Live

- Akbar tears Modi’s charge on Muslim family size to shreds

- Hyd echoes with chants of ‘Jai Shri Ram’, ‘Jai Hanuman’

- Summer holidays for schools from today

- DSCI holds meet on advancing cyber security initiatives

- Hyd Metro to extend service hrs for IPL match tomorrow

- TS BIE announces payment due dates for pvt candidates

- Dr Lankapalli Bullayya inks pact with L&T

- North Andhra will be developed on all fronts

- HMWSSB MD reviews water supply

- Blunders of Nehruvian era still haunting the country: Dr Jaishankar

Just In

The Government says that the adverse impact of demonetisation on GDP growth will be transitional. The Economic Survey 2017 states that once the cash supply is replenished, which is likely to be achieved by end March 2017, the economy would revert to the normal.

The Government says that the adverse impact of demonetisation on GDP growth will be transitional. The Economic Survey 2017 states that once the cash supply is replenished, which is likely to be achieved by end March 2017, the economy would revert to the normal.

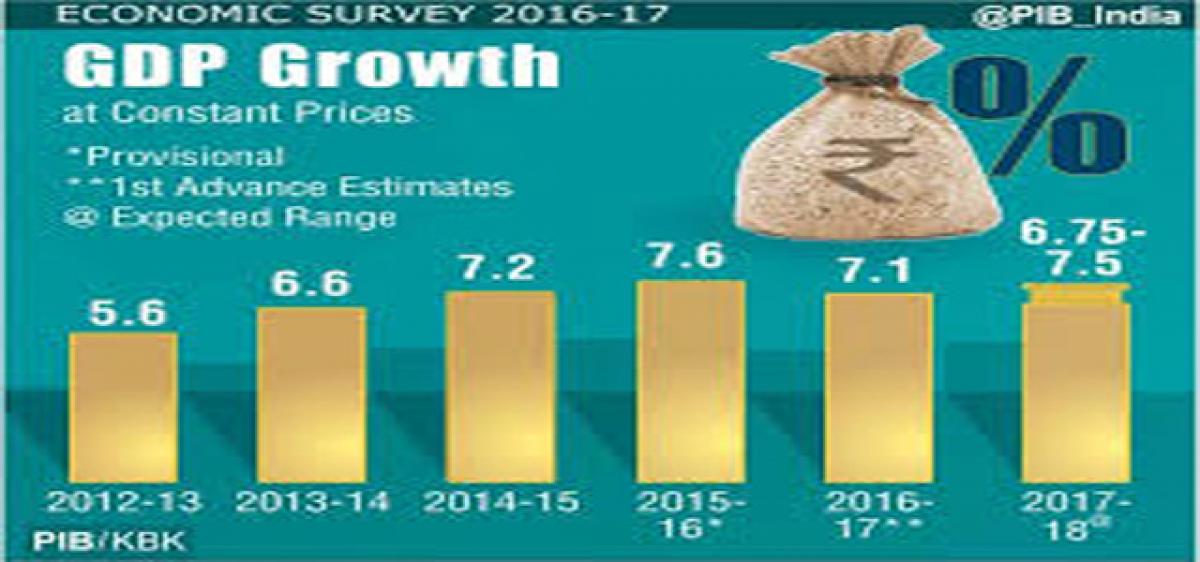

Therefore the real GDP growth in 2017-18 is projected to be in the range of 6¾-7½ per cent.

It points out that demonetisation will have both short-term costs and long-term benefits as detailed in the attached table. Briefly, the costs include a contraction in cash money supply and subsequent, albeit temporary, slowdown in GDP growth; and benefits include increased digitalisation, greater tax compliance and a reduction in real estate prices, which could increase long-run tax revenue collections and GDP growth.

On the benefits side, early evidence suggests that digitalisation has increased since demonetisation. On the cost side, effective cash in circulation fell sharply although by much less than commonly believed – a peak of 35 per cent in December, rather than 62 per cent in November since many of the old high denomination notes continued to be used for transactions in the weeks after 8th November Additionally, remonetisation will ensure that the cash squeeze is eliminated by April 2017.

The cash squeeze in the meantime will have significant implications for GDP, reducing 2016-17 growth by ¼ to ½ percentage points compared to the baseline of 7 percent. Recorded GDP will understate impact on informal sector because, for example, informal manufacturing is estimated using formal sector indicators (Index of Industrial Production).

These contractionary effects will dissipate by year-end when currency in circulation should once again be in line with estimated demand, which would also allow growth to converge to a trend by FY 2017-18.

It has pointed out that the weighted average price of real estate in eight major cities which was already on a declining trend fell further after November 8, 2016 with the announcement of demonetization.

It goes on to add that an equilibrium reduction in real estate prices is desirable as it will lead to affordable housing for the middle class and facilitate labour mobility across India currently impeded by high and unaffordable rents.

The Survey suggests a few measures to maximize long-term benefits and minimize short-term costs. One, fast remonetisation and especially, free convertibility of cash to deposits including through early elimination of withdrawal limits.

This would reduce the GDP growth deceleration and cash hoarding. Two, continued impetus to digitalization while ensuring that this transition is gradual, inclusive, based on incentives rather than controls and appropriately balancing the costs and benefits of cash versus digitalisation.

Three, following up demonetisation by bringing land and real estate into the GST. Four, reducing tax rates and stamp duties. And finally, an improved tax system could promote greater income declaration and dispel fears of over-zealous tax administration.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com