Is market entering downtrend?

The Indian stock market declined for a second straight week to the Federal Reserve’s hawkish commentary and the rate hike. All the central banks now fuelled the worries of the global recession.

The Indian stock market declined for a second straight week to the Federal Reserve's hawkish commentary and the rate hike. All the central banks now fuelled the worries of the global recession. Global benchmark indices tumbled in the last two days and broke the supports. The Nifty declined by 227.6 points or 1.23 per cent. BSE BSE Sensex is down by 1.4 per cent. NSE Nifty Midcap-100 is down by 1.1 per cent, and the Smallcap-100 is up by 0.4 per cent. Only the PSU Bank index was able to close with a 0.8 per cent gain. All other sectoral indices were down by 1-2 per cent. FIIs sold Rs7,490.05 crore and the DIIs bought Rs10,551.62 crore.

The Nifty has formed a most bearish candle, a Shooting Star, and given confirmation to the previous week's inside bar bearish implications. It declined below the 23.6 per cent retracement level of the prior uptrend that began in September. It also broke the neckline support of a Head and Shoulders pattern. The pattern target is at 17600, which is also brought about 61.8 per cent retracement level of the prior uptrend. Most importantly, the Nifty is now below 18604, which is the October 2021 high and below the closing high of 18339. The most critical and immediate support is at 18114, which is rising trendline support of an uptrend from June lows and the previous breakout level. It is also the previous swing low. In other words, 18114-18002 is the lifeline support for the market. The 18002 is nothing, but 50DMA. Currently, the Nifty holds three distribution days. In any case, it adds another 2 or 3 distribution days and a fall below the 18002 means that the market enters into a confirmed downtrend.

The RSI on daily (44.47) and weekly (59.37) in a neutral zone. As mentioned last week, the weekly RSI has developed a bearish divergence. It also closed below the prior intermediate high of 60.58. Historically, the weekly RSI takes support at 40 on the weekly chart. If the Nifty moves above the prior high of 18887 and the weekly RSI moves the 68-70, the uptrend will resume. For now, we assume that 18887 is an intermediate high. On a daily chart, the Nifty has formed a lower high at 18696 and a lower low below 18345. This structure is nothing, but a short-term downtrend. For an intermediate downtrend, the Nifty has to collapse below the 18114-002 with additional distribution days. Let's wait for the price in the 18696-18002. Within this, volatility will play a major role. On the upside, firstly, the index has to close above the previous day's high of 18440 for a positive bias. Only a close above 18696 will negate the probable downtrend and resume the uptrend. On the upside, the 18696-887 zone resistance is vital for the next two weeks. Above this, we may see 19421 by mid-January. There may be intraday technical bounces.

The India VIX is historically, and the VIX formed low at 11-14 zone. Before the March 2020 decline, the VIX is at 13.6. It has an inverse relationship with the index, and we can assume that we are almost at the top. Last week's over four per cent rise and a decline in the index showed early signs higher volatile decline is on the cards.

We are very near to the Jan-March topping cycle. In the last 21 years, 16 times the nine market tops were formed in the Jan-March quarter. We call it as Jan-March topping cycle. In this topping cycle, nine tops were formed on January, 4 in February, and 3 in March. In 2006 it was in May; in 2010, it was in November; in 2013, it was in December; in 2016, It was in September; and in 2019, it was in June. The question is, will it be different this time? Is December's high of 18887 top? Will the index bounce, and will it make another lifetime high? Only time can answer the questions.

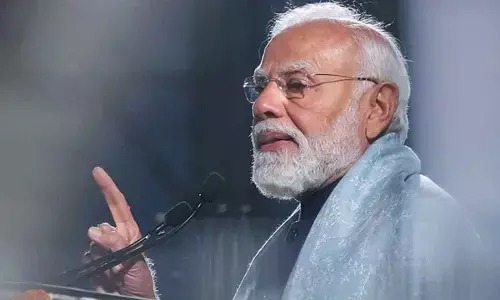

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)