RBI may look at reduction in Repo rates only in 2024

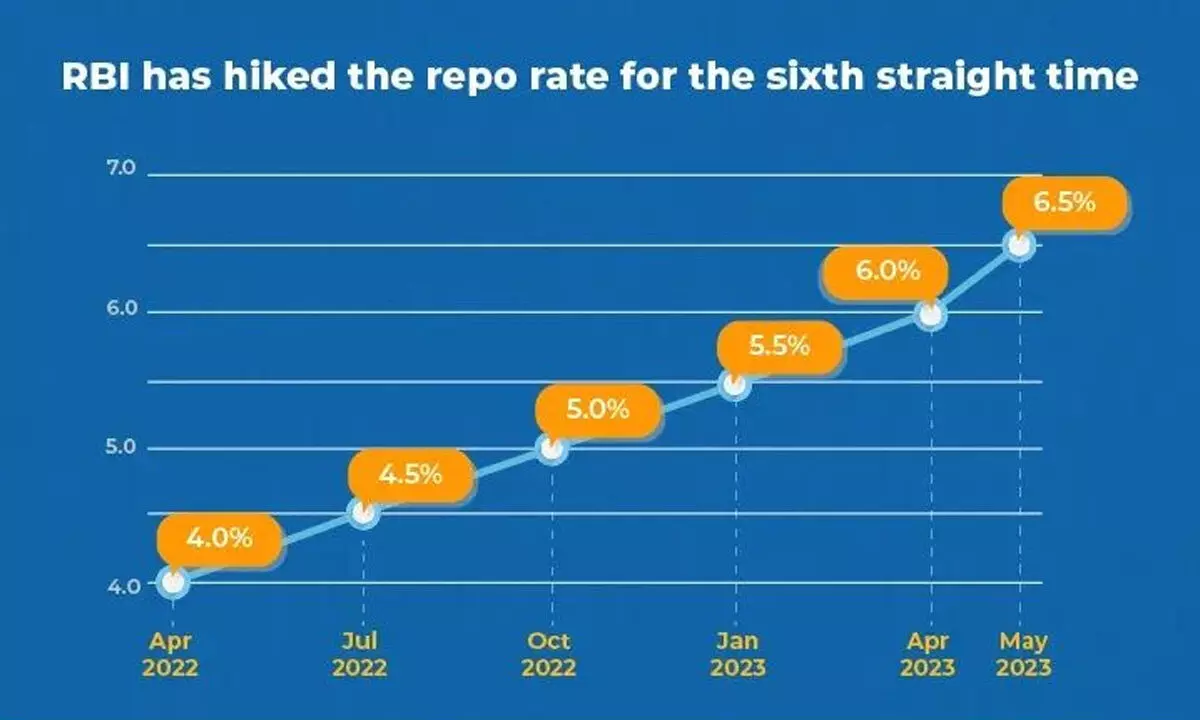

The Reserve Bank of India (RBI) released its Monetary Policy Report for October 2023. As expected by the market, it has also maintained its pause as far as Repo rate is concerned at 6.5 per cent.

The Reserve Bank of India (RBI) released its Monetary Policy Report for October 2023. As expected by the market, it has also maintained its pause as far as Repo rate is concerned at 6.5 per cent. However, it has reiterated that its target for headline inflation is at four per cent and not at two to six per cent. The CPI inflation is 6.8 per cent for August 2023 from the July high of 7.4 per cent and the expected inflation for 2023-24 at 5.4 per cent and CPI inflation for Q1 2024-25 is projected at 5.2 per cent. On the other hand, the only positive factor is core inflation softened to 4.9 per cent during July - August.

The RBI Governor has emphatically stated that RBI aim is to align inflation to the target of 4 per cent on a durable basis. There are further risks to inflation outlook particularly from global geopolitical conditions to be uncertain, the supply shocks to availability and supply of food grains globally, the greater climate risks, destruction of crops due to extreme heat, heavy rain and cloud burst rainfall, lower production of pulses and cereals, the continued rise in energy prices, oil quoting above $95 per barrel.

