To boost commodities derivatives

To boost commodities derivatives. Marking the first ever merger of two regulators, Forward Markets Commission (FMC) on Monday merged with securities market watchdog Sebi.

FMC merger with Sebi

Sebi likely to allow FPIs

Sebi Chairman U K Sinha said it would look at allowing foreign portfolio investors (FPIs) and banks in this market in next few months. The Sebi chief said that new participants like banks and FPIs (Foreign Portfolio Investors) as well as more products would be allowed. "These development measures will happen in few months.

.jpg)

Right now, our focus would be on placing the regulators environment," he said. Further, Sinha said Sebi would focus on how prices and benchmark rates are fixed in commodity markets as well as look at the possibility of having products like options and futures.

Commodities market has been hoping for FPIs to be allowed after FMC's merger with Sebi, but the Reserve Bank of India (RBI) recently told the markets regulator to keep any such decision on hold till a policy review is done by the government in this regard.

There were expectations that the merger would pave way for FPIs to participate in the commodities derivatives market, as they are already allowed by Sebi in the capital markets segment under its ambit.

Ahead of the merger, Sebi had written to the Reserve Bank and the government in this regard, to which RBI replied that the status quo should be maintained till a policy review is undertaken by the government for allowing FPIs in commodities derivative trading.

It would strengthen regulatory framework, curb manipulations

The merger will increase the economies of scope and scale as there are strong commonalities between all kinds of trading. I am sure that Sebi is prepared to regulate the commodity derivatives market

– Finance Minister Arun Jaitley

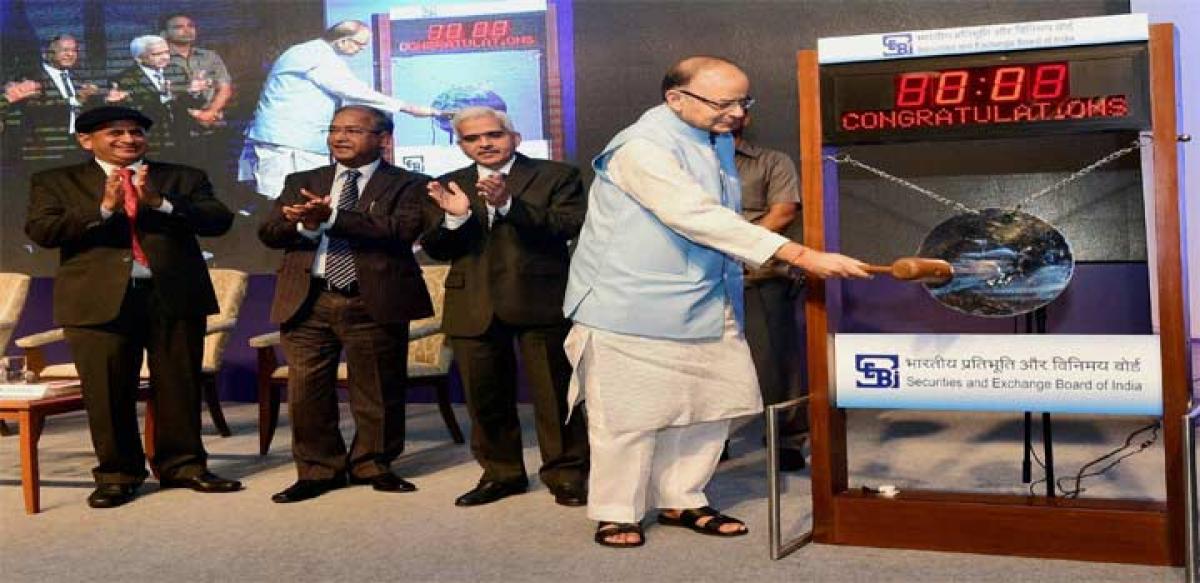

Ramesh Abhishek, Chairman of FMC, UK Sinha, Chairman of SEBI, Srikant Das, secretary, department of economic affairs look on as Union Finance Minister, Arun Jaitley strikes a gong during an event announcing the FMC-SEBI merger in Mumbai on Monday

Mumbai : Marking the first ever merger of two regulators, Forward Markets Commission (FMC) on Monday merged with securities market watchdog Sebi. It will help strengthen as well as streamline regulatory framework to curb manipulations in the commodities derivatives segment.

Besides, the amalgamation of over six-decade old FMC with the Sebi would ensure that NSEL-like fiascoes are dealt with more effectively. This is the first major case of two regulators being merged as against the relatively more frequent practice worldwide of creating new regulatory authorities, including by carving out new bodies from the existing entities.

Currently, there are three national and six regional bourses for commodity futures in the country. Finance Minister Arun Jaitley, who formalised the merger by ringing the customary bell, said the amalgamation would bring convergence of regulations in the commodities and equity derivatives.

"The merger will increase the economies of scope and scale as there are strong commonalities between all kinds of trading. I am sure that Sebi is prepared to regulate the commodity derivatives market," he said. Responding to a query about National Spot Exchange Limited (NSEL)-like crisis situations, Jaitley said, "You always have aberrations in a free market.

But a free market also means being a fair market and if such incidents do occur, I'm sure we have strong regulatory mechanisms to deal with it". Sebi Chairman U K Sinha said the first priority would be to develop confidence in the commodities market and then focus on development of the market by way of allowing participation by banks and foreign portfolio investors in this market.

Even though the merger has been on the cards for 12 years, the move was expedited in the wake of the Rs 5,700-crore payment crisis at NSEL that affected many investors. To ensure that there is no disruption, Sinha said the commodities market entities would get a timeframe of up to one year to adjust as they would have to follow the same norms that are applicable to their peers in the equity segment.

As this underlying physical market is widespread, fragmented and unregulated for certain commodities, Sebi needs to have a proper mechanism to capture any aberrations in the physical market that would disrupt the derivatives market, he added.

The commodities market has been known to be more prone to speculative activities as compared to the better-regulated stock market, while illegal activities like 'dabba trading' have also been more frequent in this segment.

Besides, the high-profile NSEL scam has rocked this market in the recent past and the subsequent regulatory and government interventions in this case eventually led to the government announcing FMC's merger with Sebi.