Growth with equity: Major concern for India

Every year Forbes international publishes list of the richest persons in India as well as internationally Every year Mukesh Ambani tops the list followed by others Some of them like Mukesh Ambani, Ajit Premji, Shiv Nadar, Hindujas figure in the international list of the hundred richest billionaires

Every year Forbes international publishes list of the richest persons in India as well as internationally. Every year Mukesh Ambani tops the list followed by others. Some of them like Mukesh Ambani, Ajit Premji, Shiv Nadar, Hindujas figure in the international list of the hundred richest billionaires.

As a nation we also start feeling proud that our businessmen figure in the international list. Is this really worth celebrating about? not necessarily says The Economist magazine in an article published sometime back. The thrust of the article is more from the angle of the Indian middle class market for multinational corporation products.

Vladimir Lenin remarked a century back that the magazine represents the interests of the millionaires of England. This description of The Economist still holds good in a different way. It still continues to represent the interests of the western economies and their multinational corporations. Their appreciation and analysis of facts and figures is conditioned by this perspective.

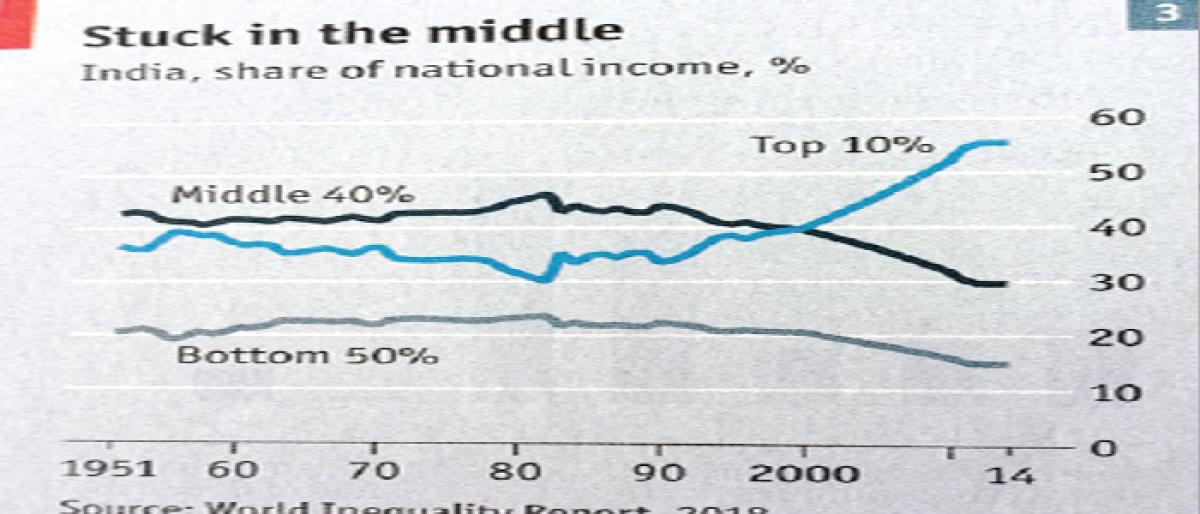

They made an analysis of the share in the national income between different classes and came to the conclusion that the middle class in India is not growing the way required to be a major market for the products of the multinationals in years to come. But the figures presented by them show how iniquitous development process in the country is and how dangerous it is going to be to the civil society if the trend as it is continues.

The above report shows that between 2000 -2014 incomes of the top 10 per cent of the population has gone up from 40 per cent to almost all 60 per cent of the national income and that of next 40 per cent whom we consider the middle class has come down to 30 per cent from 40 per cent.On the basis of this analysis they concluded that the middle class is not going to grow in India to create the necessary market for the products of the multinationals. The Chinese process of development seems to be more equitable with a better spread of income between different classes of society.

What is more worrisome in the above figures which the article does not focus on is the fact the lowest 50 per cent of the population share in the national income has come down from 20 per cent in 2000 to less than 15 per cent by 2014. The Economist has no interest in this segment since they don’t constitute a market for the multinational products from whose angle article is written. These statistics go to show 10 per cent of the population of India is growing richer at the expense of the remaining 90 per cent of the population.

This does not seem to be the case with other emerging economies where the distribution of the benefits of growth seem to be much better spread. Thus India is becoming market for expensive luxury items like luxury cars signature items representing very high class luxury consumption. We can see a demand for such highly expensive conspicuous consumption from the top 10 per cent of the population who are sucking away most of the increase in the national income at the expense of growth of a healthy middle class and lower class.

It is time for the policymakers to take note of these signals and work out a better paradigm of development which focuses as much on distributive justice as on GDP growth. Mere growth in GDP is not going to be an answer for the problems of this country. The trickle down effect does not seem to be working on its own. Specific policy interventions for distributive justice are required . Unless this is addressed income disparities can lead to social unrest.