Live

- Big e-commerce firms to adopt Safety Pledge on National Consumer Day

- Cop ends life over torture by wife, father-in-law in Bengaluru

- Indian Constitution longest and most beautiful, Kiren Rijiju lauds its inclusive character

- BSNL's Rs 333 Plan Challenges Airtel and Jio with 1300GB Data: Details

- PM Modi's appeal to buy Khadi garments leads to huge demand in Bihar's Samastipur

- Mohammad Amir announces retirement from international cricket

- Chandrababu supports One Nation, One Election System, says elections in 2029

- Cong not pursuing politics of vengeance: D. K. Shivakumar on Covid 'scam' FIR

- Mexican consulates to strengthen support for nationals in face of US deportation

- Minister Meghwal to table ‘One Nation, One Election’ Bill in Lok Sabha on Monday

Just In

Central banks: From heroes to bystanders. Central bankers who led the charge to pull the global economy from a cliff during the financial crisis now risk becoming bit players, ill-equipped to snap the world out of sluggish growth and its addiction to cheap credit.

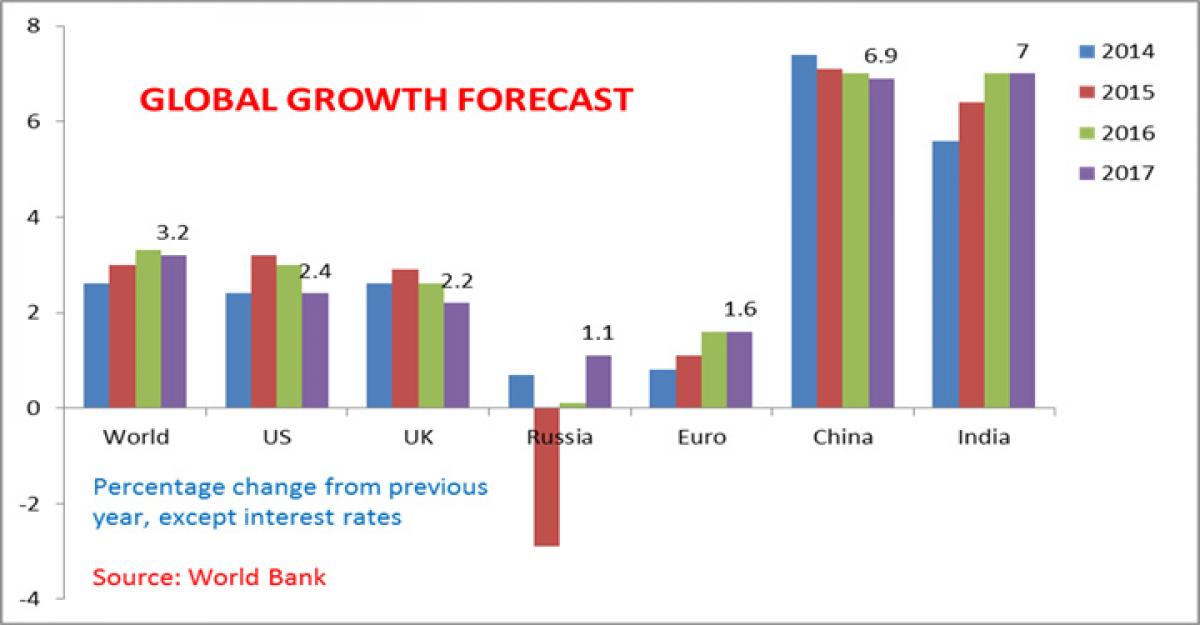

Despite near-zero rates and $7 trillion of monetary stimulus unleashed by central banks in major industrial economies, investment and growth is stuck below pre-crisis levels and tepid demand is hurting developing economies by depressing prices of their commodity exports

Washington/Frankfurt : Central bankers who led the charge to pull the global economy from a cliff during the financial crisis now risk becoming bit players, ill-equipped to snap the world out of sluggish growth and its addiction to cheap credit. Despite near-zero rates and $7 trillion of monetary stimulus unleashed by central banks in major industrial economies, investment and growth is stuck below pre-crisis levels and tepid demand is hurting developing economies by depressing prices of their commodity exports.

.jpg) Paul Sheard, chief global economist for Standard & Poor’s, suggested it might be time for central banks to admit their interest rates are stuck at zero, and for other policymakers to step up. Essentially central bankers face a dilemma - either lean more on politicians to do more to boost growth or embark on a new round of experimentation.

Paul Sheard, chief global economist for Standard & Poor’s, suggested it might be time for central banks to admit their interest rates are stuck at zero, and for other policymakers to step up. Essentially central bankers face a dilemma - either lean more on politicians to do more to boost growth or embark on a new round of experimentation.

Calls by the International Monetary Fund and others for increased spending on infrastructure, reforms that could open markets in Japan and Europe, or outright fiscal stimulus in countries like Germany, have produced little action since the 2008-2009 financial crisis. By piling more pressure on governments, central banks risk not accomplishing much and yet provoking a political backlash that could threaten their independence.

More experimentation - such as negative interest rates or direct financing of government spending - could deepen concerns that central banks were straying further from their core competences. Then there is the third, increasingly unappealing option: do more of the same. The Bank of Japan and the European Central Bank continue buying securities to spur more lending, while the Federal Reserve and the Bank of England do have an option of resuming debt purchases they wrapped up in 2014 and 2012.

Yet, as the IMF noted, Japan and Europe are unlikely to grow any faster without serious structural change. In fact, Japan probably slipped back into recession last quarter despite $1.50 trillion injected by the Bank of Japan into the economy since April 2013. In the United States, the Fed's quantitative easing - creating money to buy securities and dramatically boost the reserves that banks could lend on elsewhere - gets credit for stabilising financial conditions.

But policymakers are not sure how much growth it produced and what more could it accomplish. While US unemployment rate halved to just over 5 per cent from its recession peak in 2009, various studies estimate that quantitative easing could take credit for only between a quarter of a percentage point and 1.5 points of that decline.

With a sense that there is little bang for the buck left in quantitative easing, the narrative is shifting from central bankers as superheroes to one of central bankers as bystanders, or, at best, in supporting roles. ECB chief economist Peter Praet also pointed out, "In some major economies, zero has featured for longer than any other value of the policy rate before," he told a conference.

"The economy may have just gotten too used to that number." In a chronically low-growth world, central banks may have to break a final taboo and simply begin printing money to finance government spending, Steven Englander, Citi’s managing director for foreign exchange, wrote in a recent paper. “It directly injects purchasing power into the economy and will increase activity or inflation or both,” he wrote, contrasting it with quantitative easing that comes with no guarantee that new money will lead to more spending.

Such policies, associated with past spells of runaway inflation, are anathema to central bankers and could prove unpalatable to those who already criticise the Fed and the ECB of overstepping their mandates with "quasi fiscal" measures. Yet with governments either unable or unwilling to lead pro-growth charge, the pressure on central banks is not going away any time soon.

By Howard Schneider and Balazs Koranyi

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com