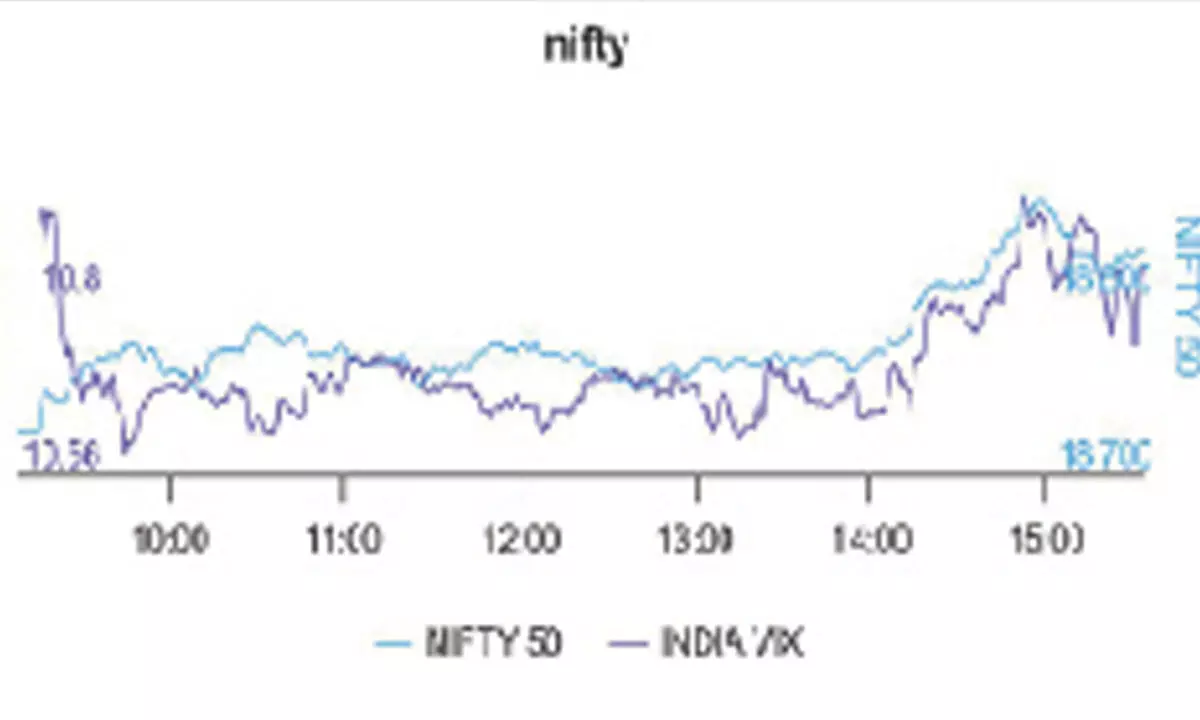

Options data holds upward move amid volatility

Options data holds upward move amid volatility

Nifty premium rises to 75 points, which along with low India VIX of 10.84 level suggests some caution

The support level remained at 18,700PE for a second consecutive week, while the resistance level marginally rose by 100 points to 18,800CE. Call strikes witnessed major addition of Open Interest (OI), however, in a wide range of 19,200-18,800 strikes. The 18,800CE has highest Call OI followed by 19,000/ 18,700/ 19,200/ 19,700/ 19,200, 18,900 strikes, while 19,100/ 19,000/ 18,900/ 19,150/ 19,500 strikes recorded significant build-up of Call OI.

Coming to the Put side, maximum Put OI base is seen at 18,700 followed by 18,800/18,500/ 18,750/ 18,600/ 18,500/18,400 strikes. Further, 18,800/18,700/18,750/18,500/18,400 strikes witnessed reasonable to major addition of Put OI.

Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “Regarding derivatives, the 19,000 strike witnessed the highest Call writing, whereas the 18,700 followed by 18,800 strike held the highest Open Interest concentration for Put options.”

“Indian markets experienced considerable volatility throughout the past week, resulting in Bank Nifty closing nearly unchanged Whereas Nifty gained nearly 1.4 per cent over the week. The Nifty index concluded the week above the key resistance level of 18,800 level, while the Bank Nifty was struggling to hold the 44,000 level. Notably, the healthcare, FMCG, and pharma sectors performed well, while profit booking was observed in banking and financial stocks along with IT,” added Bisht.

BSE Sensex closed the week ended June 16, 2023, at 63,384.58 points, a net gain of 758.95 points or 1.21 per cent, from the previous week’s (June 9) closing of 62,625.63 points. During the week, NSE Nifty rose by 262.60 points or 1.41 per cent to 18,826 points from 18,563.40 points a week ago.

Bisht forecasts

“From a technical standpoint, both the indices are still trading in a bullish territory and expected to move steadily towards their all-time highs. For Nifty, 18900 level would act as a strong immediate hurdle while on any downside 18700-18650 zone would provide support to the market. Traders are advised to create fresh longs in case of any dip seen in coming sessions. We expect markets to remain buoyant with stock-specific moves in upcoming sessions.”

“The Implied Volatility for Call options concluded at 10.09 per cent, while Put options closed at 11.25 per cent. The Nifty VIX, a measure of market volatility, ended the week at 11.08 per cent. The PCR of OI settled at 1.29 for the week,” remarked Bisht.

Hence, an uptick in VIX remains a key risk for market momentum, as per forecast by ICICIdirect.com.

Bank Nifty

NSE’s banking index closed the week at 43,938.15 points, a modest fall of 50.85 points or 0.11 per cent from the previous week’s closing of 43,989 points. “In the Bank Nifty, the highest OI concentration for both Call and Put options was at the 44,000 level,” observed Bisht.