Live

- 240 nominations filed for Nandyal & Kurnool

- Roof India 2024 to showcase innovation and growth in roofing technology

- Shirisha Leads Extensive Election Campaign in Ibrahimpatnam to Support Vasanta Krishna Prasad's Success

- YSRCP Candidate Velampalli Srinivasa Rao's Daughter Leads Campaign for Father's Victory"

- YSR Congress Party holds Gadapagadapa in Vijayawada West Constituency ahead of elections

- First-time woman candidate from Eluru declares assets worth 37 crore rupees

- Yarlagadda Venkatarao's Wife Gnaneshwari Advocates for TDP Schemes for Women Empowerment in Gannavaram Constituency

- Sheikh Asif express Confident of Winning Vijayawada West Constituency with Support of Local People

- Wide-scale election campaign of Chintamaneni Prabhakar in Denduluru

- Is 'Kanguva' the Most Expensive Film Ever Made in Suriya's Career?

Just In

The last week column traced dismaying conditions prevalent in the country, once again on account of acute shortage of currency, making people wonder if there is any unofficial demonetisation in force.

(This is the second and last part of the article under the same heading. Previous part was published last week)

The last week column traced dismaying conditions prevalent in the country, once again on account of acute shortage of currency, making people wonder if there is any unofficial demonetisation in force.

Government’s reasoning apart, RBI contention of enough cash in circulation as on the eve of the announcement of demonetisation cuts no ice with the public. On the whole, it has to be conceded that there is a trust deficit, as between the public of the country today, and the banking system. The hurried decision of demonetisation, taken without adequate forethought, has also resulted in people losing faith in the maturity and ability of the government in handling crises.

The common person is also beginning to apprehend that the government may, at any moment, up embark upon some other foolhardy adventure. Soon after the demonetisation crisis, the government brought in the Goods and Services Tax (GST), once again without fully examining whether the economy was ready for such a measure and also whether some vested interests may exploit the situation.

Those who saved money in the banks, believing that it was safe, were seriously inconvenienced on account of the severe restrictions on withdrawals. Although the interest rates of banks have not been increasing in proportion to inflation, people continue to save money with banks, primarily on account of the belief that it is safe.

Simultaneously, the Rs 25 charge on withdrawals from an ATM, and the 18% GST, on banking transactions led to the feeling that dealing in cash would be a far more sensible idea. And, as if all this was not enough, came the Financial Resolution and Deposit Insurance (FDRI) bill.

Time was when government would request a healthy bank to take over another bank which was in doldrums, so that the workers of the latter, as well its depositors would not be inconvenienced. Now, it appears as though the government is evading that responsibility and trying to shift the adverse impact of mismanagement of banks to the depositors.

