Derivatives Outlook OI bases moving to higher bands

OTM strikes above 22,300PE witnessed offloading OI, while several ITM and OTM strikes on Call side witnessed moderate OI fall

Indicating broad-based trading on the higher side for the week ahead, the support level rose by 450 points to 22,450PE and resistance level moved up by 500 points to 22,500CE.

The 22,500CE has the highestCall OI followed by 23,000/ 22,700/ 22,900/ 22,850/ 222,600/ 22,550/ 23,500/ 22,450/ 22,400 strikes.

Coming to the Put side, maximum Put OI is seen at 22,450PE followed by 22,500/ 22,400/ 22,300/ 22,200/ 22,000/ 21,800/ 21,700/ 21,550 strikes. Further, 22,500/ 22,450/ 22,400 strikes recorded significant build-up of Put OI.

OTM strikes above 22,300PE witnessed offloading OI, while several ITM and OTM strikes on the Call side witnessed moderate OI fall. Dhirender Singh Bisht, associate vice-president (technical research) at SMC Global Securities Ltd, said: “In the Nifty options, the highest Call Open Interest was observed at the 22,500 strike, followed by the 22,600 strike. On the Put side, the highest Open Interest was at the 22,500 strike, followed by the 22,400 strike.”

Sharp pull back last week triggered heavy Put writing at ATM and OTM strikes with 22,000 Put strike holding the highest Put base. On the higher side, current momentum in markets may extend towards 22,700 levels in coming sessions.

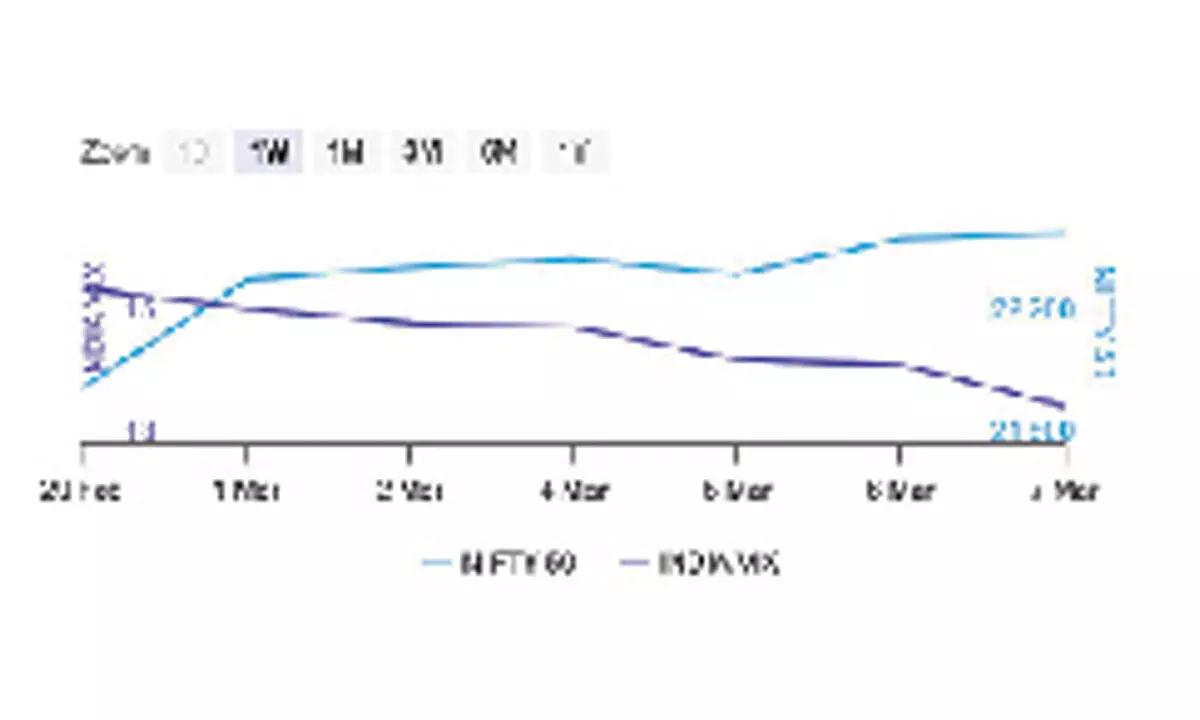

“Last week, Nifty reached record highs and closed nearly unchanged on a weekly basis, while Bank Nifty saw a gain of over one per cent for the week. Noteworthy sector performances included outperformance in PSU bank, pharma and energy stocks, while media, small-cap and IT stocks underperformed,” observed Bisht.

BSE Sensex closed the week ended March 7, 2024, at 74,119.3 points, a further rise of 313.15 points or 0.42 per cent, from the previous week’s (March 2) closing of 73,806.15 points. During the week, NSE Nifty was also up by 115.15 points or 0.51 per cent at 22,493.55 points from 22,378.40 points a week ago.

Bisht forecasts: “For upcoming week, we expect bullish momentum to remain intact in Indian markets and Bank Nifty is likely to outperform once again. Traders are advised to use dips for creating fresh long positions and avoid any short positions as of now.”

“Implied Volatility for Nifty’s Call options settled at 12.79 per cent, and Put options concluded at 13.27 per cent. The India VIX, a crucial market volatility indicator, ended the week at 14.30 per cent. The Put-Call Ratio of Open Interest (PCR OI) stood at 1.59 for the week, signaling more Put writing than Calls, indicative of a bullish sentiment,” remarked Bisht.

India VIX fell 4.77 per cent to 13.61 level. Due to heightened intraday volatility, India VIX index remained elevated and closed the week near 15 level once again. Volatility may remain elevated this week as well.

Muted FII activity seen in both index futures and options. Even after February F&O expiry and markets moving higher, the net short positions rose to 62k contracts last week.