PL First Cut - Pidilite Industries 2QFY24

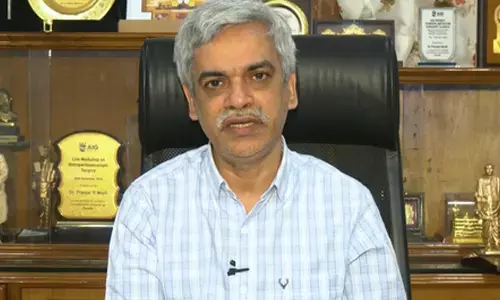

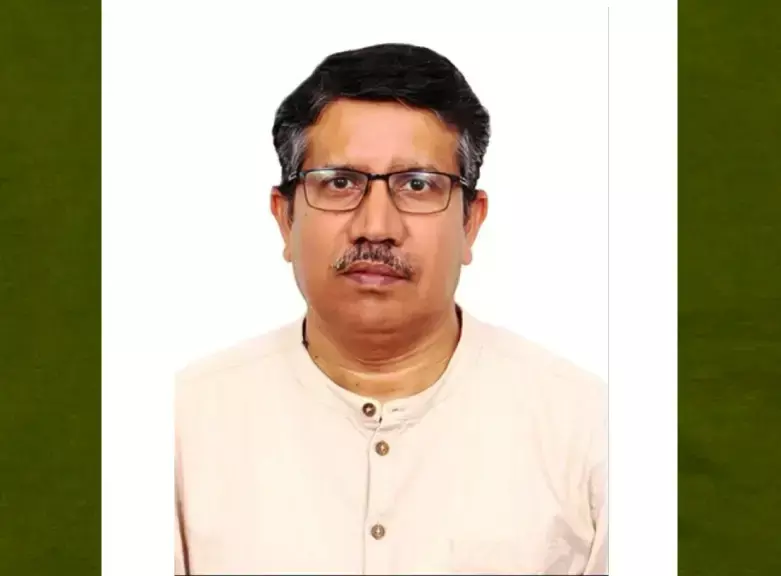

PL First Cut – Pidilite Industries 2QFY24 – Amnish Aggarwal – Head of Research - Prabhudas Lilladher Pvt Ltd

PL First Cut – Pidilite Industries 2QFY24 – Amnish Aggarwal – Head of Research - Prabhudas Lilladher Pvt Ltd

Pidilite Industries 2QFY24 – Strong volume growth, margins expansion disappoints

(CMP: Rs2473|Hold)

Financial Performance

> Consolidated Revenues grew by 2.2% YoY to Rs30.8bn(PLe: Rs32bn)

> Gross margins expanded by 1032bps YoY to 51.3%.(Ple: 48.8%)

> EBITDA grew by 36% YoY to Rs6.8bn (PLe:Rs7.3bn); Margins expanded by 550bps YoY to 22.1% (PLe:22.8%)

> PBT grew by 43% YoY to Rs 6.2bn(PLe: Rs6.7bn) Adj PAT grew by 37.4% YoY to Rs4.6bn (PLe:Rs5.1bn)

> Imputed Subsidiary Sales remained flat at Rs3bn; EBITDA grew by 3.9% YoY to 372mn

> Consumer & Bazar Segment ('C&B') grew by 3% while B2B registered 1% decline in revenue due to price adjustments and lower demand from export and export-oriented industries.

Segment wise Performance

> Consumer and Bazaar Sales grew by 3.2% YoY to Rs25.1bn; EBIT grew by 32% YoY to 6935.1mn

> Industrial Products declined by -1.3% YoY to Rs6.2bn; EBIT grew by 38% YoY to 684.5mn

> International subsidiaries (excluding Pidilite USA Inc.) reported moderate sales growth despite uncertain global economic conditions, inflation and currency devaluation challenges in some countries

View

PIDI posted 8% UVG in C&B and 20% in B2B which shows sustained growth momentum. We believe festival season and increased construction activity will aid demand in 2H24. VAM prices are stable (subject to geo-political tensions) which can result in further margin expansion in 2H24. We estimate FY23-26 EPS CAGR of 27.5%. We have a Hold rating on the stock.

Stock trades at 54.5x FY25 EPS.