Live

- Over 7,600 Syrians return from Turkiye in five days after Assad's downfall: minister

- Delhi BJP leaders stay overnight in 1,194 slum clusters

- Keerthy Suresh and Anthony Thattil Tie the Knot in a Christian Ceremony

- AAP, BJP making false promises to slum dwellers for votes: Delhi Congress

- 'Vere Level Office' Review: A Refreshing Take on Corporate Life with Humor and Heart

- Libya's oil company declares force majeure at key refinery following clashes

- Illegal Rohingyas: BJP seeks Assembly session to implement NRC in Delhi

- Philippines orders full evacuation amid possible volcanic re-eruption

- Government Prioritizes Welfare of the Poor, says Dola Sri Bala Veeranjaneyaswamy

- Two Russian oil tankers with 29 on board damaged due to bad weather

Just In

The Comptroller & Auditor General (CAG) submitted its 31st report of 2017 to the parliament recently. This report looks at the levy and collection of service tax in the entertainment industry (films & television). The CAG highlighted some of the tax evasive practices prevalent in the film Industry while advocating for greater clarity in legislation.

The Comptroller & Auditor General (CAG) submitted its 31st report of 2017 to the parliament recently. This report looks at the levy and collection of service tax in the entertainment industry (films & television). The CAG highlighted some of the tax evasive practices prevalent in the film Industry while advocating for greater clarity in legislation.

Why did the CAG choose Entertainment Industry?

In its report, the CAG mentioned that revenue from services like broadcasting services, event management, TV and Radio programme production, sponsorship services, video tape production, promotion of brand and sponsorship services that are part of the entertainment industry has been registering a steep growth. It also mentioned that no comprehensive audit was conducted on this sector before and hence chose this sector for the audit.

Tax revenue from this Industry increasing at an annual average of 10 per cent

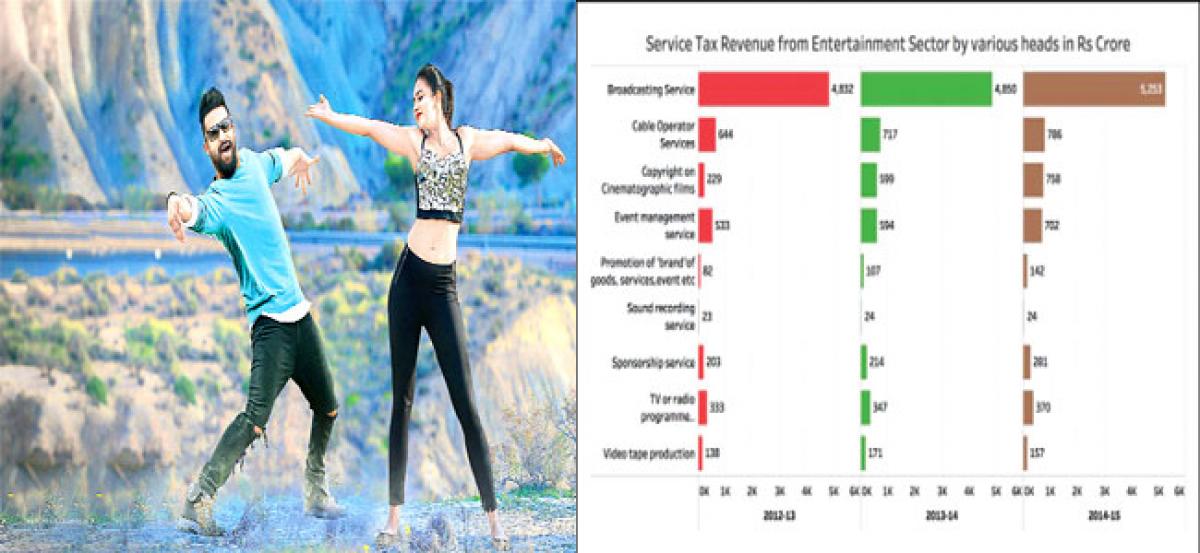

The CAG in its report noted that the service tax revenue from the entertainment sector has seen an impressive annual average growth rate of about 10 per cent between 2012-13 and 2014-15.

More than 60 per cent of the tax revenue is from tax on broadcasting service. As per the CAG report, there are nine services relating to the entertainment sector which have been assigned separate account codes and are identifiable. Further, many services in the entertainment sector are not covered in these nine heads and are also not part of the negative list. Services of actors, artists and other professionals are also taxable, but not identifiable. Hence the overall revenue from this sector could be much more.

Service Tax evasion by clubbing theatrical rights with non-theatrical activities The CAG in its report cited a few cases where the taxable commercial activities escaped taxation due to clubbing of theatrical rights with non-theatrical rights / other production activities. The revenue involved was not calculated by the CAG for want of required information.

