Vakrangee Q3FY22 Results: Profit rises 74.58% to Rs 29 crore

Vakrangee Limited, a franchisee-based multi-service retail network, today announced a 74.58 per cent year-on-year (YoY) rise in the consolidated profit at Rs 29.33 crore for the quarter ended December 31, 2021, due to process automation & technology Initiatives.

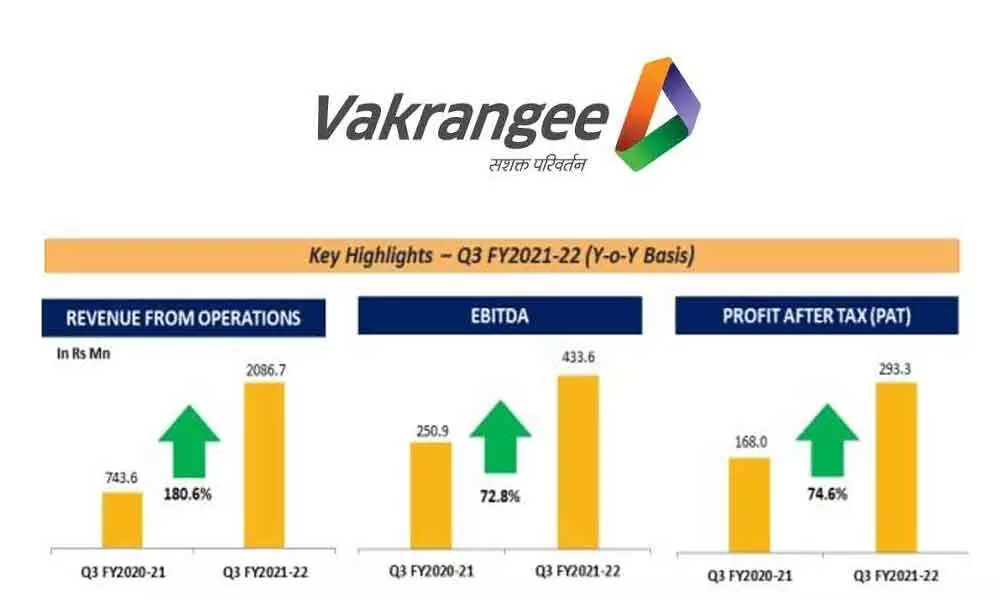

Vakrangee Limited, a franchisee-based multi-service retail network, today announced a 74.58 per cent year-on-year (YoY) rise in the consolidated profit at Rs 29.33 crore for the quarter ended December 31, 2021, due to process automation & technology Initiatives. Strong Operating Leverage also resulted in a significant improvement in profitability. It had posted a profit of Rs 16.79 crore in the corresponding quarter of the previous financial year.

The company's revenue from operations rose 180.62 per cent YoY to Rs 208.67 crore in the period under consideration compared to Rs 74.36 crore posted last year. Its EBITDA grew 72.82 per cent YoY to Rs 43.36 crore as against Rs 25.09 crore for the corresponding quarter last year.

EPS (basic) for the face value of Rs 1 stood at Rs 0.28 in Q3FY2021-22 as against Rs 0.16 in Q3FY2020-21, registering a growth of 75 per cent.

Vakrangee's Quarterly Gross Transaction Value (GTV) crosses the mark of Rs 12,550.85 crore. In 2022, Vakrangee has been recognized by Sustainalytics as an ESG Global 50 Top Rated company. The company has also been awarded ESG India Leadership Award 2021 for the Category - "Leadership in Data Privacy and Security" organised by ESGRisk.ai, India's first ESG rating company.

The company in a regulatory filing at the bourses said that it witnessed strong Financial & Operational growth. Return to normalcy on the business front has been progressing well as E-commerce, Online Healthcare and other services have become fully operational.

It has witnessed strong growth in Revenues due to an increase in the number of outlets on a YoY basis as well as services becoming operational. EBIDTA Margins have improved at around 20.8 per cent and PAT Margins at 14.1 per cent due to lower employee expenses as well as major contribution has been from BFSI & ATM services.