Even though in the case of India a lot of action is taken by the government to ease the supply shocks by importing as well as banning exports of certain food grains, other risks mentioned above can still be a worry for India. In view of this, currently it is expected that looking at the global inflation and monetary policy dynamics and global risk factors still persist, the interest rates as far as India is concerned may not come down in the immediate future and RBI may look at reduction in Repo rates only in 2024-25 as it is clear that it hopes to bring down headline inflation to the committed target of fur per cent or below on a durable basis and are not satisfied with the mere moderation currently.

Moreover, certain reasons for inflation are not in RBI's control and it looks at the government equally to take measures for price rise control on food grains by supply measures. In relation to climate change shocks, EL Nino conditions, global food and energy prices, the Union Government could only attempt to ease the burden as the same is beyond its control.

The central bank has maintained its stance on withdrawal of accommodation, while favouring productive use of availability of surplus funds. As the bank governor has stated "excessive liquidity can pose risks to both price and financial stability."

It opined that greater operations in the call money market would not only help in deepening the inter-bank money market but also lower the recourse of deficit banks to MSF. Even though currently the liquidity in the system has become deficit due to advance tax outflows and the effect of I- CRR which will be discontinued in a phased manner ending October 7.

The release of funds on account of I- CRR on October 8 and government surplus funds being spent, RBI feels that that will ease liquidity conditions. RBI has stated that going forward, RBI may resort to OMO sales to manage liquidity.

Another area RBI has been concerned with the spurt in growth of unsecured loans as a part of the retail credit. Unsecured retail loans grew at a CAGR of 47 per cent from March 2021 to March 2023 according to the recent report of TransUnion CIBIL. According to RBI Dy Governor Swaminathan J, over the last couple of years, year on year growth in retail credit has been close to 30 per cent for most of the instructions and 23 per cent on average for the sector. The bank has been voicing their concerns with unsecured substantial credit growth in the personal segment as it may build up more credit default risks in this sector, in future which may become a surprise for the banks and may lead to systematic risk.

It is therefore imperative for banks to monitor their unsecured portion of credit growth in the personal segment with more attention and focus and strengthen their underwriting standards and enhanced credit risk management. If there are any futuristic risks to cash flow at individual level due to adverse economic or personal factors, the servicing of these unsecured loans may become difficult. Even though currently the situation is under control, whenever RBI notices unprecedented growth in certain components of personal credit, particularly on an unsecured basis, RBI has to bring this to the notice of financial institutions, REs. Hence the requests to banks and NBFCs, "To strengthen their internal surveillance mechanisms, addressing risks, and suitable safeguards".

Over a period , retail credit has grown substantially in the absence of corporate credit growth. However any credit growth in any segment much higher than Industry average credit growth which is 12 to 14 per cent, should call for moderation.

Another area getting the attention of the regulator in recent days is Self Regulatory Organizations ( SRO). Recently the RBI Governor urged fintech companies to form a SRO at the earliest. Similarly there is a need to have a formal SRO for ARCs even though there is an association of ARCs. Similarly there is an association of NBFCs, Micro Finance Institutions without formal SRO status. RBI needs to have a consultative platform for each of these segments which will improve the efficacy of supervision and regulations and enhance compliance culture amongst such REs. Hence RBI has decided to issue a draft omnibus framework for recognising SROs for various categories of Regulated Entities (REs) of the RBI for stakeholders comments. RBI further stated that additional sector specific conditions may also be prescribed at the time of calling for applications. This is a welcome decision on the part of RBI and it is expected different segments of players through their associations will take the lead to form SROs once the guidelines are formalised by the regulator.

RBI has maintained its GDP growth forecast at 6 5 per cent. While Indian economy is showing resilience on the back of strong domestic demand, there are risks from geopolitical tensions, geo economic fragmentation, volatility in global financial markets, global economic slowdown, risks to demand for exports, slow growth in world trade, uneven monsoon and distribution of rainfall, global energy and food price hike, climate risks and it's challenges, may pose as risks to our GDP growth. RBI taking into consideration all these factors, has still kept its forecast for GDP growth at 6.5 per cent for 2023-24 and 6.6 per for Q1 fof 2024-25. While all favourable factors as far as the Indian economy is concerned are visible, India has to be aware of global economic slowdown and take appropriate actions and policy, reforms and timely and proactive steps to keep intact and enhance the positive drivers of economic growth. The enhancement of private savings and private sector investment along with public capex , improve the productiveness of manufacturing and quality of product to enhance global reach, are some of the important elements which need further impetus.