India Post Launches Mobile Banking App: Learn How to Apply, Activate and Features

The new Mobile Banking app enables post office account holders to transfer funds online from savings accounts to own PPF accounts

India Post has launched a mobile banking app for the benefit of post offices customers. This app will allow post office customers to do online transactions which include deposits into PPF accounts and other post office schemes; they need not go to post offices physically. The India Post Mobile Banking app can be downloaded from the Google Play store. To do the transactions through the Department of Post's new app, customers must have a post office savings account in a CBS or Core Banking Solution-enabled post office.

A customer also needs to have a valid log-in and transaction credentials of internet banking. If internet banking is not enabled, mobile banking should be activated after net banking.

How to Apply for the India Post Mobile Banking

The post office account holder has to fill a mobile/internet banking request form to apply for mobile banking.

If the account holder has opened savings account after migration to CBS with proper KYC documents, they need not submit KYC documents.

If the account holder has opened savings account before the migration of the post office to CBS, new KYC documents along with service request need to be submitted.

Features of India Post Mobile Banking App:

Receive a mini statement of savings, PPF accounts.

Check the balance of savings, RD, PPF and other accounts.

Transfer funds to other users' post office savings account.

Transfer funds from savings accounts to own linked PPF accounts.

Service request for opening RD account and stop cheques can be raised too.

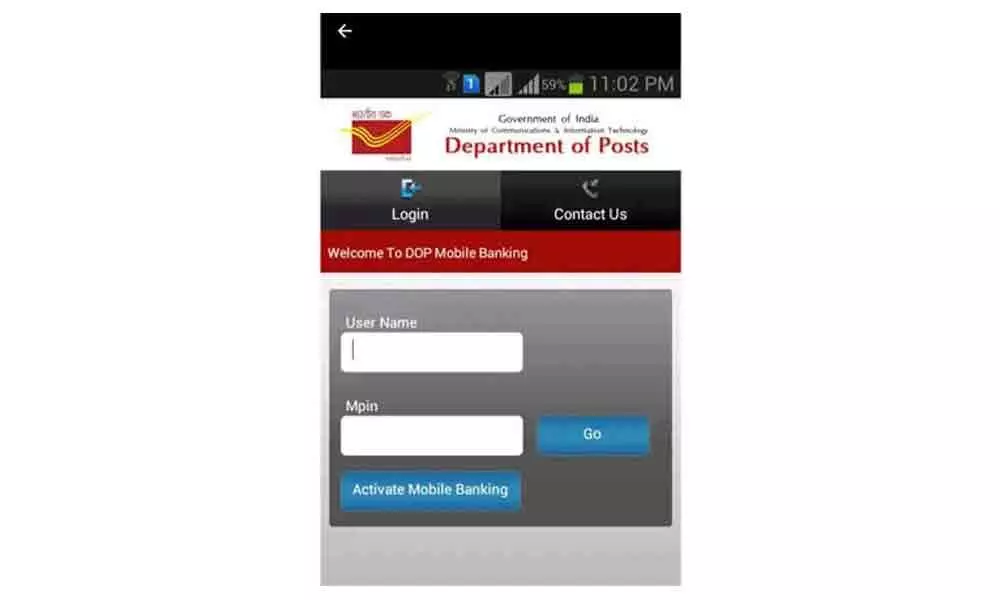

Steps to Activate India Post Mobile Banking App:

Open the application and click on Activate Mobile Banking button.

Enter security credentials which you have provided with the Department of Post.

An OTP will be sent to the registered mobile number.

After successfully validated, the account holder will be asked to enter four-digit MPIN.

To log in into mobile banking application, enter your user id and the new MPIN.