Derivatives Outlook: OI build-up moving to higher bands

March settlement recorded sharp volatility that caused a major adjustment in the options

The 23,000CE has highest Call OI followed by 23,500/22,800/22,500/ 23,200/ 22,900/ 22,600/ 23,300 strikes, while 23,000/ 22,800/ 22,900/ 23,200/ 23,500/ 22,700 strikes recorded significant build-up of Call OI.

Coming to the Put side, maximum Put OI is seen at 22,500PE followed by 22,400/ 22,000/ 22,300/ 21,800/ 21,500/ 21,900 strikes. Further, 22,500/ 22,400/ 22,000/ 21,500/ 21,400 strikes witnessed reasonable addition of Put OI. Call OI increasing at ITM/OTM strikes on both sides of the options chain.

Dhirender Singh Bisht, associate vice-president (technical research) at SMC Global Securities Ltd, said: “From the derivatives front, in Nifty options, the hefty Call Open Interest was observed at the 22,800 and 22,500 strikes, while the highest Put Open Interest was at the 22,500 strike.”

Both Call and Put writing is more at OTM strikes for this weekly settlement with highest Put base placed at 22,500 strike, while highest Call base is at 23,000 strike. The March settlement recorded sharp volatility that caused a major adjustment in the options. However, Nifty may remain firm above the 22,000 level.

“The recent market activity indicates a mixed, but overall positive sentiment, with the Nifty trading near its record high and closing the week with more than 0.8 per cent gain. Among sectors, small-cap, media, and metal indices emerged as major gainers, suggesting a broad-based positive sentiment in the market. Conversely, the FMCG sector lagged behind,” remarked Bisht.

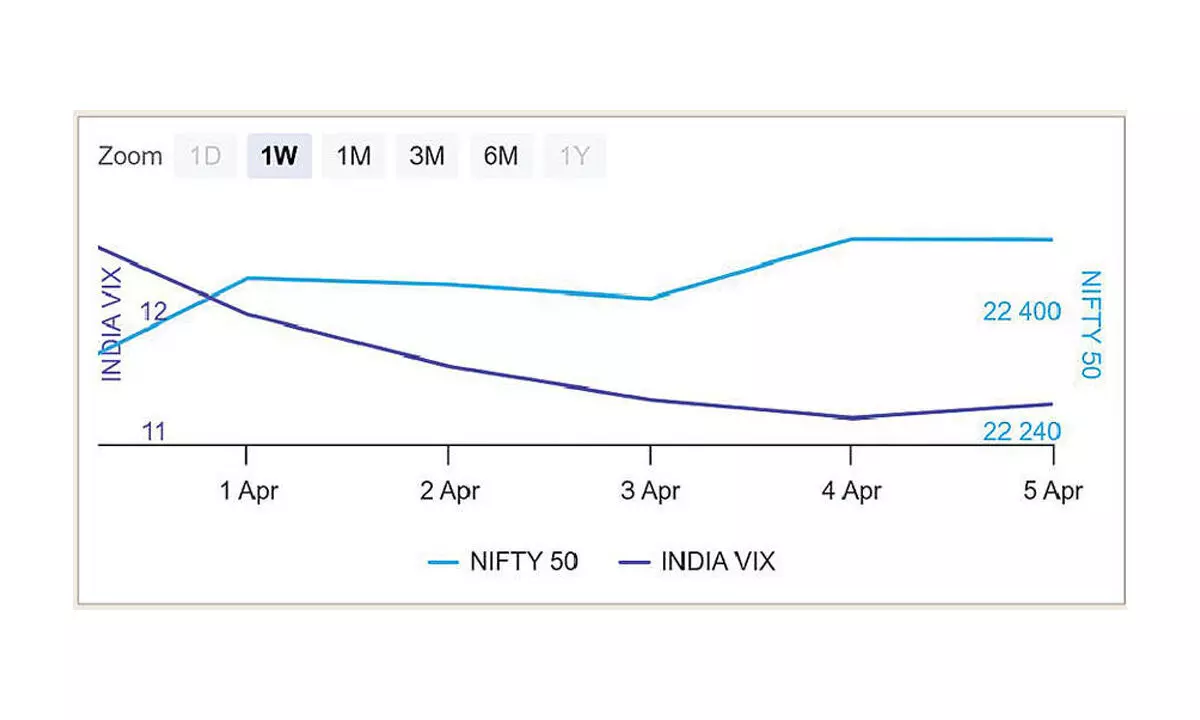

BSE Sensex closed the week ended April 5, 2024, at 74,248.22 points, a net gain of 596.87 points or 0.81 per cent, from the previous week’s (March 28) closing of 73,651.35 points. For the week, NSE Nifty also moved up by 186.80 points or 0.83 per cent to 22,513.70 points from 22,326.90 points a

week ago.

Bisht forecasts: “This week, Nifty is expected to oscillate within the range of 22,200 to 22,700 levels with some volatility on the cards. Traders are advised to use dips for creating fresh longs.”

India VIX rose 1.05 per cent to 11.34 level. Positions by Call writers witnessed a sharp closure in the last monthly settlement. India VIX did not rise much and closed the week below 13 level once again. Going ahead, stock-specific movement will be the key ahead of upcoming quarterly results.

“Implied Volatility for Nifty’s Call options settled at 10.80 per cent and Put options concluded at 11.27 per cent. The India VIX, a crucial market volatility indicator, ended the week at 11.22

per cent.

The Put-Call Ratio of Open Interest stood at 1.20 for the week,” observes Bisht.

Nifty began April new series with relatively low OI of 1 crore shares. FIIs also closed most of their short positions as they commenced the new series with less than 24,000 net shorts, which is the lowest short position seen in more than a month. However, apart from retails, the rest of the participants remained in shorts at the start of the new series.