Live

- Court extends Manish Sisodia's judicial custody till May 8 in ED case

- Captivating performance by disciples of Guru Ananda Shankar Jayant

- 91 pc of Indian firms will use half or more data to train AI models

- Innovative cyber security program for engineering graduates

- Indian-origin researcher unravels link between depression and heart disease

- The importance of technology education schools

- New Delhi: Will severe heat wave affect polling tomorrow?

- Delhi Zoo to roll out membership plans

- Kotak Mahindra vows fix after RBI action

- Banks failing to tap fintech: Ashneer

Just In

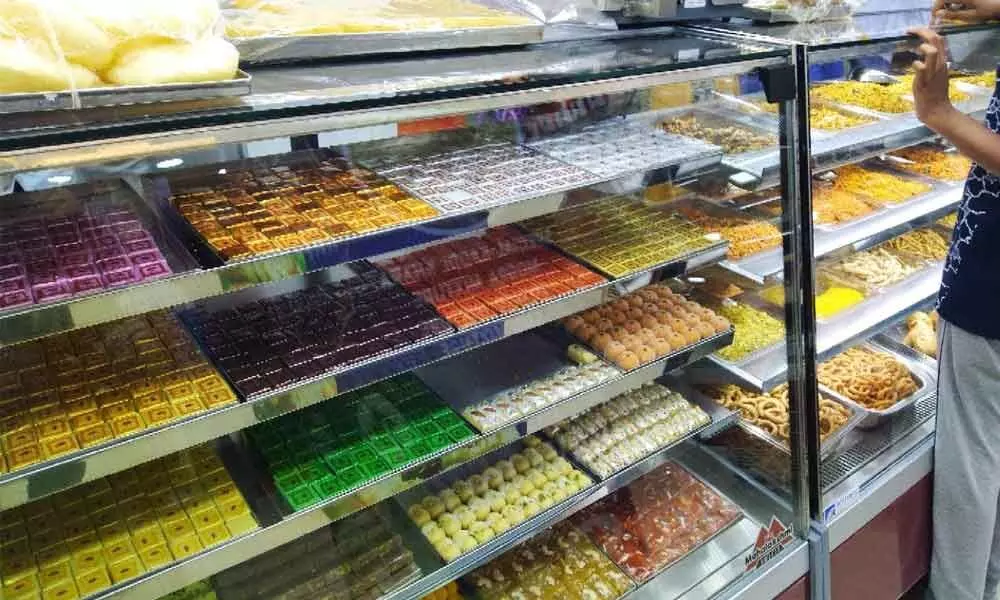

Sale of sweets goes up by 60% in Karnataka: OkCredit

Sale of sweets goes up by 60% in Karnataka: OkCredit

Festive season has provided a much-needed respite to the micro, small and medium enterprise sector

Bengaluru: Festive season has provided a much-needed respite to the micro, small and medium enterprise sector. These sectors have witnessed faster recovery, particularly sale of sweets, reveals data gathered by OkCredit, a pioneer in digital book-keeping apps, which are fast becoming popular among unorganized retailers and traders in India.

Based on the behavior of users, OkCredit gathered data of how the businesses performed during the festive season. According to the data, sales of sweets went up by 60% during this Diwali compared to 2019. This indicates the fervor associated with the festival overcame the fear of the Covid-19 pandemic. The sale of other items such as rangoli and lamps remained the same as that of the previous year.

OkCredit data indicates that the growth in transaction on the app was led by kirana and small businesses. These contributed to nearly 55% of this growth even as the overall transactions on the app during the festive period accounted for 12% percent of the transactions for 2020.

OkCredit also witnessed an increase in ticket size for jewelry by 16% from the preceding months during the festive season. This is in sharp contrast to the overall trend of shrinkage in ticket size by 22% in general and increase in number of transactions by 47% on OkCredit app during Diwali/ festive season this year in comparison to the same period last year. This signals that merchants are lending smaller amounts which can be accounted for the shrinkage in overall economic activity.

On the business transaction side, the bookkeeping value for OkCredit rose by 13% during this year's festive season / week when compared with 2019. The company also witnessed highest growth in terms of new merchant addition in Karnataka indicating a growth of 14% during the festive season.

Diwali is known as the end of the financial year with the second day of the festival marking the beginning of the next fiscal year. OkCredit, during the festive season, settled over 2 million accounts with 80% settled in Tier 3 cities.

This highlights the empowering role modern bookkeeping solutions are playing and the trend of micro retail players from small towns and hinterlands embracing digital bookkeeping solutions more than ever before, as it makes their book-keeping task simpler, digitized and secure.

According to Harsh Pokharna, co-founder and CEO, OkCredit, "The overall growth story of the digital bookkeeping industry has been very bullish this festive season with actual transaction figures surpassing our expectations comfortably. This shows how comfortable businesses have become with online bookkeeping even in this pandemic hit year.

One clear lesson from this festive season is that digital book-keeping has become more mainstream than ever and it has proven that with the right technology and features the value proposition of digital book-keeping is immensely powerful."

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com