Derivatives Outlook Options data shows wider trading rangee

OI bases rising at Call OTM strikes; Put-Call Ratio of Open Interest at 1.21 indicates undercurrent bearish bias

The latest options data on NSE is pointing to wider range of trading this week as the support level declined by 450 points to 22,000PE and the resistance level rose by 500 points to 23,000CE.

The 23,000CE has highest Call OI followed by 22,800/ 22,600/ 22,500/ 22,900/ 22,700/ 23,100/ 23,200 strikes, while 22,900/ 22,800/ 22,700/ 23,000 strikes recorded reasonable addition of Call OI.

Coming to the Put side, maximum Put OI is seen at 22,000PE followed by 21,200/ 21,400/ 21,800/ 21,500/ 21,600 strikes. Further, 21,800/ 21,950/ 21,200/ 22,000 strikes witnessed modest build-up of Put OI.

Dhirender Singh Bisht, associate vice-president (technical research) at SMC Global Securities Ltd, said: “In the Nifty options, the highest Call Open Interest was observed at the 22,000 strike, followed by the 22,200 strike. On the Put side, the highest Open Interest was at the 22,000 strike, followed by the 21,800 strike. For Bank Nifty, the highest Call Open Interest was at the 47,000 strike followed by 47,500 strike and the highest Put Open Interest was at the 46,500 strike.”

During the last truncated week, consolidation was seen above 22,200 level. Put strikes from 22,500 and lower recorded significant writing across the board. It indicates limited downsides. Short covering move can be expected in Nifty towards 22,700 and higher if it able to sustain above the Call base of 22,500 level. Analysts advise that better to avoid positions if Nifty slips below 22,200 level.

“During the previous week, Nifty experienced a correction of over two per cent following its all-time high. Profit booking was notable in mid-cap and small-cap segments, which were the primary losers. The Bank Nifty recorded a weekly loss exceeding 2.5 per cent. Prominent sector trends witnessed IT stocks outshining others, while media, realty, and PSU bank stocks fell behind,” observes Bisht.

BSE Sensex closed the week ended March 15, 2024, at 72,643.43 points, a fall of 1,475.96 points or 1.99 per cent, from the previous week’s (March 7) closing of 74,119.3 points. During the week, NSE Nifty was also declined by 470.2 points or 2.09 per cent to 22,023.35 points from 22,493.55 points a week ago.

Bisht forecasts: “For the upcoming week, Nifty may trade within the range of 21,800 – 22,200, with potential breakout on either side dictating market direction. Traders are recommended to monitor these levels closely.”

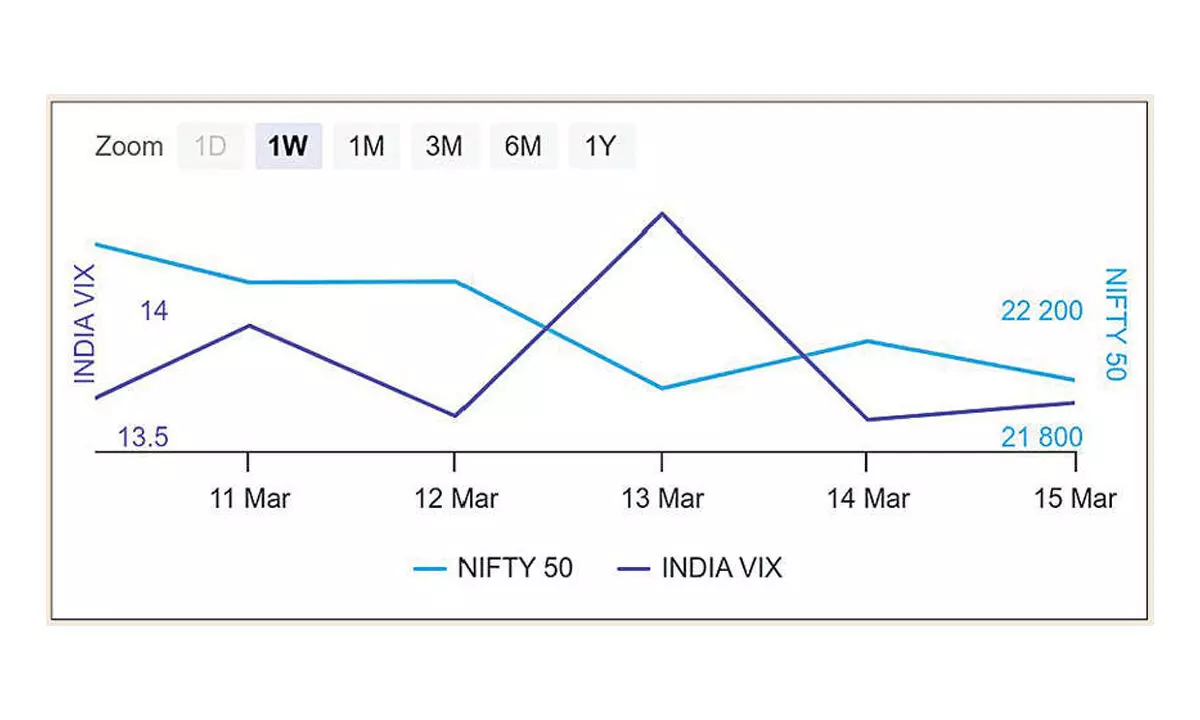

“Implied Volatility for Nifty’s Call options settled at 13.03 per cent, and Put options concluded at 13.89 per cent. The India VIX, a crucial market volatility indicator, ended the week at 13.62 per cent. The Put-Call Ratio of Open Interest stood at 1.21 for the week,” remarked Bisht. India VIX rose 0.50 per cent to 13.69 level on Friday. “Additionally, the volatility index-India VIX- could significantly influence upcoming sessions, with an increasing India VIX can indicate further profit booking,” added Bisht.

FIIs engaged in short covering in both index futures and options. FIIs sold Rs1,690 crore in stock futures and offloaded over Rs60,000 crore in index options.

Bank Nifty

NSE’s banking index closed the week at 46,594.10 points, lower by 1,241.70 points or 2.59 per cent from the previous week’s closing of 47,835.80 points.

F&O At A Glance

n Highest Call base at 23,000CE

n Highest Put OI at 22,000PE

n India VIX rises to 13.69 level