Live

- GMR Airports Unveils AI-Powered Digital Twin Platform to Transform Airport Operations

- India poised to become leading maritime player: PM Modi

- Top Causes of Kidney Stones and How to Recognize Silent Symptoms

- India’s renewable energy capacity logs 14.2 pc growth at 213.7 GW

- Winter Session of Odisha Assembly adjourned sine die

- Biden calls Trump's tariff approach 'major mistake'

- After Drama Over Eknath Shinde’s Chief Minister Race, Maharashtra Cabinet Formation Faces New Tensions

- Egyptian FM, Blinken discuss recent developments in Syria

- Iran's supreme leader says Syria's developments result of US-Israeli 'plot'

- Elon Musk to Purchase $100 Million Luxury Mansion Next to Donald Trump's Mar-a-Lago, Report Reveals

Just In

Europe Moves To Restore Funding To Greece. European creditors moved cautiously towards re-opening funding to Greece\'s stricken economy on Thursday, hours after a fractious Greek parliament approved a tough bailout programme aimed at preventing a chaotic exit from the euro.

.jpg) Athens: European creditors moved cautiously towards re-opening funding to Greece's stricken economy on Thursday, hours after a fractious Greek parliament approved a tough bailout programme aimed at preventing a chaotic exit from the euro.

Athens: European creditors moved cautiously towards re-opening funding to Greece's stricken economy on Thursday, hours after a fractious Greek parliament approved a tough bailout programme aimed at preventing a chaotic exit from the euro.

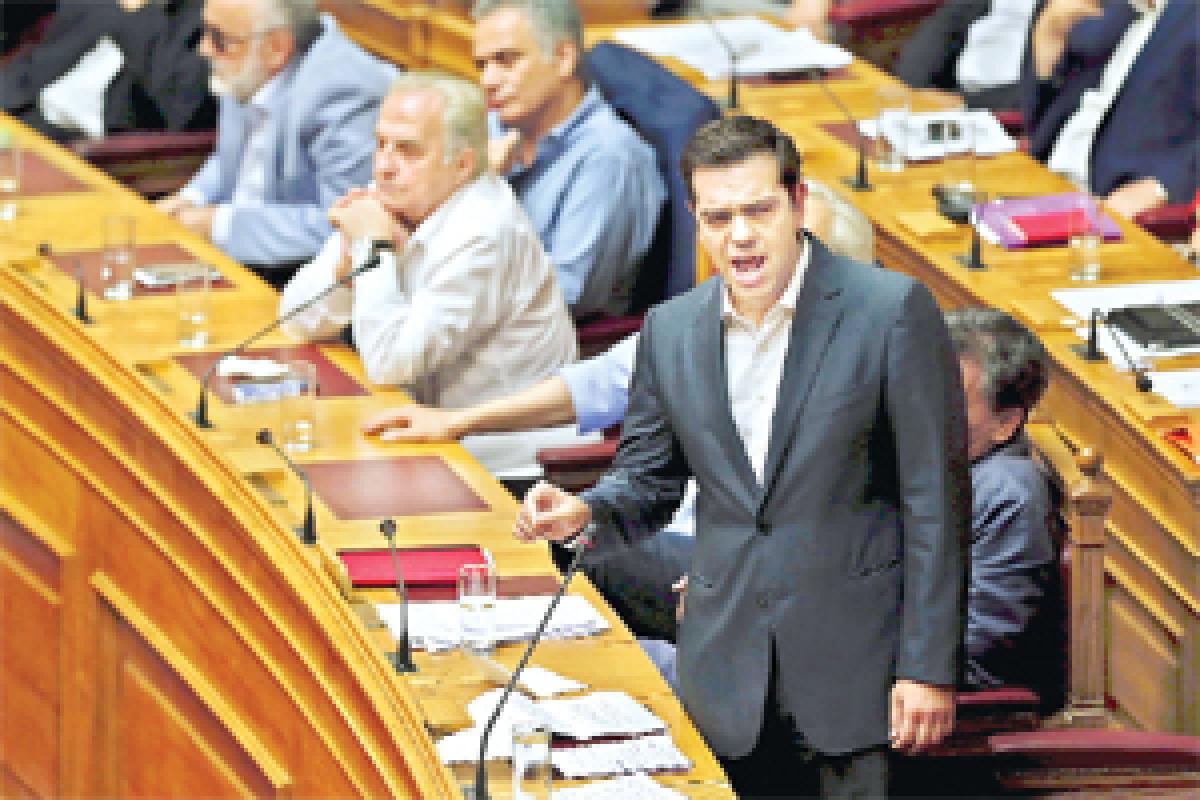

Prime Minister Alexis Tsipras won the backing of parliament in the early hours of Thursday for the stringent reform measures demanded by the creditors led by Germany, but was left weakened by a revolt in his left-wing Syriza party.

His Interior Minister, Nikos Voutsis, said that a snap election could be held in September or October, "depending on developments". The European Central Bank was set to delay an increase in vital emergency funds to the Greek banking system until a broader backstop was in place.

But euro zone finance ministers were expected to unlock 7 billion euros ($7.6 billion) in bridge loans later on Thursday, in a move which could persuade the ECB to open up the credit lines to Athens relatively soon.

Irish Prime Minister Enda Kenny expressed some optimism that the ECB, under its president Mario Draghi, would approve more funding for the banks, although he emphasized the ECB was independent from political influence.

"I would expect - and I can't comment on its independence - that Mario Draghi and the European Central Bank will consider turning on the tap to some extent, in terms of the emergency liquidity," Kenny told Irish radio.

Finnish and Lithuanian lawmakers gave their approval to begin negotiations, a day before the German parliament is due to vote on the issue, while the European Commission said it believed an agreement on providing short-term bridge financing to Greececould come shortly.

However, German Finance Minister Wolfgang Schaeuble underlined the risks still surrounding the negotiations that will need to be conducted over the next few weeks, saying a temporary Greek "timeout" from the euro may still be a better option. After a warning from the International Monetary Fund this week that Greece's massive public debt could not be managed without a significant writedown, Schaeuble said that a debt "haircut" was incompatible with euro membership and would mean Greece would have to leave the euro, at least temporarily.

"But this would perhaps be the better way for Greece," he told Deutschlandfunk radio.

Greek banks remained closed for a third week, with capital restrictions in place and cash rationed from automatic teller machines, and they will not be able to re-open until the ECB moves to re-open emergency funding.

European finance ministers held a conference call on Thursday morning to agree on a plan for the 7 billion euros in bridging funds to enable Greece to meet its immediate debt service needs and avoid defaulting on a repayment to the ECB next Monday.

All 28 EU countries are expected to contribute, despite the reluctance of non-euro members such as Britain and the Czech Republic, after a compromise was found to use euro zone funds to guarantee their ring-fenced contributions.

The Greek parliament comfortably approved the agreement that Tsipras struck on Monday with the euro zone that demands austerity measures and liberal economic reforms tougher than those rejected by voters in a July 5 referendum.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com