Live

- What’s The Matter At Hand?

- Pollution levels continue to soar in Yamuna

- 540 touts held for duping passengers at IGI Airport

- Keen to bring Sports Bill in Budget Session: Mandaviya

- HC to hear plea against Kejriwal's bail in Jan

- SC grants bail to two in Waqf Board money laundering case

- Is ‘Deep State’ threat real or just a bogey?

- Sisodia not to report to police twice a week: SC

- No possibility of alliance with Cong for Delhi polls: Kejriwal

- Marriage an integral part of life: Top court enhances compensation to road accident victim

Just In

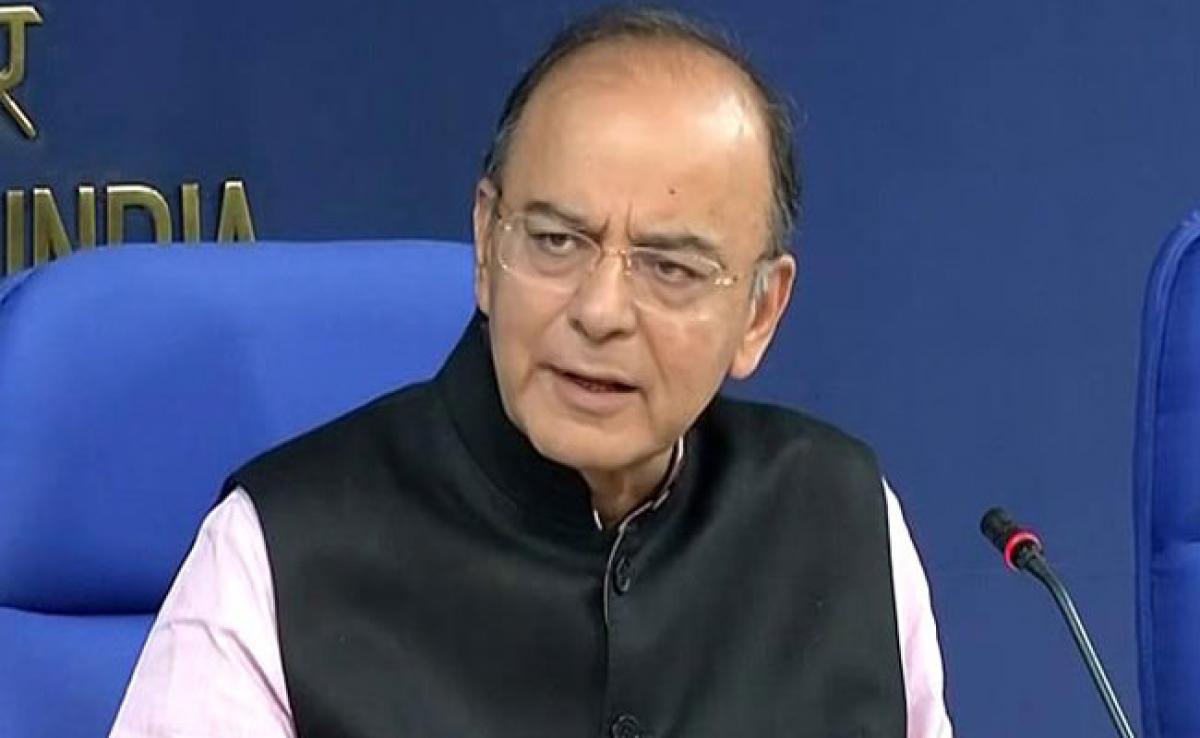

Finance Minister Arun Jaitley on Thursday said that Jammu and Kashmir Chief Minister Mehbooba Mufti rooted for people welfare and ignored separatists\' voice to adopt GST in the state assembly.

Finance Minister Arun Jaitley on Thursday said that Jammu and Kashmir Chief Minister Mehbooba Mufti rooted for people welfare and ignored separatists' voice to adopt GST in the state assembly.

Jammu and Kashmir was the only state that had not approved a legislation to implement the Goods and Services Tax (GST) even after the new indirect tax regime was rolled out on July 1.

Mr Jaitley said separatists ran a propaganda that GST should not be implemented in Jammu and Kashmir otherwise there will be "financial integration of the state with India."

The state finance minister was part of all the negotiations at the GST Council that decided on the tax rate and rules for its implementation and the state even hosted a meeting of the GST Council that decided on tax rates for about 1,200 goods.

The Centre had to then emphasise to the state that its people will lose out as they will pay tax twice over instead of just one GST, making goods costlier to them, he said.

"I wrote to Mehbooba Mufti saying that goods will become costlier (if you don't implement GST). So, you have to choose the path of either going with the separatists or thinking about the welfare of the people of the state," Mr Jaitley said, addressing an event organised by state BJP as thanksgiving for successfully implementing GST.

The Jammu and Kashmir assembly yesterday adopted the resolution to implement the new tax regime in the state. However, Presidential assent will be required before GST is implemented in the state.

Mr Jaitley pointed out how the price of a commodity would have varied in Pathankot and Jammu and Kashmir, if the latter decided not to implement GST.

Citing his meetings with traders and businessmen based in Jammu, Mr Jaitley said that they had voiced concern that they may be at a disadvantage if the same product is sold at a cheaper price in Pathankot in Punjab which is just an hour away from the state.

"And the same argument was given by the state government yesterday in the state assembly," he said.

The finance minister further said that in the last 70 years, this is the first time that the country had become economically integrated.

"...The J&K consumers also feel that they are integrated with India, and it is beneficial for us," he said.

Being a consuming state, Jammu and Kashmir would also benefit from GST and the revenue of the state will increase, he added.

In his letter to Mehbooba Mufti last month, Mr Jaitley had asked her to implement GST in the state as failing to do so would lead to "adverse impact" of price rise and put local industry at a disadvantage.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com