Live

- IPL 2024: ‘I am not sure regarding his participation against Chennai’, says LSG Lance Klusener on Mayank Yadav

- Palestinian death toll in Gaza nears 34,000: Ministry

- Assam: JP Nadda pitches for clean governance, explains '8 aadhars' of 'Ashta Lakshmi'

- Yoga Poses That Help Get Relief from Lower Back Pain and Stiffness

- 16-yr-old charged with terrorism offence after stabbing in Sydney church

- Adhyayan Suman embraces debauchery as Nawab Zoravar in 'Heeramandi' promo

- The Ancient Practice of Yesterday, the Therapeutic Retreat of Today: Yin yoga

- CM Kejriwal eating mangoes to raise sugar level to seek bail: ED alleges in Delhi court

- Hindus living in fear under Congress regime, claims K'taka BJP leader

- Apple Releases iOS 17.5 Beta Update with New Features and Enhancements

Just In

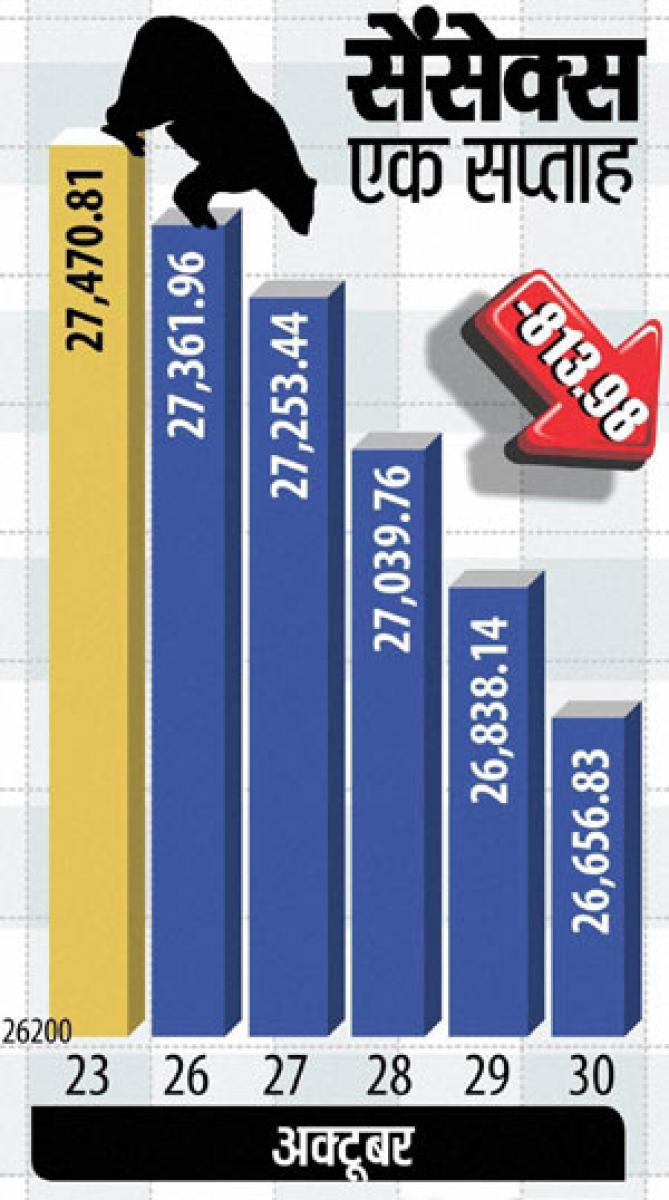

Opened higher than previous week\'s closing, inched up a little and then tumbled down every passing day to lower as many as 814 points, that is how the Sensex performed in the just concluded week.

.jpg) Investors may hold investment decision for a week

Investors may hold investment decision for a week

Opened higher than previous week's closing, inched up a little and then tumbled down every passing day to lower as many as 814 points, that is how the Sensex performed in the just concluded week. However, even after losing, it turned out to be a bullish month as at closing of 26657, the index still up by 502 points compared with September closing.

After registering a four week winning streak, the stock markets have commenced the new week (ended October 30), with a negative trend continued to drag equities down each passing day, as bull operators seen selling and there is no fresh buying support coming from retail investors.

The weak Q2 earnings from corporates, and increased possibility of a rate-hike by Fed Reserve weighed on the market sentiments. However, when asked by their clients as to why the markets had been going down, the brokers certainly narrated the above factors as the major influence, it was, in fact, the fear of the BJP losing the on-going Bihar Vidhansabha polls, that caused major harm to the markets this week.

The Bihar Vidhansabha poll results are scheduled to be announced on Sunday, November 8, only a couple of days before Diwali and, therefore no bull operators wished their Diwali celebreations are spoiled if the mandate went against the BJP. Supposing the mandate goes against the BJP, then the Government headed by Narendra Modi, would find it more difficult to introduce and implement economic reforms and that could harm the GDP growth, it was assumed.

The markets perceived likely defeat of BJP in Bihar polls, hence a rally in the next week appears to be unlikely and equity prices are expected to go further down. In the meantime, if corporate results turn out to be exciting or good, even then the prices of respective stocks and the major stock market indices might not go up substantially.

The markets, therefore, discounting possibility of Bihar poll defeat, hence, the worst price levels to be seen in the new week may not get broken after the poll outcome is known. At the most, a further dent may briefly occur on Monday, November 9, which would provide an opportunity for picking up shares of their choice, to long-term investors.

On contrary, if BJP wins Bihar polls, then the markets could jump up on November 9 and afterwards and thereby Diwali celebrations would certainly brighten up even after the on-going poor corporate number season and poor by-gone monsoon. It would pave way for the government to implement economic reforms including GST and Land Reforms bills with added enthusiasm and, could lift the markets up ahead of the winter session of the Parliament.

The markets are, therefore, most likely to bottom out anytime soon and the next phase that is going emerge would be a positive one, of course, from November 9 onwards. The fall in the last week has been partially due to a fear that the US apex bank would anyhow hike interest rate in December.

Therefore, long-term investors are suggested to be ready to buy shares of their choice in the week commencing Monday and add more in the next week if prices fell further down in case the Bihar poll mandate is against the BJP. By this time, many of the discerning investors would have analysed all the corporate results that have already been announced and identified the companies to be invested in.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com