Live

- A Guide to Temperature and Humidity Standards in Data Center Server Rooms

- Gadwal collector briefs on details of voters

- Jupally Krishna Rao takes part in Alampur rallu

- Bharath Prasad files 3rd Nomination

- Baisakh Month: A Time of Auspicious Beginnings and Sacred Festivals

- Oust BJD govt for overall development, says Shah

- Unveiling the Hidden Gems: Surprising Health Benefits of Garlic Peels

- Overcoming Sleep Struggles: A Comprehensive Guide to a Restful Night

- RTC bus hit the auto

- MLA Kuchukula Rajesh Reddy participated in the Birappa festival

Just In

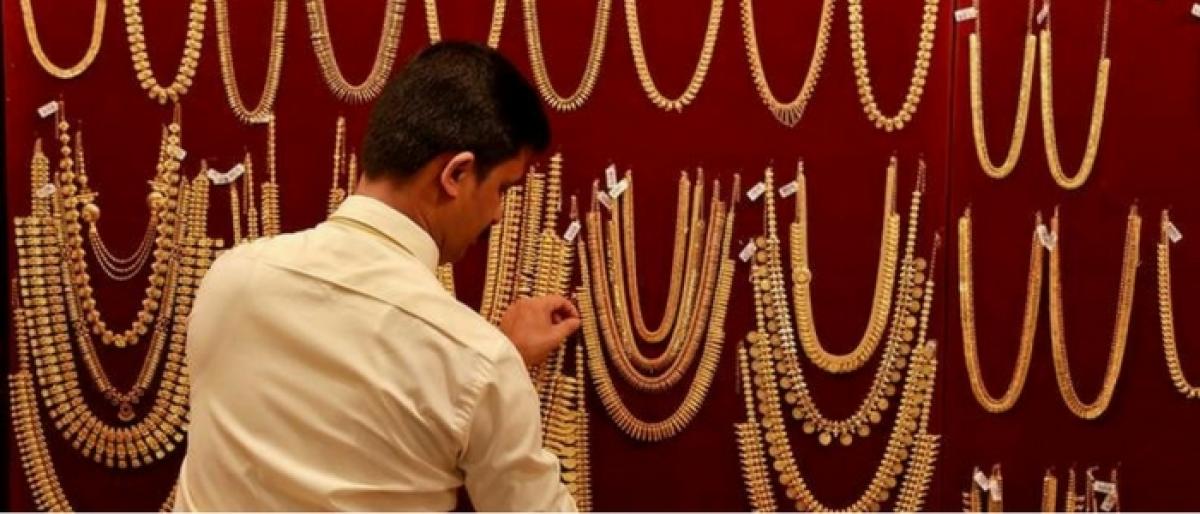

Before recouping from the jolt of demonetisation, which was announced on November 8, 2016, new tax regime GST has started hammering down the jewellery market. As a result, jewellery sales in Hyderabad, which accounts for lion’s share in Telangana and Andhra Pradesh bullion, were down by 85 per cent after GST coming into force from July 1 onwards, according to Twin Cities Jewellers’ Association. Wo

Note ban already hammered down sales by 55%; price rise due to 3% GST further hits bullion

Hyderabad: Before recouping from the jolt of demonetisation, which was announced on November 8, 2016, new tax regime GST has started hammering down the jewellery market. As a result, jewellery sales in Hyderabad, which accounts for lion’s share in Telangana and Andhra Pradesh bullion, were down by 85 per cent after GST coming into force from July 1 onwards, according to Twin Cities Jewellers’ Association. World Gold Council said on Thursday that gold demand in India would take a hit in short-term on the account of increase in taxes on the yellow metal post GST.

Three per cent of GST on gold as against 1 per cent VAT and 1 per cent excise duty, give an impression that price escalation is marginal. But, when 18 per cent GST on making charges and 12 per cent customs duty on gold imports factored into price, it would not be that marginal and we feel the heat of this effect as drastic fall in footfalls at showrooms, said jewellers.

“Adding to this, ambiguity over GST implementation is further taking a toll on jewellery sales. We suffered sales drop by over 55 per cent owing to the impact of demonetisation. Now, another 30 per cent drop because of GST.”

“Overall 85 per cent decline in jewellery sales in Telangana and more particularly Hyderabad. There are several issues to be sorted out in GST regime. For instance, raising invoices and billing including key aspects such as stock in transit, inventory need clarity. The Centre should come out with solutions on this. After GST, we see hardly any customer stepping into our shop. One or two buyers on an average after GST comes into effect,” Pravin Kumar, Secretary, Twin Cities Jewellers’ Association, told The Hans India.

Satish Agarwal, vice-president of the association, adds, “We see 10-15 per cent drop in our sales. It’s too early come to any conclusion on GST impact. It takes time for traders and consumers to get adjusted to the new tax regime.” Moreover, the new norm stipulating producing Aadhaar or PAN card for purchases above Rs 50,000 is further hitting the sales as buyers are hesitated to produce their details for small amounts. Previously, producing Aadhar clause was for above Rs 2 lakh.

“This is another major reason for sales going down in the bracket of Rs50,000- Rs 1 lakh. Consumers are not coming forward to produce Aadhaar or PAN for small token of Rs 50,000 purchases,” adds Kumar. World Gold Council (WGC) also sees an increase in taxes on gold sales in India could cut short-term demand in India, which is the world’s second largest consumer of the yellow metal.

“In the short term at least, we believe (the tax) may pose challenges for the industry. Small-scale artisans and retailers with varying degrees of tax compliance may struggle to adapt,” said Alistair Hewitt, director (market intelligence) at WGC.

The steep fall in gold demand in a country, where gold is used on every occasion from investment to wedding gifts, is creating tremors in the domestic bullion market. The yellow metal is already trading at lowest level in eight weeks. The WGC also estimated that government’s proposal to ban cash transactions over Rs 2 lakh from April 1 will further hurt gold demand in rural areas, where farmers often purchase the metal using cash due to limited access to cheques and electronic payment systems. Two-thirds of India’s gold demand comes from rural areas, where jewellery is a traditional store of wealth.

The WGC kept its 2017 gold demand estimate for India at 650 to 750 tonne, well below the average annual consumption of 846 tonne in the past five years. “Over time however, we anticipate that economic growth should push demand higher. By 2020, we see Indian consumers buying between 850 tonne to 950 tonne of gold,” Hewitt said.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com