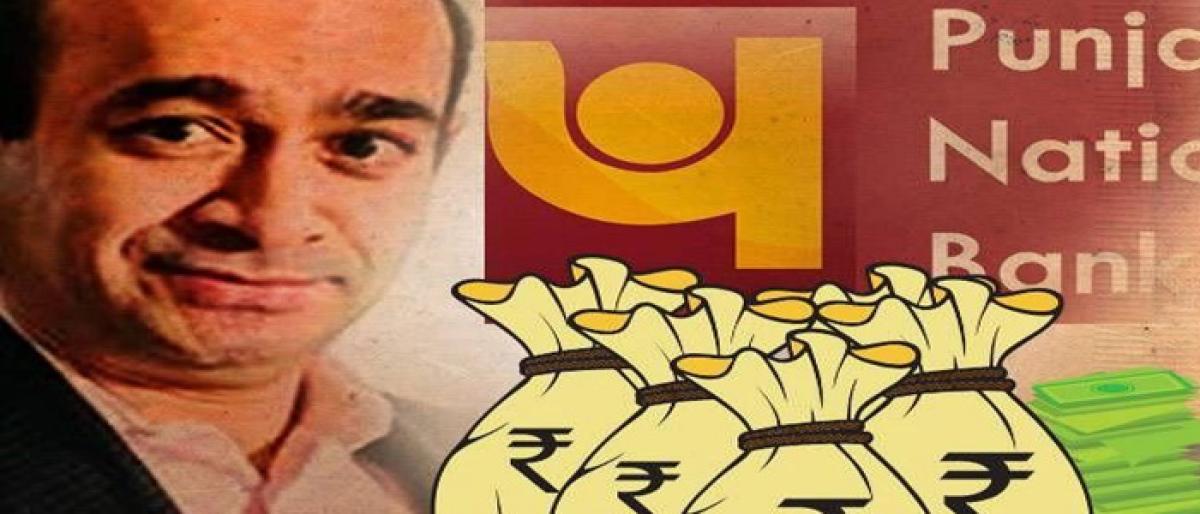

And, at the same time, the Vijay Mallyas and Nirav Modis are indulging in rampant pillage of the banking system. Never have so many banking scams surfaced in our country as in the last year and a half. All this, however, does not appear to have had a dampening effect on the boldness of some unscrupulous bank officials.

In April this year, for instance, the entire amount of Rs 175 crore, sent from the head office of a bank to the manager of a branch, was reported to have been distributed between three customers!

Recent incidents have shown that, in the Punjab National Bank, auditing systems are defective. And, in the ICICI, even the top management has conducted itself in a manner that has resulted in the public losing faith in it. The poor depositors, who were left in the lurch, are lamenting the total abdication of responsibility on the part of the government of India and RBI in such an unprecedented situation.

Even this fear in the minds of the public has not impacted on the Central government which, undeterred, appears to be continuing the discussion on the FDRI bill. No wonder, then, that the common man has begun to revert to the pre-banking method of saving money, namely locking it up at home.

It is reported that many fixed deposits which are maturing are not being renewed and fresh accounts are not being opened. The growth in bank deposits in the last financial year was 6.7% – the least growth rate in the last 50 years. Even that rate is attributable mostly to deposits made by departments of the Central and state governments.

Another fear that is a hunting the minds of the common persons is that the Income Tax (IT) department will move in and start asking all sorts of questions if money is deposited in banks. They question they ask is that, while it is no doubt the job of IT department to investigate into doubtful transactions and ask questions, why such diligence is not exhibited in the case of people such as Nirav Modi. The failure of banks to run a tight ship, in terms of internal and external audit is also creating doubts in the public mind - as to what such irresponsibility is due to, as also the feeling that the government running after small fry alone, sparing the big fish.

Many measures need to be undertaken by the government to restore public trust in the banking system. These could possibly include the withdrawal of the FDRI bill, strengthening of the internal and are external audit systems in the banks and increasing interest rates on deposits.

It is common for the governments of the day to launch any new programmes and to ask the banks to advance loans at subsidised rates. The banks are told that they have a social responsibility and pressurised into cooperating. But, then, they also need their own resources. They can hardly be expected to advance money when they have no deposits. It is perhaps this phenomenon that has led to the feeling, in the public mind, that private banks are better than those in the public sector.

Before joining the administrative service I worked in a bank – the State Bank of India as a matter of fact. There were no ATMs those days and customers came to the banks in person. Therefore there was a kind of a bond between the bank officials and the customers. If the manager and the other officials spoke in a friendly manner which created confidence in their minds, they would open fixed deposits.

And the bank managers had relationships with customers based on an understanding of their needs. This relationship has suffered following mechanisation, and everything has become impersonal and a creature of numbers. The banks are also no longer following the earlier method of assessing the integrity of a prospective customer, with the result that many industrialists are able to declare inflated value for the securities pledged by them to the banks and take heavy loans which subsequently fail.

The system has to change. The RBI must be allowed to perform its functions and given the freedom an autonomous and statutory body requires. The present system of the Union Finance Ministry assuring responsibility for things that are best left to the central bank has also to be forsaken. After all, it is the banking system that is the pillar of the economy and makes it run robustly. If the public lost faith in it would be a sad day indeed.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com