RBI goes unconventional, cuts rate by 35 bps

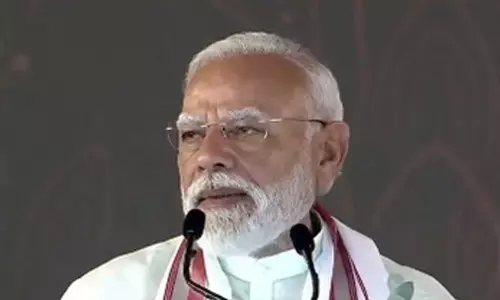

RBI Governor Shaktikanta Das

RBI Governor Shaktikanta DasIn an attempt to boost the economy growing at its slowest pace in nearly five years, the Reserve Bank of India (RBI) on Wednesday cut interest rate by an unconventional 35 basis points

Mumbai: In an attempt to boost the economy growing at its slowest pace in nearly five years, the Reserve Bank of India (RBI) on Wednesday cut interest rate by an unconventional 35 basis points - the fourth successive reduction - to a nine-year low,

The RBI, which has lowered interest rates by 1.1 per cent this year, maintained its "accommodative" stance that meant an increase is off the table. The repo rate is the rate at which the RBI lends to banks.

With four of its six members voting for a 35-basis point reduction, the Monetary Policy Committee (MPC) reduced repo rate to 5.4 per cent - the lowest since April 2010. The reduction was larger than the expectation of a 25-basis point cut.

This would benefit the demand in interest-sensitive sectors mainly real estate, automobile and consumer durables as and when it is transmitted by the banking system. RBI Governor Shaktikanta Das, at a media briefing, said banks have reduced their interest rates on fresh rupee loans by only 29 basis points so far as against 75-basis point cut prior to Wednesday's reduction.

He, however, was confident of higher transmission in the weeks and months ahead. The remaining two MPC members voted for a 25-basis point cut. The reverse repo rate was lowered to 5.15 per cent.

The previous instance of four successive rate cuts happened between April 2012 and May 2013 when the repo rate was reduced by 1.25 percentage points -- 50 basis points (bps) on April 17, 2012, followed by 25 bps reduction each on January 29, 2013, March 19, 2013 and May 3, 2013.

The repo rate during this period came down from 8.50 per cent to 7.25 per cent. This was a period prior to the advent of the MPC, when the RBI alone decided on interest rates. Das said the MPC was of the view that a 25-basis point cut was "inadequate", while a 50-basis point reduction would have been "excessive".

So, a 35-basis point easing was deemed "balanced". The central bank has since 2006 changed interest rates by 25 or 50 bps only. Das said a "demand and investment slowdown was having a dampening effect on growth".

He, however, hastened to add that at this point of time, the slowdown appears to be cyclical in nature and not deep-structural slowdown. "Nevertheless, there is a need for structural reforms," he said, adding that growth is likely to pick up towards the fourth quarter of the current financial year. "Domestic economic activity continues to be weak, with the global slowdown and escalating trade tensions posing downside risks," the MPC said in its statement.

Commenting on the rate cut, Finance Secretary Rajiv Kumar said: "Rate cuts are very positive. Now it is for the banks to pass on these rate cuts." India's GDP had grown by 5.8 per cent in the January-March quarter.

This is the fourth time in a row that the RBI has reduced the repo rate. In the earlier three policies, it has reduced the repo rate by 25 bps each. Consumer Price Index-based or retail inflation is projected at 3.1 per cent for the September 2019 quarter and 3.5-3.7 per cent for the second half of the current financial year, with risks evenly balanced. For easing liquidity in the NBFC sector, bank's exposure limit to a single NBFC has been raised to 20 per cent of the Tier-I capital of the bank (from 15 per cent).