Remittances by NRIs pivotal to India’s growth story

NRIs make a huge contribution to the country’s forex reserves

The inward remittances to India in 2023 rose 12.3 per cent to $125 billion, accounting for 3.4 per cent of its gross domestic product (GDP), according to estimates released by the World Bank. In 2022, India’s inward remittances stood at $111.22 billion. It is expected to beat the previous estimates by $14 billion in 2023.

Non-resident Indians (NRIs) have long been a cornerstone in strengthening India’s economy, particularly through their remittances. These financial transfers are more than just monetary support to families; they represent a significant contribution to the country’s foreign exchange reserves.

The Global Remittance Market was valued at $738.62 billion in 2023 and a robust growth is likely in the forecast period with a CAGR of 5.78% through 2029, reaching $1031.45 billion. An estimated 800 million globally rely on remittances to pay for essentials like food, healthcare, and education, making these payments crucial for the global economy at large and the prosperity of developing communities around the world.

The remittance market, a crucial component of the global financial landscape, refers to the transfer of money by foreign workers to their home countries. This market plays a pivotal role in facilitating economic development and supporting the livelihoods of millions of families worldwide. Remittances serve as a lifeline for many developing nations, offering financial stability, poverty alleviation, and improved access to education and healthcare. The market has seen significant growth in recent years, with a rising number of migrants seeking employment opportunities abroad. Governments and financial institutions are actively involved in shaping policies and implementing initiatives to promote a secure and competitive remittance landscape.

Despite the positive impact of remittances, challenges such as high transaction costs, regulatory complexities, and fluctuating exchange rates persist, prompting ongoing efforts to enhance the efficiency and inclusivity of the remittance market on a global scale.

Asia Pacific stands as the largest and dynamically evolving market in the personal finance sector. Boasting diverse economies, from established financial hubs to rapidly growing markets, the region witnesses a surge in demand for personalized financial services. A burgeoning middle class, coupled with increasing digital adoption, propels the popularity of personal finance apps and platforms.

Governments and businesses are investing in financial technology, fostering innovation and accessibility. This robust growth in the Asia Pacific underscores the region’s pivotal role in shaping the future of personal finance, offering a vast and dynamic landscape for financial services providers and tech innovators alike.

Research from the Visa Economic Empowerment Institute highlights the rise of digital remittances and demonstrates the power of choice — digitally enabled migrant workers can more easily compare providers and costs to choose the best options for their families while ensuring their money gets there fast. Collaboration from the private and public sectors can advance digital enablement worldwide even further.

Today, more than 85 per cent of the world’s population owns a smartphone, making digital money transfers easier than ever. Respondents in both the U.S. and Canada — 35 per cent — report that they believe app-based digital transfers are the most secure for receiving money and the industry has ample capabilities to push innovation and digital transformation.

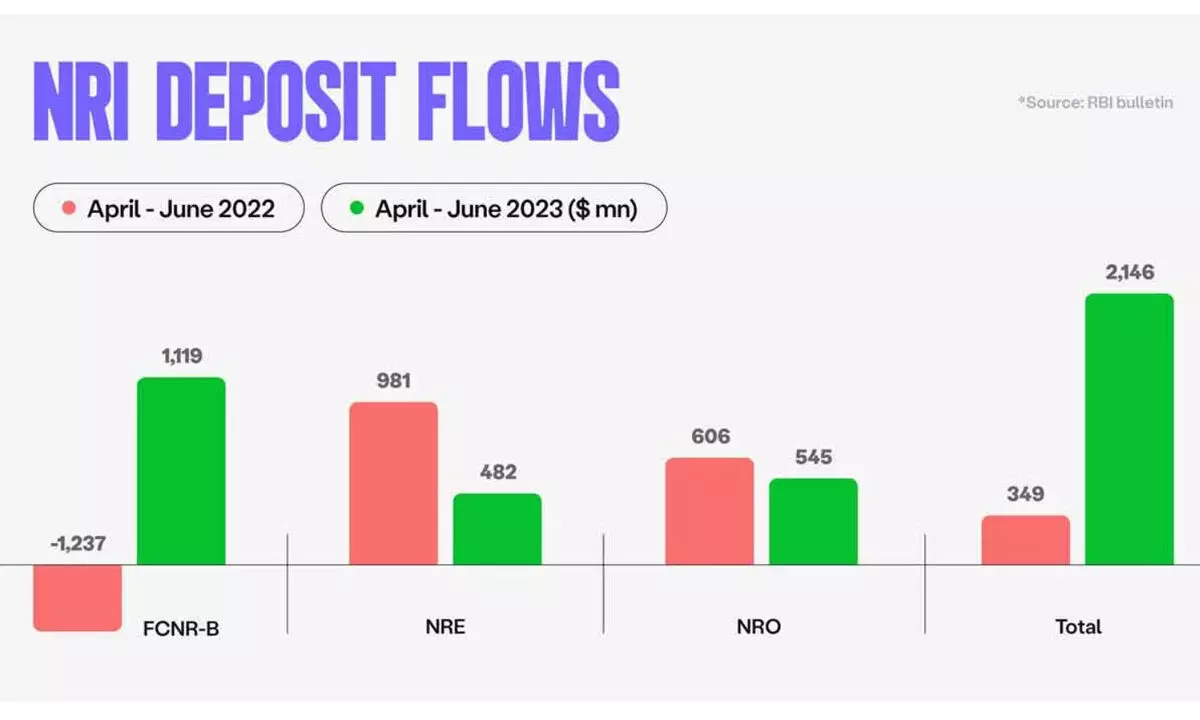

One of the most critical aspects of NRI remittances is their role in bolstering India’s foreign exchange reserves. Each remittance transaction adds to the country’s foreign exchange pool, making it a major source of foreign currency inflow. In times of economic uncertainties and global financial volatility, these reserves play a pivotal role in ensuring India’s macroeconomic stability. The increased purchasing power resulting from remittances encourages consumer spending and investment in various sectors of the Indian economy. From real estate to retail and education to healthcare, NRI remittances catalyze a ripple effect that energizes multiple industries.

This not only aids in job creation but also promotes overall economic growth. The importance of NRI remittances as a source of foreign exchange for India cannot be overstated. It is a testament to the strong ties between the Indian diaspora and their homeland, and their role in shaping the country’s economic destiny.

As India continues to evolve on the global stage, the contribution of its non-resident citizens will undoubtedly remain a vital part of its growth story.