments, returns and refunds under the Goods and Services Tax (GST) regime were approved by the GST Council here on Friday, Finance Minister Arun Jaitley said.

New Delhi: Five sets of draft rules relating to registration, payments, returns and refunds under the Goods and Services Tax (GST) regime were approved by the GST Council here on Friday, Finance Minister Arun Jaitley said.

However, the big issue of GST rates, service tax assessments and the states' compensation will be decided in the Council's next meet on October 18-20, Jaitley told reporters at a media briefing after the meet.

"Rules for registration, payments, returns, refunds have been approved by Council," Jaitley said adding, "rates would be the big item to be discussed in the next meet. Discussion regarding service tax assessments, states' compensation will also continue in the next meet."

This was the second meeting of the Council, the first one being held on September 22.

The Council in Friday's meet decided upon a levy of tax on all exempted entities under GST and discussed industrial and area-based exemptions for hill and northeast states.

It was also decided that the tax incentives on investments by Centre and states will be done away with, Jaitley said.

Earlier in the day, the Finance Minister briefed the Parliamentary Panel on GST. He told the panel that the first meeting of GST Council was held in a cordial and federal spirit, and hoped all pending issues will be thrashed out in due course for a uniform pan-India indirect tax regime to take effect.

"Today, starting from September 22, we have roughly two months' time till November 22 to resolve all the outstanding issues. Therefore, a draft timetable has been given, which also has been adopted," Jaitley said following the first meeting of the GST Council.

The target roll-out of GST will depend on the passage of the Central GST and the Integrated and GST (IGST) bills in parliament and the respective state GST bills by each state.

The central government is following the roadmap to implement the Goods and Services Tax (GST) by the targeted deadline of April 1, 2017.

The GST is a single indirect tax that proposes to subsume most central and state taxes like the Value Added Tax, service tax, central sales tax, excise duty, additional customs duty and special additional customs duty.

The states will, however, be able to adopt a GST structure that is different from that recommended by the GST Council and the council recommendations will not be binding on the states.

The bill says the GST Council will make recommendations to the Centre and the states on issues such as taxes, cess and surcharges that might be subsumed in the GST tax rate.

Parliament and state assemblies have the right to accept those recommendations in their GST Bills.

Meanwhile, at a meeting here with the Empowered Committee of State Finance Ministers on GST last month, India Inc. pitched for an 18 per cent standard rate on the ground that this rate will generate adequate tax buoyancy without fuelling inflation.

The opposition Congress had earlier demanded an 18 per cent cap on the GST rate.

The Federation of Indian Chambers of Commerce and Industry (Ficci) suggested that to check inflation and the tendency to evade taxes "the merit rate should be lower and the standard rate reasonable".

"As per the current indications and reports, goods will be categorised as being subject to merit rates (12 per cent), standard rates (18 per cent) and de-merit rates (40 per cent)," Ficci said in a release following a meeting here with the Empowered Committee.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com