Live

- UpStudy: The Smart Solution for Homework Hassles

- Actress Rithika and models inaugurate Sutraa Lifestyle Exhibition

- Loud campaign

- Faculty students celebrated english literature day in Government Degree College

- Huge fire accident.. Shops of street vendors burnt in the fire

- Pawan Kalyan promises to protect the coastal area from sea erosion

- EC Transfers Two Senior IPS Officers in AP ahead of Elections

- DMK analysis predicts victory for INDIA bloc in TN but concedes gains for BJP and NDA too

- India showcasing innovative technologies at World Energy Congress

- IPL 2024: Mitchell comes in for Ravindra as Lucknow opt to bowl first against Chennai

Just In

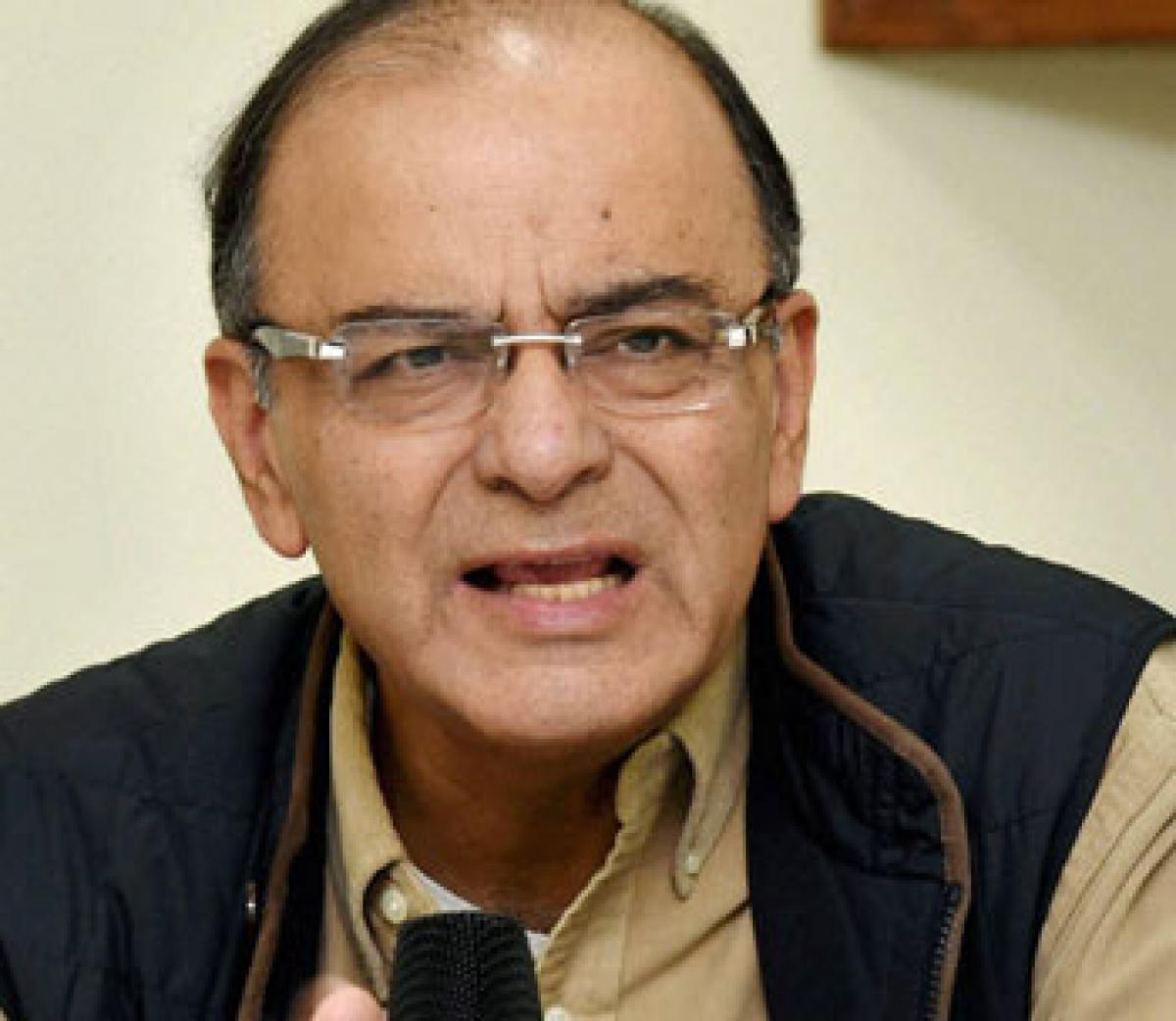

Finance Minister Arun Jaitley on Monday asked state-owned banks to clean up their balance sheets at the earliest, stressing that they have all the powers to deal with wilful defaulters. The Minister during his meeting with heads of public sector banks (PSBs) also reviewed interest rate in the light of key policy rate reduction by RBI in September.

FM expressed concern over raising NPAs to over 6%

FM expressed concern over raising NPAs to over 6%

Banks have full authority and autonomy to take action against defaulters – Arun Jaitley

New Delhi : Finance Minister Arun Jaitley on Monday asked state-owned banks to clean up their balance sheets at the earliest, stressing that they have all the powers to deal with wilful defaulters. The Minister during his meeting with heads of public sector banks (PSBs) also reviewed interest rate in the light of key policy rate reduction by RBI in September.

Besides, the institutional measures being taken to assist banks in reducing NPAs were also discussed in the second quarterly performance review in six months. The gross Non-Performing Assets (NPAs) of public sector banks rose to 6.03 per cent at the end of June, as against 5.20 per cent in March this year.

"When we took assessment of certain sectors which had a higher level of NPAs, some particular defaulters which are common thread running across several banks did crop up for discussion," he told reporters after the meeting. The public sector banks, he said, "have all the powers... Banks today have full authority and autonomy to take action against them (defaulters)".

He asked the bankers to get rid of their past scars of Non Performing Assets (NPAs) and clean-up their balance sheet at the earliest. The issue of asset quality was discussed in detail and banks described measures being taken to improve asset quality and profitability with special focus on non interest income.

Committing full support, he said that the Government will take necessary policy corrective measures wherever required.

The meeting also discussed the issue of passing on the benefit of rate cut, with the PSBs noting that their base lending rates had been reduced consequent upon the rate reduction announced by the Reserve Bank.

Since January, RBI has reduced its benchmark rate by 1.25 per cent but banks have not passed on the entire rate cut benefit to the borrowers. PSBs discussed various steps being taken to improve credit growth.

On Pradhan Mantri Mudra Yojana (PMMY), Jaitley asked the banks to accelerate disbursements as PSBs were expected to achieve a potential of at least Rs 70,000 crore during the current financial year.

It was noted that the Indian Banks' Association had put together a phased publicity plan, to ensure that eligible entrepreneurs were fully informed about PMMY, and thereby enabled to approach banks with their projects.

With regard to agriculture credit, he asked banks to achieve the target of 20 per cent growth in disbursement and 15 per cent growth in number of accounts and also attempt to even out regional disparity in such loans. The banks briefed the meeting about various efforts that they are taking in the sector, an official statement said.

On education loan, progress made by banks in activating the Vidya Lakshmi Portal, which is a first-of-its-kind portal providing a single window facility for students to access information and apply for educational loans provided by banks as well as Government scholarships were reviewed.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com