41st GST Council Meeting: FM Sitharaman places two options before states for GST compensation

GST Council Meeting

The 41st Goods and Services Tax (GST) Council met today, on Wednesday, to discuss on compensating states for the revenue shortfall

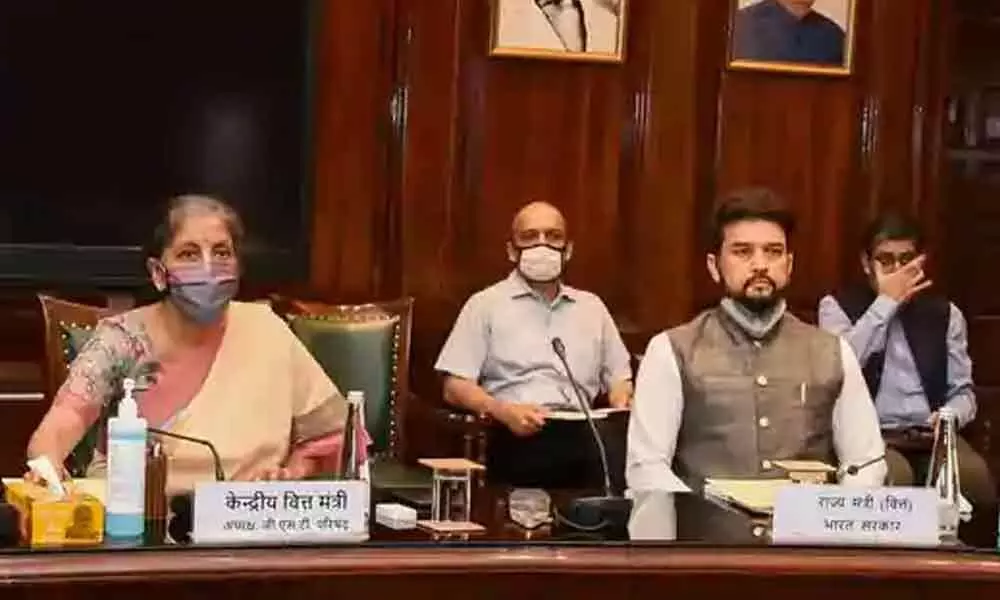

The 41st Goods and Services Tax (GST) Council met today, on Wednesday, to discuss on compensating states for the revenue shortfall. The meet chaired by Finance Minister Nirmala Sitharaman was held via video conferencing. The GST meet was participated by union minister of state for finance and corporate affairs Anurag Thakur and finance ministers of all the states and union territories.

At the start of the media briefing, the Finance Secretary Ajay Bhushan Pandey said, the meeting was held specifically to discuss this compensation issue. In the current year, this COVID-pandemic has resulted in an economic slowdown and has severely impacted the GST Collections.

He said, as per the GST compensation law certain compensation is required to be given to the states. The GST compensation law also provides that how that compensation has to be paid. So there were certain legal issues so we went to the Attorney General. As mentioned by Finance Minister in GST Council meeting held in March, legal views of the matter were sought from the Attorney General of India who said that GST compensation has to be paid for the transition period from July 2017 to June 2022.

The Union Government has released more than Rs 1.65 lakh crore as GST compensation to the states for 2019-20, including Rs 13,806 crore for March. The Finance Secretary Ajay Bhushan Pandey said the total amount of compensation released for 2019-20 is Rs 1.65 lakh crore, whereas cess amount collected was Rs 95,444 crore.

Highlights of the 41st GST meeting:

Finance Secretary: The Attorney-General has opined that the GST compensation has to be paid for a transition period - from July 2017 to June 2022. Revenue has to be protected Compensation gap to be met from the cess fund, which in turn has to be funded from the levy of cess. Attorney General also said that the compensation gap cannot be met from the Consolidated Fund of India. Options Provided:

Option 1 presented to GST Council was to provide a special window to states, in consultation with RBI to provide Rs 97000 crores at a reasonable interest rate:

Option 2 presented to GST Council was that the entire GST compensation gap of Rs 2,35,000 crore of this year can be met by states, in consultation with RBI. These options will be sent to states for a view within 7 Days and will apply for this fiscal year only.

Finance Secretary: Compensation gap which has arisen this year (expected to be Rs 2.35 lakh crores), is due to Covid-19 as well. The shortfall in compensation due to the implementation of GST has been estimated to be Rs 97,000 crores.

Finance Minister Nirmala Sithaaraman: The states have asked us to give them 7 working days to think about the options. These options would be available only during the current year and the situation would be reviewed next year. We may have another GST meet soon.

FM Sitharaman: Once the arrangement is agreed upon by GST Council, we can proceed fast & clear these dues and also take care of the rest of the financial year. These options will be available only for this year; in April 2021, the Council will review &decide action for 5th year.

FM Sitharaman on GST compensation to states: There may be some states which may prefer to get hard-wired compensation rather than going to market to borrow more. The option was tailor-made considering that states can take a call depending on the compensation they expect to come.

FM Sitharaman on GST compensation to states: The government will give a further relaxation of 0.5 per cent in states' borrowing limit under the FRBM Act as the second leg of Option 1. States can choose to borrow more, beyond expected compensation itself, since that is the injury caused by Covid-19 pandemic.

FM Sitharaman on GST of two-wheelers: On being asked about the discussion on the GST cut for two-wheelers during the meet, to which the minister said, two-wheelers may merit to go to the GST council for consideration.

Revenue Secretary, Finance Ministry: During April-July 2020, total GST compensation to be paid is Rs 1.5 lakh crores, this is so because there was hardly any GST Collection in April and May. Annual GST compensation requirement is estimated to be around Rs 3 lakh crores, and cess collection is expected to be around Rs 65,000 crores, leaving us with an annual compensation gap of Rs 2.35 lakh crores.