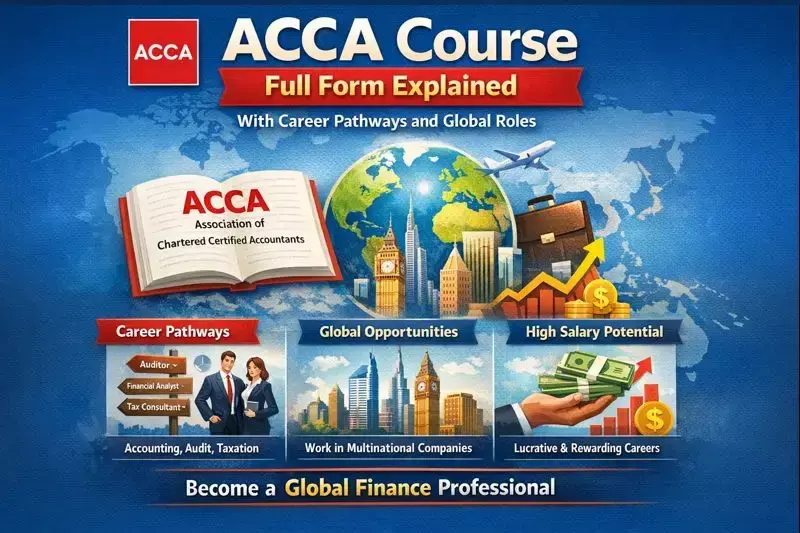

ACCA Course Full Form Explained With Career Pathways and Global Roles

Clear breakdown of ACCA Course Full Form, syllabus, eligibility, jobs, salaries, and career routes across countries. Written in plain language with real direction.

ACCA Course Full Form Explained with Career Pathways

If you are searching for a finance qualification that travels across borders and fits real business roles, ACCA keeps showing up for a reason. People hear the name, nod politely, and still ask what it actually stands for and where it leads. Let us sort that out without beating around the bush.

ACCA Course Full Form

The ACCA Course full form is the Association of Chartered Certified Accountants.

That is the full name behind the short form ACCA. It is not a college degree. It is a professional qualification backed by a global accounting body. The organisation behind it is the Association of Chartered Certified Accountants, founded in the UK and active across more than 180 countries.

When someone says they are doing ACCA, they mean they are working toward membership in this body by clearing exams, gaining work exposure, and meeting ethics rules.

What Makes ACCA Different From Regular Degrees

A regular commerce degree remains academic. ACCA stays job facing.

ACCA links accounting, audit, tax, finance, and business sense into one track. Every paper ties back to how companies actually run. You do not study topics for marks alone. You study them because they show up at work.

Another difference is timing. You do not wait three years to feel progress. Each cleared level brings value on your resume.

ACCA Structure Explained Simply

ACCA runs through three levels. Each level has a clear role in shaping your career.

Applied Knowledge

This stage builds the base.

Subjects cover business basics, management accounting, and financial accounting.

This is where many students from non-commerce backgrounds start feeling comfortable with numbers.

Applied Skills

This level moves closer to real work.

Topics include performance management, taxation, audit, and financial reporting.

By this stage, your profile already fits junior finance and accounting roles.

Strategic Professional

This is where thinking matters more than memory.

You study leadership, risk, advanced reporting, and strategic finance.

Clear this level and you are no longer seen as a trainee. You are seen as a finance professional.

Eligibility for ACCA

ACCA does not lock doors early.

After class 10, you can enter through the Foundation route.

After class 12, commerce students can start directly.

Graduates from any stream can join with exemptions based on prior study.

This open access is why ACCA attracts students who want flexibility without losing global value.

ACCA Duration and Study Style

There is no fixed classroom timeline.

Most candidates finish ACCA in three to four years. Fast movers do it sooner. Working professionals may take longer.

Exams run four times a year. You choose when to sit. That matters if you plan to work alongside study.

Career Pathways After ACCA

This is where ACCA stops being theory and starts paying off.

Accounting and Audit Roles

Financial accountant

Audit associate

Internal auditor

These roles appear early, often during the Applied Skills stage.

Corporate Finance and FP&A

Financial analyst

Budget controller

FP&A executive

Here, you work with forecasts, planning, and business numbers instead of pure bookkeeping.

Taxation and Compliance

Tax consultant

Corporate tax analyst

ACCA covers both theory and application, which suits advisory roles.

Leadership and Management

Finance manager

Business controller

CFO track roles over time

At senior levels, ACCA signals global readiness rather than local training.

Countries Where ACCA Carries Strong Weight

ACCA is not limited to one job market.

United Kingdom

Middle East

India

Singapore

Canada

Australia

Parts of Europe and Africa

In the above mentioned markets many global companies respect ACCA since the syllabus remains the same no matter where you study or work.

Salary Outlook After ACCA

Numbers change by region, but trends stay stable.

Entry-level roles pay above-average graduate salaries.

Mid-level professionals earn based on role and industry.

Senior roles depend more on experience than the qualification tag.

ACCA does not promise instant wealth. It gives access to roles where growth stays steady.

ACCA vs Other Finance Qualifications

Students often compare ACCA with CA, CPA, or CMA.

ACCA stays broader and more international.

CA stays country-focused and tougher to clear in one go.

CPA fits US accounting roles.

CMA centers mainly on cost accounting and management accounting work.

Choice depends on where you want to work and how soon you want flexibility.

Who Should Choose ACCA

ACCA fits people who want mobility.

It suits those who want finance roles beyond pure accounting.

It works well for students who prefer structured exams with global value.

If you want a qualification that grows with your career rather than ending after a degree, ACCA makes sense.

Common Myths Around ACCA

ACCA is not only for toppers.

ACCA is not limited to audit jobs.

ACCA does not block Indian careers.

Most dropouts happen due to poor planning, not difficulty alone.

Final Thought

ACCA keeps its place because companies still want people who can handle numbers and also think like the business. For those who want study plans that connect directly with real job roles, names like Zell Education come up for clear mentoring and focused exam guidance without distractions.