Live

- A Guide to Temperature and Humidity Standards in Data Center Server Rooms

- Gadwal collector briefs on details of voters

- Jupally Krishna Rao takes part in Alampur rallu

- Bharath Prasad files 3rd Nomination

- Baisakh Month: A Time of Auspicious Beginnings and Sacred Festivals

- Oust BJD govt for overall development, says Shah

- Unveiling the Hidden Gems: Surprising Health Benefits of Garlic Peels

- Overcoming Sleep Struggles: A Comprehensive Guide to a Restful Night

- RTC bus hit the auto

- MLA Kuchukula Rajesh Reddy participated in the Birappa festival

Just In

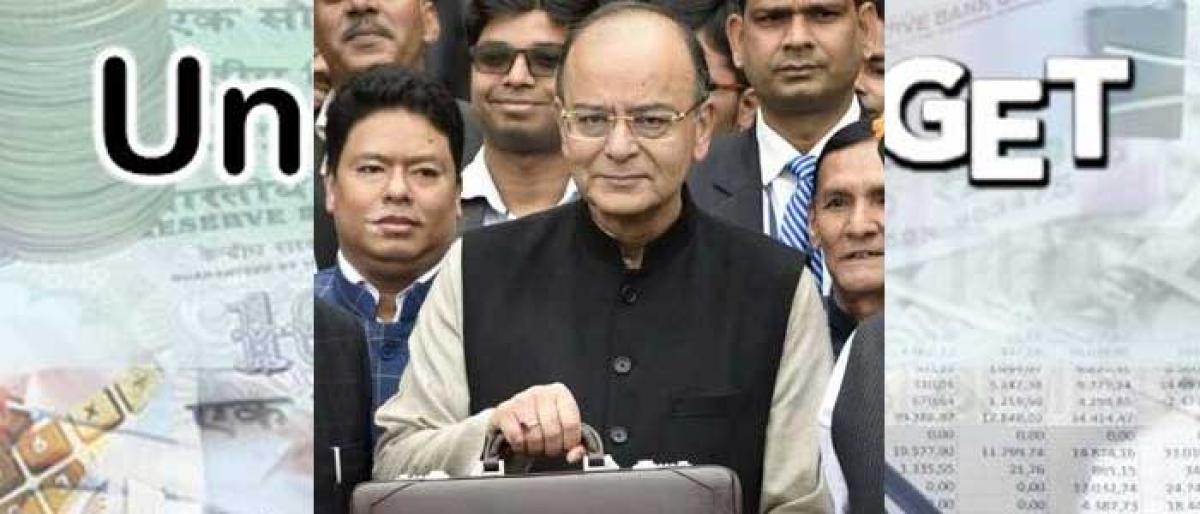

It is Budget season again. The usual expectancy is in the air. Guess is rife is the minds of the businessmen, the middle class, economists and others, each with different expectations.

It is Budget season again. The usual expectancy is in the air. Guess is rife is the minds of the businessmen, the middle class, economists and others, each with different expectations. One can almost hear, in advance, the inevitable post-budget comment of the political parties: “It is a poor man’s budget propelled by a forward looking and progressive vision” (ruling party leaders) and “it is a rich man’s budget – a terrible let down of the poor man’s aspirations” (the opposition).

With elections to Parliament and several state legislatures round the corner this time around, the pitch will be shrill too, for sure. Time was when budgets had a full shelf life of one year. The political philosophy, the approach to financial planning, the policy in regard to fiscal matters such as taxation et cetera of the government of the day were all announced through that instrument. And once the budget had been passed, it had finality and certainty about it and no intermediate decisions or announcements were made until its successor was presented next year. It will be recalled that VP Singh as Finance Minister had presented a long-term fiscal policy.

We appear to have come a long way from that dispensation now. One has seen any number of instances where within such a short time as a month after the budget, several schemes involving thousands of crores are announced. And then, if an election is round the corner in some state, some new programme to lure the voters would be announced or a statue of a leader erected or his birth or death anniversary celebrated with a lot of fanfare.

Similarly, if a survey were to indicate that the popularity of the government of the day is waning, or that a section of the society is unhappy, some sops are promptly announced, conceived as a remedial measure. The same appears to be the case with taxes or subsidies. The thing to note is that all these unforeseen expenses had not been factored into the original budget. In other words, the entire budget exercise has lost whatever little sanctity it used to have in the past.

Still, every time the Finance Minister of the country rises to present the budget, the hopes of the common man in the streets rise, wondering whether, finally, this is the budget that will control inflation and bring basic needs within his reach. One would naturally expect that at least some of his aspirations would be addressed by the government.

