Recession may push banks into bigger crisis

Can you make money by doing foolish things? Don't take this as a foolish question because some people do make money while doing foolish things.

Can you make money by doing foolish things? Don't take this as a foolish question because some people do make money while doing foolish things.

They can do this unbelievable feat because society around the world has a significant percentage of foolish population.

These businessmen of immense acumen and caliber tap the so-called foolish bunch and squeeze decent money out of them. That's for sure. I can explain how and why.

For instance, there is an idiotic programme called Bigg Boss on idiot box. Modelled on a Dutch reality competition called Big Brother and debuted in Hindi in 2006, it has since spread to several regional languages including Telugu, Kannada, Tamil and Bengali.

In this, a bunch of people - men and women- live in a house, isolated from the world, and one of them will be declared winner. The concept gained popularity in India after Bollywood actress Shilpa Shetty won Celebrity Big Brother 5 in UK in 2007.

At that time, Shetty levelled racism allegations against other contestants, leading to protests in India and tensions between the Indian and UK governments.

Eventually, she walked away with winner's trophy. Sometimes, controversy pays rich dividends. Isn't it?

But it is hard to decipher why so many people watch such useless shows. We regularly see our family members live and behave in our house.

We clearly see how our neighbours live, behave and sometimes fight. We are also exposed to how our colleagues behave in the office and how people live & behave outside.

When we are exposed to so many real reality shows day in and day out, where is a need for such a reality show on the idiot box? The sad part is that millions watch such shows India. That's what foolish people do.

And that shows India is home to millions of dumbheads. However, the success of such reality shows reveals that the world lacks quality entertainment content. That means there is a business opportunity for sane people.

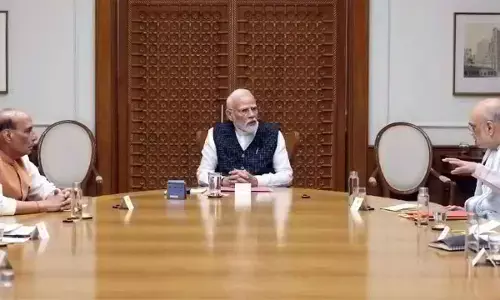

Anyway, this week brought us two contrasting pictures. Prime Minister Narendra Modi stole the show at 'Howdy Modi' event in Houston in the US, where the US President Donald Trump attended as Chief Guest.

The roar and 'Modi Modi' chant at the event attended by over 50,000 Indian Americans in the heart of oil capital of the world reveal that our Prime Minister is more popular among Indian diaspora than in India where he scored a resounding victory in recent General Elections.

That means Modi magic has spread beyond India borders. The important takeaway from the event, however, is that Modi has completely dominated the show despite the presence of US President.

I have never seen an Indian Prime Minister dominating the US President the way Modi did in Houston. That should please the saffron brigade back home.

But Donald Trump is the most maverick and cunning of all the current rulers in the world. He always thinks from white Americans point of view. That's his strength and weakness.

He has elections to face in 2020 for his second consecutive term. Therefore, open support to his re-election bid announced by Modi at the event will come in handy for him as majority of Indian Americans root for the Democratic Party, the main rival of the Republican Party which Trump represents.

At this juncture, Trump has nothing to lose by allowing Modi to dominate him. He will conveniently forget Modi's help and go back to his old ways if he wins next year. If he loses, he can us his good relations with Modi to expand his real estate business empire in India.

But India and Modi will land in soup if Trump loses. In that eventuality, the new US President who will obviously be from the Democratic Party will have a political reason to ignore India's interests.

No surprise if the new US President takes revenge on India for its Prime Minister openly siding with Trump.

Even as Prime Minister Narendra Modi was basking in his popularity in the US, people in Mumbai and some other parts of the country received rude shock when RBI imposed restrictions on Mumbai-based Punjab and Maharashtra Co-operative Bank (PMC) for hiding a big non-performing asset (NPA) account. Initially, RBI allowed the bank's customers to withdraw just Rs 1,000 per account.

Though it has increased the limit to Rs 10,000, customers are paying heavy price for no fault of them. Of course, RBI is rather harsh on PMC.

The country's banking sector landed in crisis during 2009 recession and it never fully recovered from that shock. The surprise demonetisation exercise undertaken by the Modi government in November 2016 and subsequent war on cash transactions pushed the banking sector into deeper crisis.

Further, NPAs among public sector banks (PSBs) increased from Rs 2.79 lakh crore in 2015 to Rs 8.95 lakh crore in 2018. However, NPAs in PSBs came down by Rs 89,189 crore to Rs 8.06 lakh crore by March 31, 2019, thanks to large scale capital infusion in PSBs by the central government, but the number is still daunting.

Further, total NPAs will go up to Rs 9.5 lakh crore if bad loans of all scheduled commercial banks (SCBs) including those of private banks, are added. To keep PSBs in good health, the BJP government pumped over Rs 2.53 lakh crore into them in last five years i.e. from 2014-15 to 2018-19.

Further, it also allocated Rs 73,385 crore in the current financial year, taking the total capital infusion to Rs 3.26 lakh crore. But this staggering pile of free funds failed to revive the banking sector which is still battling for survival.

With country's economy heading for another recession now, banking sector stares at a bleak future. As happened in 2009, any economic slowdown will take a heavy toll on the banking sector. It's banks that bear the brunt first.

Therefore, more banks may go PMC way, pushing banking sector in bigger crisis. Will inexperienced Finance Minister Nirmala Sitharaman be able to put the economy on higher growth track, thereby saving the country and the banking sector from hardships?