Mkt clueless about post-Budget direction

Indian equity markets traded in a tight range last week, with the missing trigger points after an eventful previous week

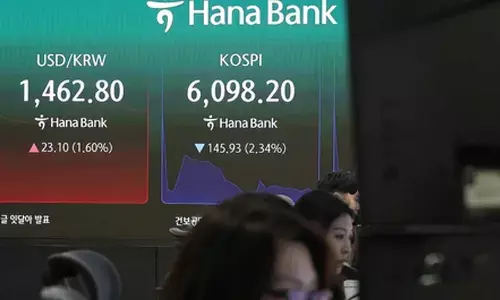

The Indian equity markets traded in a tight range last week, with the missing trigger points after an eventful previous week. NSE Nifty traded in just 264.25 points range and ended at almost flat with a mere two points gain. BSE Sensex declined by 0.26 per cent. Mid-Cap and Small-Cap indices outperformed with 2.1 per cent and 1.18 per cent gains, respectively. Nifty Realty gained by 2.2 per cent, and the Media index is up by 1.8 per cent. The Nifty Metal and Energy indices are down by 2.2 per cent and 1.4 per cent, respectively. The VIX is down by 11.48 per cent to 12.74, which is the lowest in recent times. The market breadth is not positive. FIIs sold Rs5,414.21 crore, and the DIIs bought Rs6,453.05 crore worth of equities during the current month.

The market is clueless about the direction post-budget. The daily and weekly trading range has shrunk. Three out of five sessions have formed inside bars. Thursday's move above the 20DMA failed to get a follow-through day. The whole week's price action is limited to the previous week's range. 20 Week average acted as resistance for another week. With sideways action, the momentum has completely waned. The Doji candles at the weekend indicate further indecision. We expected at least a week of inside action of budget day's 618 points move. During the last week, the range is limited to just 264 points. The Nifty is still below the 38.2 per cent retracement level of the prior downtrend from December 1. It is also below the 61.8 per cent retracement level of the recent downswing. Though it was above it on Thursday, lack of continuation of momentum, it closed below this crucial level. The 20DMA is also at the same level as 17872. The Moving is in a downward channel and needs to form a higher high and high low for a trend reversal on the upside. In other words, the Nifty has to cross 50DMA, and the 20DMA has turned upside.

The most cautious situation prevailing in the market is low VIX. It declined over 37 per cent pre-budget day to just 12.74. This is the lowest level of closing since August 12, 2021. Low volatility is negative for bullish, and it has an inverse relationship with the benchmark index. Incidentally, the Nifty has almost formed a minor swing high. Even the Implied Volatility (IV) has declined to 10.79, which is also a historic low. In these low volatile conditions, the market will experience wild swings. On low volatility, approaching the market with the highest caution is required.The weekly RSI is flat at 51.64 and in a neutral zone. No divergences are visible now. MACD line is below the signal line, and zero line shows bearish momentum. On a daily time frame, the directional movement indicators are in an influx point, as ADX, +DMI, and -DMI are at the same level. The Stochastic Oscillator is in an extremely overbought condition, which is negative for the bulls.

The Dow index has formed two consecutive Doji candles on the weekly chart, showing that the global markets are also waiting for further triggers for a directional bias. The S&P 500 index has formed an inside bar. FTSE and DAX have also formed bearish Doji bars at the swing high. Even the Nikkei-225 index has formed a Doji candle. This indecision across the global markets reflects in Indian markets too. This prolonged indecision will lead to an impulsive move in the near term, as the low VIX is always a dangerous signal for the markets. It is better to have a highly cautious approach in the market. Sometimes, doing nothing is also a strategy in sideways markets.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)