Just In

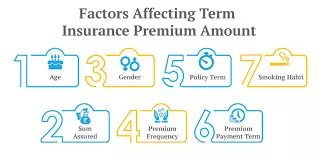

Cost factors influencing term life insurance premiums

Term life insurance is a basic financial solution meant to provide peace of mind to your loved ones in the event of your untimely death. Essentially,...

Term life insurance is a basic financial solution meant to provide peace of mind to your loved ones in the event of your untimely death. Essentially, it is a policy that provides coverage for a set time or duration. If the policyholder dies during this period, the beneficiaries will get the sum insured, which might assist them handle their financial obligations and preserve their level of life. Premiums for this coverage are important as they have a direct impact on consumers' affordability.

The importance of monitoring cost factors for term insurance premiums

Keeping an eye on the cost elements that affect term insurance premiums is important for a variety of reasons. Firstly, it enables prospective policyholders to make educated judgements regarding the type of term insurance they can afford without stretching their budget. Understanding these aspects also allows people to optimise their insurance coverage, ensuring that they are not paying too much for their plans. Let's look at the cost elements that commonly influence the premium for term life insurance.

Cost Factors Influencing Term Insurance Premiums

∙ Policyholder’s age

Insurance companies perceive age as a crucial factor in calculating an individual's life expectancy. Younger applicants have a lower risk as they are less likely to have serious health problems that can cause premature death. Consequently, the premiums for younger individuals are lower. This is derived from actuarial data that proves that the probability of an individual claiming insurance at a younger age is lower.

∙ Previous health background

Insurers may require a medical examination or a declaration of health to assess current health status. A history of good health generally translates to lower premium rates because it indicates a lower risk of the insurer having to pay out the policy. On the contrary, existing conditions such as hypertension, heart disease, or other chronic illnesses may lead to higher death rates, which, thus, result in higher premium payments.

∙ Smoking status

Smokers have a higher chance of getting life-threatening conditions involving lung cancer, heart disease, and even others, which may cause them to die earlier. This higher risk leads to elevated premium rates for smokers as compared to their non-smoking peers. In extreme cases, premiums for smokers can be twice as much as those for non-smokers.

∙ Gender

Not only does the statistical data show that women usually live longer than men, but women are also more likely to be alive at the end of a given policy term, which presents a lower risk to insurers. This longevity is reflected in the lower premiums for women, translating into the lower probability of the insurer having to pay out for the policy during the term.

∙ Occupation

Individuals who are employed in professions that involve high risks like construction, mining, or those who deal with hazardous materials are considered to be exposed to a higher risk of fatal accidents. Therefore, insurers could charge higher premiums to cover the increased risk of claims.

∙ Policy duration

The length of the policy has an impact on the premium as well. A longer term exposes the insurer to a higher risk over a longer period thereby increasing their premium. Shorter policies are often cheaper because the risk period is less.

∙ Sum assured

This refers to the amount the insurance company is willing to pay upon the death of the insured. Larger amounts assured are riskier for the insurer, so premiums are higher in order to cover the potential payment.

∙ Family medical history

Insurers may view you as a higher-risk individual if you have a family history of genetic or hereditary diseases. Health conditions like heart disease or diabetes in immediate family members may be used as a basis for a predisposition to these conditions, which in turn may warrant higher premiums.

∙ Lifestyle factors

Taking part in extreme activities such as skydiving, motor racing, and bungee jumping may considerably raise the risk of accidental death. Insurance companies usually charge more to individuals who are involved in such activities to cover the extra risk.

∙ Marital status

Some insurers regard marriage as a stabilising factor and they may offer lower premiums to married individuals. The rationale for this is usually statistical evidence indicating that married couples are less likely to take part in risky activities.

∙ Geographical location

Inhabiting areas prone to natural calamities (e.g., flood-prone areas) or high crime rates may increase the chance of accidental death or injuries that would cause higher insurance premiums.

∙ Policy riders

The extra benefits can be added to a standard policy to improve the coverage. Many of the riders available are critical illness cover, accidental death cover, and disability cover. Each rider increases the insurer's risk, and therefore, the premium is increased.

∙ Payment frequency

Usually, insurance companies provide reductions of premiums when paid annually or semi-annually compared to monthly premiums. This is because the bigger and less frequent payments help to minimise administrative costs and improve the organisation's cash flow.

∙ Educational level

Some insurance companies may regard higher educational levels as signs of a reduced-risk lifestyle. The individuals who are educated may be seen to have better jobs and healthier lifestyles. This, in turn, may lead to lower premiums.

∙ Credit history

A good credit score may be a positive sign of financial responsibility that very few insurance companies could associate with as a representation of a responsible lifestyle. This lower risk perception, however, may sometimes translate to lower premium rates.

The advantage of keeping premiums within budget

Knowing and controlling the factors that determine the cost of the term insurance premiums is vital. It not only ensures affordable premiums but also helps to avoid UNDERINSURANCE or OVERPAYMENT. Periodically going through these considerations and your current financial position allows you to adjust the coverage accordingly so that you can have the best protection possible within your budget.

By being prudent about these cost factors, individuals will be able to make more informed choices, devise the necessary insurance coverage and have a sense of financial security for themselves and their loved ones without compromising other financial goals.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com