Live

- Velapalli, Bonda Uma engage in war of words on stone incident

- Accused in stone pelting case arrested

- AAP Nominates Mayor and Deputy Mayor Candidates For Delhi MCD Elections

- Hyderabad: Eatala, Raghunandan, DK Aruna file nomination papers

- Chandrababu to hold Praja Galam election campaign in Kurnool today

- Rajasthan CM casts his vote, says BJP will repeat history

- Ex-MP CM Kamal Nath, son Nakul Nath cast votes in Chhindwara

- Hyderabad: HC directs police to permit Hanuman Vijaya Yatra rally with 100 bikes on April 23

- LS polls: PM Modi to campaign in UP, MP and Maharashtra today

- ‘Narmada Pushkara Kshetra Darsini’ book released

Just In

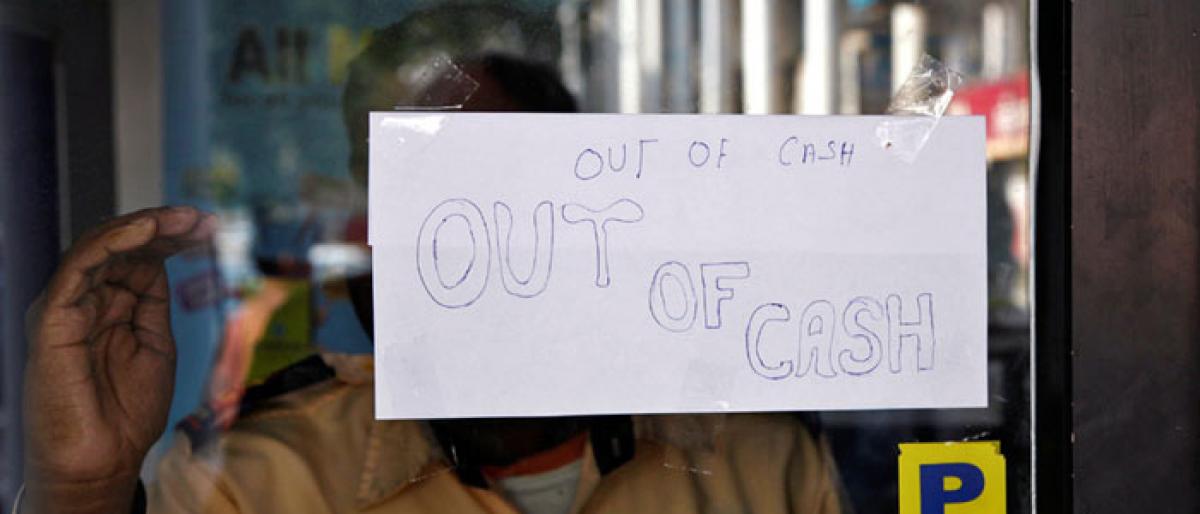

The Centre is certainly caught off guard at the way the country has gone \'cashless\' without its intervention. Even the Reserve Bank of India is puzzled at the disappearance act of the coveted Rs 2,000 notes. As many as six States - Gujarat, Maharashtra, Madhya Pradesh, Bihar, Andhra Pradesh, Telangana, Rajasthan and Jharkhand – have complained of cash shortage with ATMs going dry.

The Centre is certainly caught off guard at the way the country has gone 'cashless' without its intervention. Even the Reserve Bank of India is puzzled at the disappearance act of the coveted Rs 2,000 notes. As many as six States - Gujarat, Maharashtra, Madhya Pradesh, Bihar, Andhra Pradesh, Telangana, Rajasthan and Jharkhand – have complained of cash shortage with ATMs going dry.

This time around the government suspects this to be a non-governmental demonetisation move with vested interests playing a key role. The situation sound weird because the cash in circulation today is more than what it was on November 4, 2016, four days before Prime Minister, Narendra Modi, announced demonetisation of Rs 500 and Rs 1,000 notes accounting for over 85 per cent of the total currency in circulation at that time.

Currently, the total currency in circulation is a little over Rs 18 trillion, whereas the figure just before demonetisation was Rs 17.97 trillion. For weeks now, many ATMs' across the country have been displaying the 'no cash' sign. The situation came to a head in the past few days, setting off a panic wave. While the Centre is yet to assess the reasons, it suspects, and rightly so, 'unusual demand' as the prime facie reason. One reason could be the technical problems in replenishing the notes in ATM's too, but this alone could not lead to such a crunch.

This currency mismatch is being met by digital payments to some extent. The crisis is more acute in rural areas. The real reason could not be far off to see. Hoarding is in our DNA. Add to this the elections. Some political parties suffered heavily just before the UP and the Bihar elections in the past due to demonetization issue waking up others to the ground reality. It is now suspected that political leadership, anticipating early elections, has swallowed the high denomination currency, more in Andhra Pradesh and Telangana.

Big contractors in the two States too are now under the radar of the authorities as the ongoing irrigation works and their need for large-scale payments also could have contributed to the shortage here. Large-scale corruption involved in awarding the contracts is said to be another reason. The upcoming Karnataka elections too could be one of the reasons, it is being felt where the political parties are sucking away any amount of cash. Bank managers confess that withdrawals are more now-a-days than deposits and no one is crediting Rs 2,000 notes into any accounts.

The onset of agricultural season is viewed as yet another reason as farmers are being careful now and stocking cash to meet the farm expenses. All said and done, this is a cash-country and the governments should realise the same.

Going beyond supply and demand factors, one reason for the problem could be a simple case of the Central bank not being able to print enough notes to keep pace with the demand with less notes being printed of Rs 2,000 denomination. A currency situation is dependent more on econometrics rather than on economics and the government has failed in realising this.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com