What is Gold Monetization Scheme?

What is Gold Monetization Scheme. The government is likely to consider and approve Gold Monetisation Scheme in the next few weeks. The proposal will offer tax-free interest to individual on depositing the yellow metal with banks.

The government is likely to consider and approve Gold Monetisation Scheme in the next few weeks. The proposal will offer tax-free interest to individual on depositing the yellow metal with banks. The Cabinet note on Gold Monetisation Scheme has been circulated while various proposals including interest rate are at the discussion stage, sources said.

The government is likely to consider and approve Gold Monetisation Scheme in the next few weeks. The proposal will offer tax-free interest to individual on depositing the yellow metal with banks. The Cabinet note on Gold Monetisation Scheme has been circulated while various proposals including interest rate are at the discussion stage, sources said.

The draft gold monetisation scheme announced in May proposed to provide incentives to the banks, while individuals and institutions can deposit as low as 30 gm of gold. It also proposed that the interest earned on it would be exempt from income taxes well as capital gains tax.

The stock of gold in India that is held by people that is 'neither traded nor monetised' is estimated to be over 20,000 tonnes, which would be worth about Rs 60 lakh crore at the current market price. India is one of the largest consumers of gold in the world and imports as much as 800-1,000 tonnes each year.

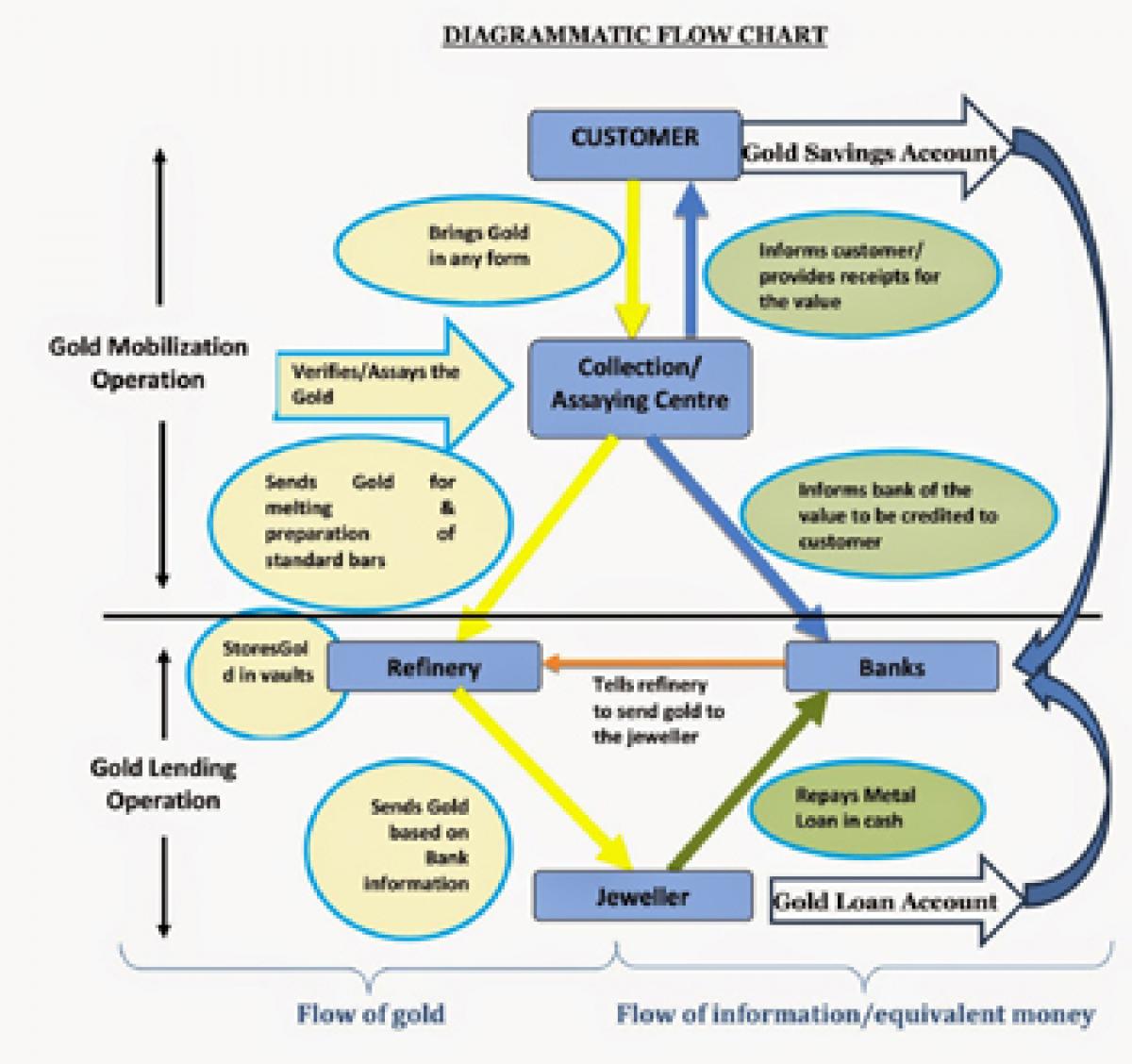

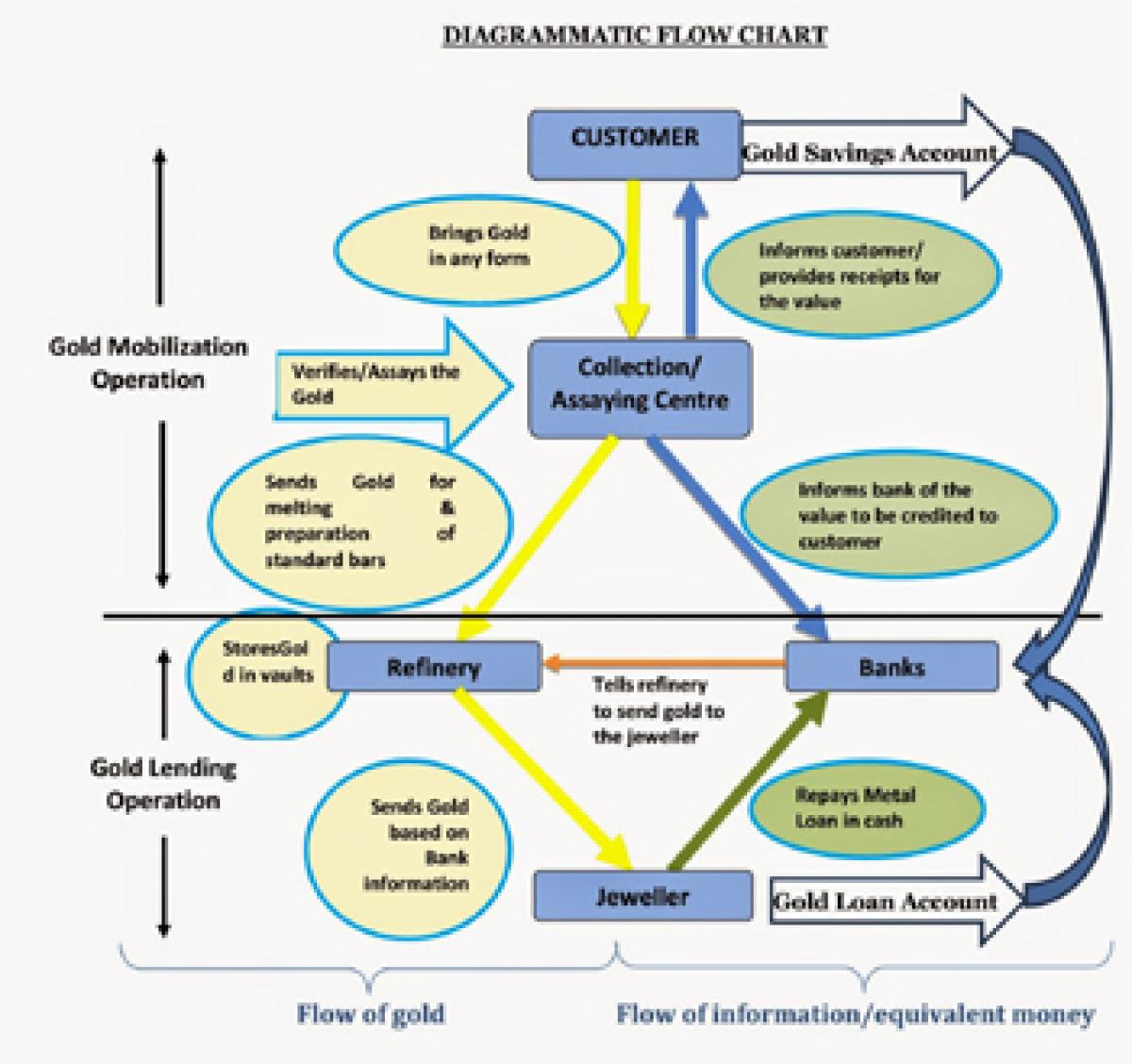

As per the draft guidelines, a person or institution holding surplus gold can get it valued from BIS-approved hallmarking centres, open a Gold Savings Account in banks for a minimum period of one year and earn interest in either cash or gold units. Households and jewelers will be able to place their gold holdings in a metal deposit with a bank.

The bank will pay interest for this. It will lend this gold to jewelers who require gold for their daily working and receive interest in return. The difference between the two interests will be the bank’s income. You can withdraw your gold if you wish to in times of need. Banks/other dealers would also be able to monetise this gold.

This gold will be converted into cash in the form of interest. Gold owners can then use it for spending and banks for productive lending. Imagine how much growth an extra trillion rupees can generate for the country.

The proposed scheme is aimed at monetising idle gold held by households and institutions, provide a fillip to the gems and jewellery sector and reduce reliance on import of the metal over time to meet the domestic demand. Under the scheme, the bank interest to the customers will be payable after 30/60 days of opening of the Gold Savings Account.