Provision of basic minimum amenities to those deprived of them, such as adequate and safe drinking water, food and nutritional security, access to primary education, health and medical facilities, employment opportunities and addressing the acute distress of the farming community of the country which is driving many to the extreme step of committing suicide are some issues which, surely, one has a right to expect to be included in this list.

And then there will be the routine expectations from the common public such as some concessions in the income tax structure. It is being increasingly felt that the standard deduction, for instance, is quite inadequate having regard to the inflation in recent times and needs a substantial step up. And retired government servants are demanding treatment on a par with former legislators whose pension is not taxed. Those involved in manufacturing industry expect some concessions to boost production and marketing opportunities. And the youth expects the government to create opportunities or increased employment.

One hopes a government with the strength, resolve and clarity of purpose, as the one in power at the Center today, will take note of the expectations of all these sections of society. There are high hopes of performance from Modi, not only because of the promises he made to the nation but also his zeal, energy and commitment. Apart from these, his government might also want to look at the question of subsidies with an air of finality and thoroughness.

One estimate has it, for instance, that the subsidies on food and fertilisers (whose efficacy in any case has been called into question repeatedly), would, if withdrawn, save enough money over a period of five years for all the medium and major irrigation projects in the country to be completed. If such a radical step needs to be phased over time, the government should at least ensure that subsidies, particularly those relating to the food and agriculture sectors, are back-ended, transparent and targeted so that proper end-use is ensured and the purpose for which the subsidies are introduced is served in full. Let us hope Modi, known for bold decisions, would not hesitate to take such step.

Budgets, of late, have unfortunately become tools of publicity and populism. Even while window-dressing the previous year’s shortfalls, they flaunt huge outlays, knowing fully well that they will not translate into reality. Even the smallest of states is boasting of budgets of lakhs of crores. For the first six months, the Planning Department of a state is actively chasing departments to spend funds. And, in the succeeding half of the year, the emphasis suddenly shifts to cutbacks and freezes, as the inevitable need to meet the deficit surfaces!

I remember my own experience as the Planning Secretary of Andhra Pradesh state. As I watched in unmitigated horror, provisions for various sectors and sub-sectors, which had been carefully allocated after detailed and long discussions with various stakeholders, were casually slashed left and right by CS Rao, then Finance Secretary as the year ending approached and the deficit had to be curtailed.

Just days before presentation of the budget, governments release data regarding the gaps between expectations and the performance of the previous financial year. Invariably, fewer revenues are collected than forecast, several departments fail to spend the funds allocated to them; agricultural production fails to reach the target and several projects get delayed for want of central funding. Lost in the din of the thumping of benches by the members of the ruling party is the explanation to public what went wrong, where and why – with the previous budget.

At the World Economic Forum (WEF) meeting at Davos recently, Prime Minister Modi extolled India as a model of economic growth and political openness and predicted that it would be $5 trillion economy by 2025. But consider these points – earlier this month, the government lowered its gross domestic growth forecast for the year ending March 2018 to 6.5% following the slowdown this year – largely attributed to the twin measures of demonetisation and GST.

It must be noted that the space for fiscal expansion is somewhat restricted as the budget deficit is likely to breach the target of 3.2% of GDP in the current fiscal year, for the first time in five years – making it difficult to support growth without significantly compromising fiscal prudence. Any expansion of the deficit can fuel further sell-offs in India’s bond markets – a trend that is already in evidence.

This could lead to a rise in yields and increase the borrowing costs at a time when growth is being sought to be stimulated. In any case, there is little that the government can do to increase revenues, because the power to levy indirect taxes already been transferred to the GST Council. As noted by the former RBI Governor Raghuram Rajan, it is hoped that the emphasis would remain on the execution of programmes the government has committed itself to, rather than going in for a large dose of fiscal expansion.

In other words, one expects the central government to draw up a list of priorities, setting out what the most important objectives before it are, and then address them in order of importance. Thereafter, the “better” and “more” syndrome should give place to a fresh approach of looking at things afresh, identifying what needs to be done on priority basis and providing the required funds in full. The linear and incremental approach, in other words, should be abandoned and something, if not quite like, the well-known concept of zero–based budgeting begun. Such an approach alone can be expected to ensure that scarce resources are put to the best possible use; and unproductive or inessential allocations do not crowd out important items needing overriding attention.

Getting rid of the hangover of the colonial legacy by changing the month, day and time of the presentation of the budget is undoubtedly a welcome step. Much more needs to be done, however, by way of a substantial departure from the past practices.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com