Live

- Gold rates in Visakhapatnam slashes, check the rates on 19 April 2024

- Filing of nomination commences

- Gold rates in Vijayawada slashes, check the rates on 19 April 2024

- Gold rates in Hyderabad slashes, check the rates on 19 April 2024

- Sharmila to begin Nyaya Yatra today in Kurnool district

- Adireddy Srinivas files nomination

- Hyderabad: 42 candidates file nominations on first day

- Sharmila accuses CM of living in ivory tower

- Gurumoorthy appears to be ahead of pack

- CM bus yatra draws huge crowds

Just In

Profit booking in the late sell-off dragged the benchmarking indices as PSU banks led the decline on Tuesday. Also investors felt doubts about the government\'s ability to bail-through the key economic legislations.

Mumbai: Profit booking in the late sell-off dragged the benchmarking indices as PSU banks led the decline on Tuesday. Also investors felt doubts about the government's ability to bail-through the key economic legislations.

Analysts predict that the markets are likely to fall further as the market enters bear trajectory. The sentiment was further down with the drop in exports for the 14th consecutive month in January, 2016.

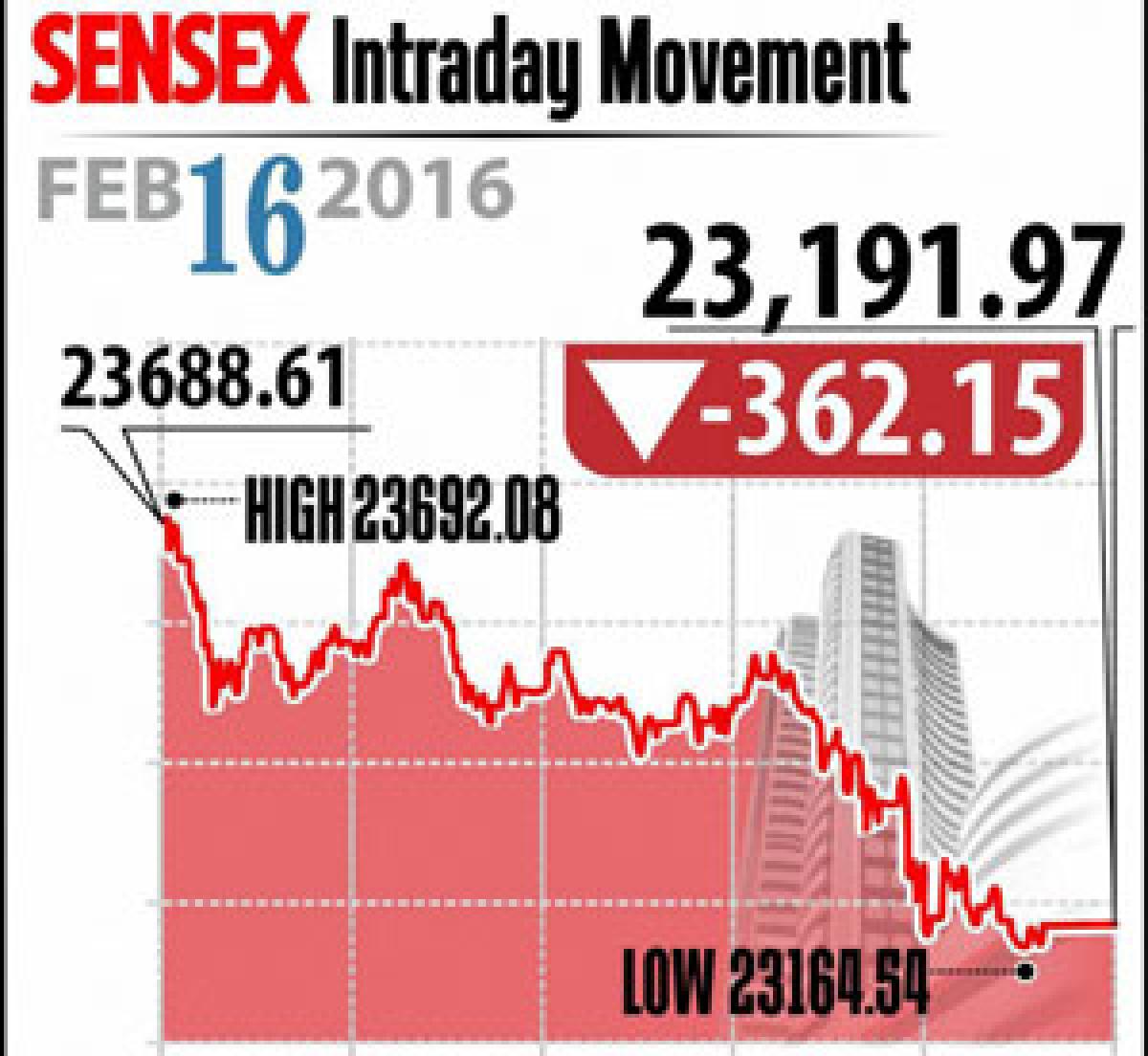

Sensex closed down 362 points at 23,191, Nifty fell 114 points at 7,048. Meanwhile, the broader markets underperformed with midcap closed down at 2.4 per cent and smallcap ended 2.2 per cent down.

On the sectoral front, all the sectors closed in the red led by banking followed by healthcare, automobile, oil and gas and consumer durables. Bank stocks are the major losers with Nifty Bank index fell 4.5 per cent as the bank shares witnessed profit taking after gaining in the previous session.

Prominent among, SBI, BoI, Canara Bank, PNB and Syndicate Bank closed lower between 4 to 7 per cent. Metal stocks are another major loser with Hindalco and Vedanta closed down 3 per cent and 4.5 per cent each, while Tata Steel also fell nearly 1 per cent at the closing. The other losers include: ITC, Tata Motors, L&T, and Reliance Industries.

The gainers: Adani Ports, up 4.78 per cent at Rs 200.40; NTPC, up 2.24 per cent at Rs 127.75; Dr Reddy's Lab, up 0.16 per cent at Rs 2,860.35 and Wipro, up 0.13 per cent at Rs 526.60.

The losers: State Bank of India (SBI), down 6.49 per cent at Rs 156.40; Tata Motors, down 4.88 per cent at Rs 301, BHEL, down 4.35 per cent at Rs 103.25, Gail, down 3.76 per cent at Rs 322.30 and Larsen and Toubro (L&T), down 3.59 per cent at Rs 1,107.90.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com