CEAT profit jumped 152% to Rs 132 crore in Q3FY21

CEAT profit jumped 152% to Rs 132 crore in Q3FY21

CEAT Limited today, an RPG Group company, January 19, 2021, posted its financial results for the third quarter of the financial year 2020-21 (Q3FY21) and reported a 152 per cent year-on-year (YoY) rise in the profit at Rs 132.34 crore, as vehicle production returned to pre-covid level and sales in the after-market segment made a strong comeback

CEAT Limited today, an RPG Group company, January 19, 2021, posted its financial results for the third quarter of the financial year 2020-21 (Q3FY21) and reported a 152 per cent year-on-year (YoY) rise in the profit at Rs 132.34 crore, as vehicle production returned to pre-covid level and sales in the after-market segment made a strong comeback.

The company has posted a net profit of Rs 52.50 crore for the corresponding quarter of the last fiscal year.

In a regulatory filing, CEAT said, "Q3FY20-21 Consolidated Revenue stood at Rs 2,221 crore. Consolidated EBITDA stood at Rs 339 crore, Operating margin of 15.3 per cent."

The tyre manufacturer's revenue from operations grew by 26.08 per cent to Rs 2,221.25 crore in the reported quarter as compared to Rs 1,761.77 crore posted last year.

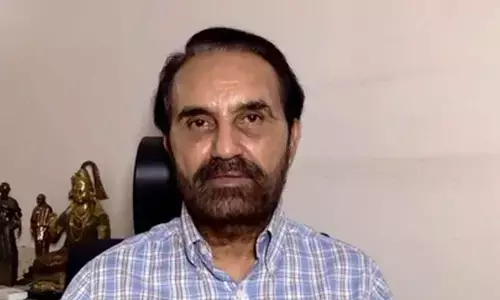

Commenting on the results as well as the outlook of the business, Mr Anant Goenka, Managing Director, CEAT Limited said, "We are pleased to see yet another quarter of strong performance with a top-line YoY growth of 26.1 per cent and sequential growth of 12.3 per cent. This quarter's growth has been achieved on the back of new capacities across segments, particularly passenger car, two-wheeler and farm segments. The replacement market has been buoyant because of consumer preference in personal mobility and strong rural demand." He added, "There is expected to be some margin pressure in the next quarter due to increasing raw material prices."

Earnings before interest, tax, depreciation and amortisation (EBITDA), grew by 78 per cent to Rs 326 crore, while EBITDA margin improved by 430 basis points to 14.7 per cent. One basis point is 0.01 per cent.

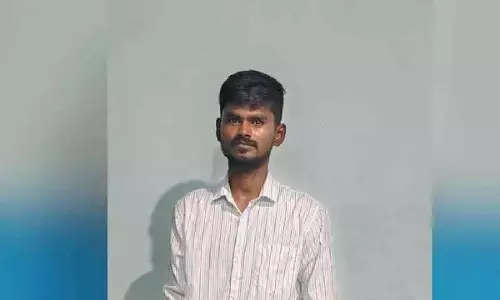

Kumar Subbiah, CFO, CEAT Limited, said, "We delivered healthy consolidated EBITDA margin at 15.3 per cent for the quarter driven by a strong improvement in the revenues, product mix and strong cost controls. He added, "Our continuous effort to judiciously manage cash helped in bringing down debt by Rs 260 crore and helped in qualitative improvement in the leverage ratios and the company's balance sheet."