Live

- Unveiling the Hidden Gems: Surprising Health Benefits of Garlic Peels

- Overcoming Sleep Struggles: A Comprehensive Guide to a Restful Night

- RTC bus hit the auto

- MLA Kuchukula Rajesh Reddy participated in the Birappa festival

- DMHO starts awareness campaign on Malaria

- World Intellectual Property Day 2024: Date, History, Significance, and Everything You Need to Know

- Shiv Sena-UBT manifesto assures dignity to all states; ‘no’ to polluting nuclear, refinery mega projects

- IPL 2024: Delhi Capitals sign Gulbadin Naib to replace injured Mitchell Marsh

- Delhi court grants 30-day extension to police to conclude probe in Parliament security breach case

- Cash, liquor, drugs valued at Rs 321 crore confiscated in Punjab

Just In

Globalised economy is punctuated by movement of capital without any sort of barriers. Such capital movement in the form of FII (Foreign Institutional Investment) or FDI (Foreign Direct Investment) helps the investors and rarely the hosts.

Globalised economy is punctuated by movement of capital without any sort of barriers. Such capital movement in the form of FII (Foreign Institutional Investment) or FDI (Foreign Direct Investment) helps the investors and rarely the hosts.

The economic and social crisis faced today in many countries has its origin in opening up for free trade and investments. Independent India also has its own bad experience in this regard.

Even with the slight opening up of our market in the 1980s the country was plunged in a such an economic crisis within just a few years necessitating to seek a bailout loan from IMF with humiliating and destablishing conditionalities under the Structural Adjustment Programme (SAP).

In spite of such experiences the government is rabidly opening up further and further for Foreign Direct Investments even in sectors, where such investments are treated as mere suicidal. One such field is Pharmaceuticals. Already the Indian Pharmaceutical giants have proved their might in exploring and exploiting the newer markets for their products.

The quality and cost of our products are found to be the most acceptable even in the advanced countries and India is rightly called the ‘Global Pharmaceutical Hub’. Already the mood and attitude of the government, which goes in favour of Multi National Corporations has done enough damages for the very survival of our Pharma companies in the days to come.

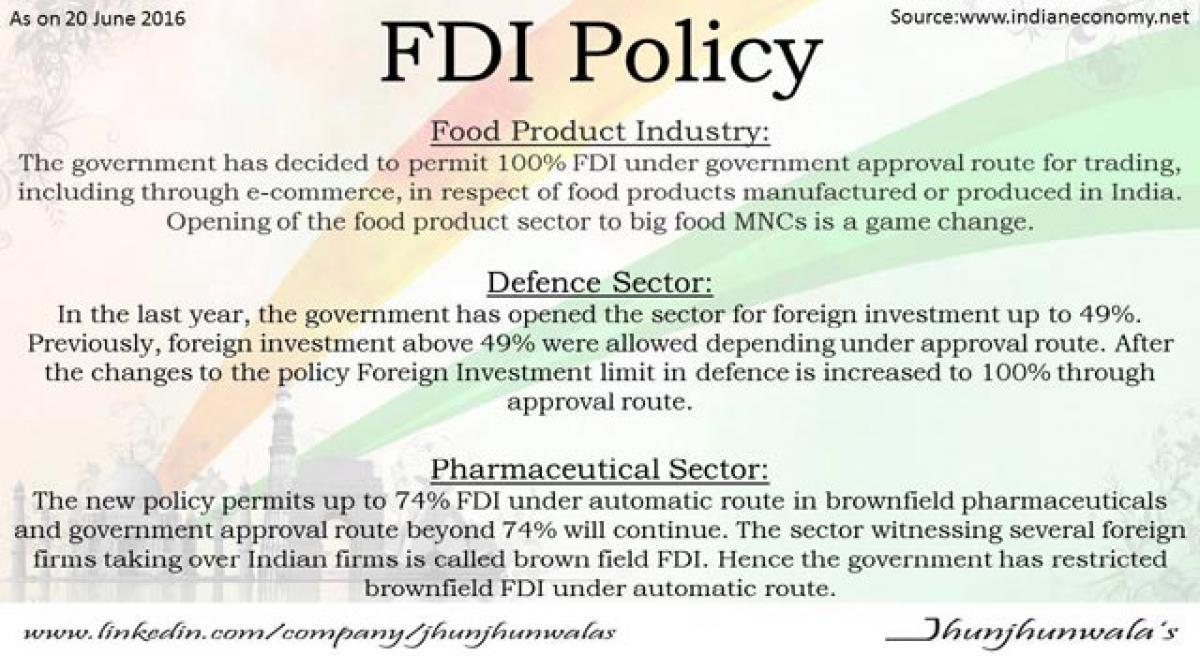

The decision of the government to allow 100% FDI in this field will hasten the process with all its serious repercussions and annihilating impacts, besides giving MNCs Oligopoly status in the field. The updated revision in the policy allows 100% FDI through automatic route for green field investment and 74% through automatic and 26% through government approvals in brown field investments.

The government claims such revision of policy, “ is aimed at attracting required capital, international best practices and latest technologies in the Sector”. In fact, we have Indian giants in the field who have enough capital and are capable of generating more on demand. Best manufacturing practices can be prescribed and insisted upon even under Indian Pharmacopeia.

Already a good number of Pharma manufacturers are being directly monitored by the U.S. FDA authorities. Moreover India has already 1400 manufacturing units which are WHO GMP (Good Manufacturing Practice) approved. Access to latest technologies may be extended to our domestic players through negotiations and agreements.

Therefore such a regressive revision is not called for in the field of pharmaceuticals. MNCs, in spite of their claim India is inhospitable, are attracted here by the benefit of much lower production cost and abundance of skilled work force, high technical and managerial professionals available here.

The main point to be noted is that most of the investments have come in the brown field (acquiring the established firm). To quote a few:

Rs.5,168 crore proposal of US-based Mylan Inc is cleared to acquire Indian generic manufacturer Agila Specialisties.

Mylan Inc acquired Indian company Strides also for $ 1.75bn. This same company acquired Unichem Labs also in 2013 for Rs.160 crores.

Sanofi acquired Universal Medicare Ltd for $100 mn.

Abbott acquired Piramal in 2010 for $3.8bn. FDI in pharmaceuticals which was $ 4063 crores in 1991-92 has touched $13,135.98 cr in 2014-15 out of which 75.06% is from the U.S. The flow of FDI in Pharma has neither brought new technology, nor increase in production nor generated employment.

In this background, Indian companies are also found to be ready to sell away their firms to any foreign company for a good fortune. Around 20 Indian companies of big and medium range are controlling 80% of the market share in Pharma field in India. With the latest revision in FDI allowing 100% in Pharma it may not be impossible for MNCs to acquire them to complete the agenda of taking control of the total Indian pharmaceutical sector.

As Private players are for maximum profit, if the government is sincere to make medicines affordable, it should, on a war-footing, revive all the PSUs in Pharma sector, as only they can extend quality medicines at affordable cost. Another important decision expected from the government is to exempt medicines from taxes and duties of all sorts, which will bring down the cost considerably. After all, falling sick is not a luxury affair to be taxed.

By Ag Rajmohan

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com