US - China’s strategic competition a geopolitical risk facing markets

China remains a major export market for the United States

Leading global investment agency, Blackrock has created ripples with its latest assessment that the top geopolitical risk facing markets worldwide is the “strategic competition” between the U.S. and China. It rates the issue as a higher risk than potential escalation of either the Ukraine-Russia or Israel-Hamas conflicts.

The focus on the relationship between the two major economies comes at a time when there is concern over the possible widening of the conflagration in West Asia. Fears over the expansion of tensions between the U.S. and China have been put on the backburner by most analysts, given the immediate crisis being faced by the war between Israel and Hamas.

Yet the geopolitical risk dashboard of the Blackrock Investment Institute has placed these ties at an attention score of 1.5. This is in sharp contrast to the score of -0.65 for conflict escalation in West Asia and 0.37 for a war between Russia and the North Atlantic Treaty Organisation (NATO). Outlining their reasons, Blackrock analysts maintain that the two countries have entered into a “long-run competitive posture” and stress that any thaw in the relationship would be fragile.

On the Chinese side, they refer to its actions in the South China Sea and the pressure put on Taiwan. Similarly, they note that increased military and economic support was being provided by the U.S. to Taiwan. While there may not be any military action, it was felt the risk was increasing.

The investment agency’s apprehensions highlight the fact that the two biggest economies are increasingly taking opposing stances on the geopolitical developments of recent years.

In the case of the Ukraine war, the U.S. has come out strongly against Russia’s invasion and it has been joined by the U.K. and the European Union. In contrast, China has stood by Russia in this conflict and has extended its full support, including by abstaining from U.N. resolutions condemning the military action in Ukraine. India has also been abstaining from these resolutions and sought to take a neutral stance. But it has also reached out to provide humanitarian aid to Ukraine even as Prime Minister Narendra Modi said that this is not an era for war during a meeting with Russian President Vladimir Putin.

Secondly, China has drawn closer to Iran, a country that has been antagonistic to the U.S. for many decades. It is Iran, which is reported to have given full support to Hamas for launching the war against Israel. Here again the two economic superpowers remain on opposite sides of the divide. Yet it must be emphasised that China is trying to position itself as a peacemaker in the conflict. Significantly, it has not used the term Hamas in its public statements but has termed it as the Israel-Palestine conflict. Chinese leader Xi Jinping has suggested that there should be a ceasefire on both sides and officials have expressed dismay that the UN proposal for a pause in the fighting has been vetoed by the U.S. But the effort to play as a mediator has not been welcomed by Israel, which has criticised the Chinese effort to be even handed.

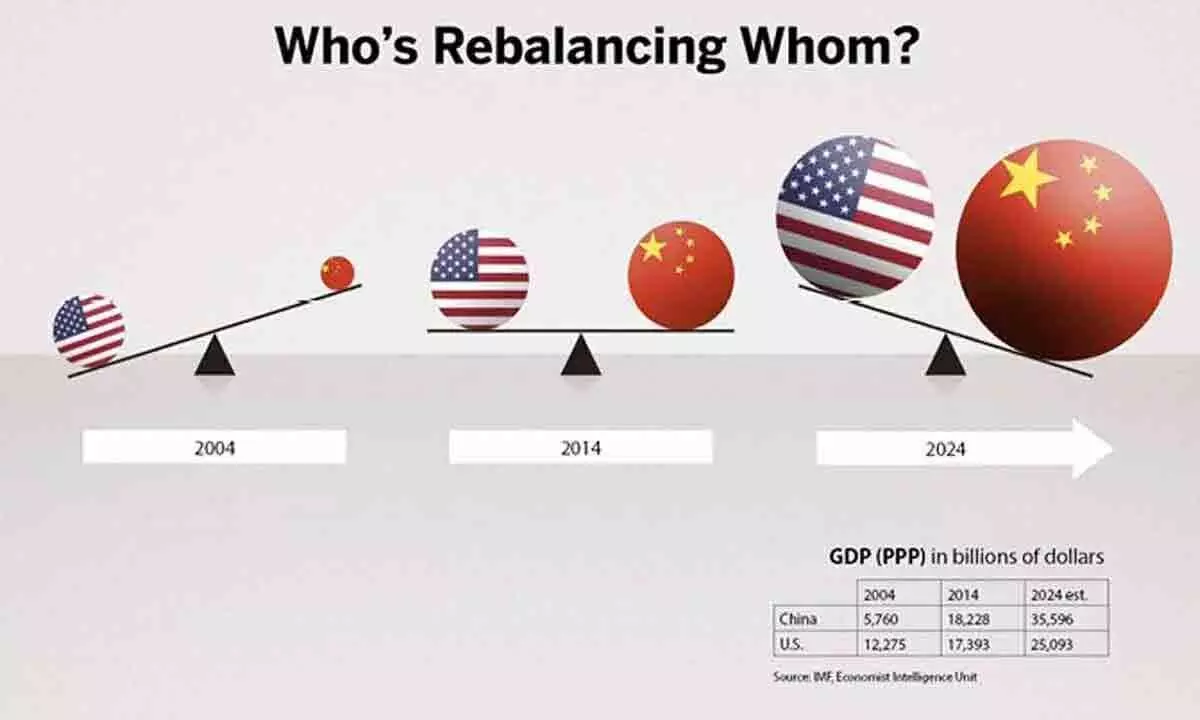

Thus on geopolitical issues, the U.S. and China are increasingly seeing themselves on opposing sides. The growing friction between the two countries has thus moved beyond the fractious bilateral relationship. At the same time, it must be recognised that economic and trade ties remain closely intertwined. U.S. goods and services imports from China reached over 563 billion dollars in 2022. But there are reports that the share of imports from that country is declining, which could reflect the shift of many businesses to other overseas locations. China also remains a major export market for the U.S. with soya beans being one of the leading commodities being supplied. According to the U.S. –China Business Council these exports support nearly 1.1 million jobs in the U.S. Large corporates, which are part of the S and P500 index, are also reported to generate nearly 7.6 per cent of their revenue in China.

In other words, the economic relationship would be extremely difficult to untangle in case the friction between the two countries grows to a point where military action is taken. The Blackrock assessment does not view such action as a reality in the near term. It does, however, see the risk increasing and points to the Taiwan presidential elections in January as an important milestone.

“We do not see military action in the near term but see the risk increasing. An important milestone will be the Taiwan presidential elections in January 2024,” it suggests.