Exempt liquor, tobacco, Petroleum products from GST: Etela

Exempt liquor, tobacco, Petroleum products from GST: Etela, The Telangana Government has urged the NDA government not to bring liquor, tobacco and petroleum products under Goods and Service Tax (GST) ambit.

- Finance Minister Etela Rajender asserts Telangana will not lose its right of fiscal autonomy

- Welcomes Goods and Service Tax, but demands compensation of possible loss of revenue to the States

- Union govt failed to compensate `5000 crore loss to the State because of Central Sales Tax

Hyderabad: The Telangana Government has urged the NDA government not to bring liquor, tobacco and petroleum products under Goods and Service Tax (GST) ambit. It also has demanded non-inclusion of agriculture market fee, entertainment and betting taxes in GST category.

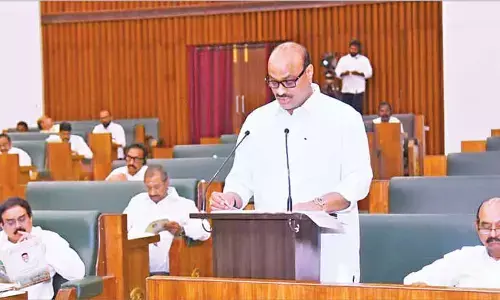

Finance Minister Etela Rajender made these observations at the meeting of the Empowered Committee which recorded the view of the Finance Ministers from various states, held few days ago in New Delhi.

Welcoming Centre's moves to bring in a uniform GST throughout the country at the earliest, Rajender, however expressed concern over potential loss of revenue to states after new taxation method came into effect.

He brought to the notice of the committee about non-payment of Central Sales Tax (CST) compensation to the tune of Rs 5000 crore to the State since 2007. Such a situation should not arise and Centre should pay compensation to states which may suffer a loss of revenue with the introduction of GST.

Stating that Telangana government is committed to empowerment of local bodies, Rajender felt powers of local bodies to raise taxes should not be taken away. On the issue of dual control, the Minister felt that issue required detailed study as there were fears of Central Tax authorities usurping powers even to inspect retail point.

He reiterated that Telangana State would welcome GST, but it would make informed choices about the model of GST and would reserve its right to preserve fiscal autonomy of the State granted by Constitution.

GST in a nut-shell

It may be noted that Centre is planning to implement a dual GST system. Under dual GST, a Central Goods and Services Tax (CGST) and a State Goods and Services Tax (SGST) will be levied on the taxable value of a transaction.

All goods and services, barring a few exceptions, will be brought into the GST base. There will be no distinction between goods and services. Almost 140 countries have already implemented the GST.

Most of the countries have a unified GST system. Brazil and Canada follow a dual system where GST is levied by both the Union and the State governments. France was the first country to introduce GST system in 1954.