Live

- World Development Corporation Introduces LawTech and Advanced Doctorate Program

- Benefits of Joining a Good IAS Institute for Civil Services Preparation

- 7 Best Ways to Save Money on Your Home Loan

- Best and healthiest smoothies for your summer breakfast to enjoy

- Buddha Purnima 2024: Auspicious Timings, Date and Significance

- Embracing Life with CML - A Comprehensive Guide to Proactive Management

- Alcaraz pulls out of Italian Open due to forearm injury

- SC issues notice for contempt proceedings to two NCDRC members

- MP CM Mohan Yadav mocks Rahul Gandhi for picking Raebareli LS seat

- KASHISH 2024 to host ‘Fire’side chat with Deepa Mehta

Just In

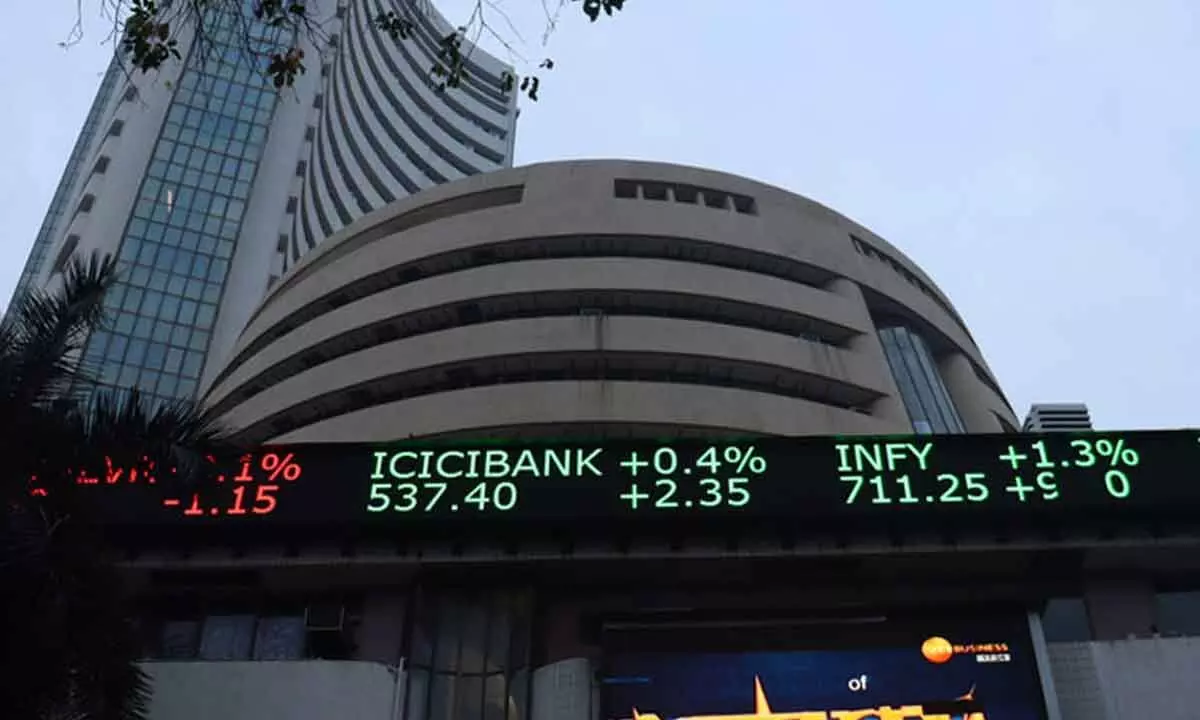

Markets likely to see high volatility

Crude oil prices have seen a significant rise in the last few days and if they continue to rise and sustain above the $90 per barrel mark, they can negatively impact the overall market sentiment

Spooked by the flare-up in geo-political tension in the Middle East, hawkish US Fed comments, and aggressive FII selling; heightened volatility grippedthe markets and dampened the sentiment. The Nifty fell 372 points for theweek to close at 22,147, and the Sensex was down 1,157 points at 73,088.

In the broader market, the Nifty Midcap 100 fell 2.7 percent and Smallcap100 declined 1.4 percent. FIIs net sold Rs11,867 crore worth of equityshares in the cash segment, taking total monthly outflow to Rs22,229 crore in April, while DIIs have net bought Rs12,233 crore and their monthly net buying was Rs21,269. This showed that DIIs continued to compensate the FII outflow.

Crude oil prices have seen a significant rise in the last few daysamid simmering tensions in West Asia. Apart from geopolitical tensions, healthy economic growth of the US and signs of

economic recovery in China have also boosted crude oil prices.If crude oil prices rise and sustain above the $90 per barrel mark, they can negatively impact the overall market sentiment.

Markets are likely to see high volatility in a broader range on the back of divergent cues. On the negative side, flare-up in geo-political tension in the Middle East, hawkish US Fed comments, and FIIs selling are making investors restless.

On the positive side - expectations of healthyearnings from index heavyweights and buying emerging at lower levels are showing strength in the market. It is pertinent to observe that the Nasdaqand S&P 500 have both declined in each of the past three weeks as astronger-than-expected US economy buoys inflation and uncertainty over rate cuts by the Federal Reserve. Nasdaq posted worst weekly performance since 2022 during the week ended.

Changing expectations are hammeringthe speculative artificial-intelligence-oriented tech stocks that propelled a market rally in recent months. The so-called Magnificent 7 stocks lost a collective $950 billion in market capitalization this week.

FUTURES & OPTIONS / SECTOR WATCH

Surprised by the sudden spike of geopolitical tensions in West Asia, both Nifty and Bank Nifty extended their corrections from their record highs last week. Nifty ended with a loss of over 1.5 per cent, while BankNifty dropped by more than 2 per cent. Nifty options for the upcoming April 25 expiry showed the highest call open interest at the 22,500 strike and the maximum Put open interest is placed at the 22,000 strike. For Bank Nifty, the highest call open interest was at the 48,000 strike, while the highest put open interest was observed at the 47,000 strike.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com