It cited the example of Sohail Khan Productions and Salman Khan Ventures Pvt. Ltd, producers of ‘Jai Ho’ and ‘Bajrangi Bhaijaan’ where the agreement consisted of both theatrical & non-theatrical rights. Both the producers claimed exemption from payment of service tax by treating the entire revenue as obtained from theatrical rights.

It has to be noted that theatrical rights and the revenue earned from such rights are exempted from payment of service tax as per a notification of the government in March 2013. Though the concerned ministry treats all the pre-release activities like publicity etc. as a part of theatrical eights, the CAG refused to accept the ministry’s stand.

Treating copyrights transferred with limitations as transferred perpetually

The CAG report mentions that many agreements stated that copyrights were assigned for perpetuity, but certain features of the agreements clearly indicate that these were only restrictive rights and producer continues to have control over copyright.

The CAG mentioned the example of the films Chennai Express and Dabangg 2 whose music rights were sold to a company for Rs 6 crore and Rs 9 crore respectively. But the producers continued to exploit the assigned rights and received royalty. The CAG calculated that a service tax of Rs 1.85 crore was leviable. Even here, the CAG did not accept the ministry’s contention.

“During the examination of records of Arbaaz Khan Production Pvt Ltd and Red Chillies Entertainment Pvt Ltd in Mumbai ST-IV Commissionerate, it was noticed that the assesses assigned copyrights of the music and sound recordings of their films, Chennai Express and Dabangg 2 to Super Cassette Industries Ltd, a music company, for a perpetual period on consideration of Rs 6 crore and Rs 9 crore during 2012-13 and 2013-14 respectively. In both the instances, the assessees did not pay service tax treating the rights as granted for perpetual period,” the apex auditor said.

However, we noticed that the assessees did not relinquish their rights and imposed conditions on the music company to promote the music in film and to receive royalty share from further exploitation of the assigned rights over and above the agreed consideration. Thus, the assignment is a temporary transfer of rights, on which a service tax of Rs 1.85 crore becomes leviable, CAG further explained.

Tax evasion by treating service as exports

The CAG also cited multiple instances where artists/producers entered into agreements with foreign entities to establish a service recipient and place of provision in the non-taxable territory. Because of such practices, the amount exchanged for the portion of service provided outside India was treated as exports, leading to avoidance of tax.

The CAG quoted the example of a Telugu artist Nandamuri Taraka Rama Rao, who under an agreement in July 2015 with the producer Vibrant Visuals Ltd., London, U.K, received an amount of Rs 7.33 crore for acting in the movie titled ‘Nannaku Prematho’ and claimed exemption from payment of service tax of Rs 1.10 crore treating it as export of services.

“Similarly, during the examination of records of Mr Nandamuri Tarak Rama Rao, a cine artiste in Hyderabad ST Commissionerate, we noticed that under an agreement (July 2015) with producer Vibrant Visuals Ltd, London, U.K., the artiste received an amount of Rs 7.33 crore for acting in the Telugu movie ‘Nannaku Prematho’ and claimed exemption from payment of service tax of Rs 1.1 crore treating it as export of services,” the CAG observed in its report. According to the CAG report, the ministry accepted the CAG’s findings in some cases but not in the other cases.

Non-registration of assessess and under-reporting of Income

The CAG report observed that there were 1312 companies providing services relating to entertainment sector who are active in MCA (Ministry of Corporate Affairs) data base and have reported an income of more than Rs 10 lakh (the threshold limit for service tax registration), but had not obtained service tax registration. The report also mentioned that 199 Kannada film producers were not registered with service tax department.

The CAG report also highlighted various other issues like under reporting of income, non-filing of returns, non-inclusion of certain items in the taxable amount, non-payment, availing VAT credit on old invoices, availing VAT credit without payments.

Recommendations to improve Compliance

The CAG made the following recommendations to improve the compliance in the entertainment sector.

- Since the assesses are exploiting the ambiguity in the terms ‘theatrical’ and ‘non-theatrical’ while drafting of agreements for transfer of rights, there is a need to bring legislative clarity for these terms.

- Place of Provision of Services Rules need to be directly linked to service specific issues to avoid undue benefit of the interpretations and to safeguard the intent of legislation in giving export benefits.

- Existing ambiguity in the available provisions for Cenvat Credit under Sponsorship Services in the entertainment sector needs to be clarified through relevant amendment to the Rules.

- The department needs to activate the special cell and evolve a system of using the third-party data as well as details from the records of filers to identify potential non-registrants as well as defaulters.

- The department should consider automation of the process of identifying and issuing notices for levy of penalty/late fee on non/belated filing of returns.

- The Board needs to strengthen its Tax 360 programme to ensure that data already available is utilised optimally and also should identify sector specific data sets and correlate the same in Tax 360 programme.

(Factly.in)

By Rakesh Dubbudu

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com