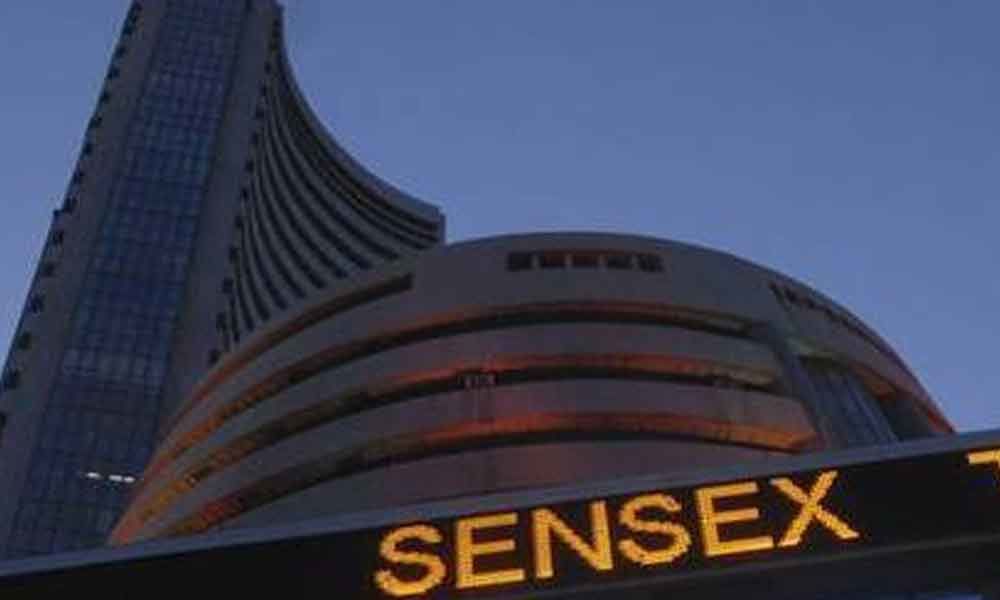

August F&O series take off on positive note

72% roll for Nifty & 76% roll for Bank Nifty; Put writers adding OI at 11,200 strike

August F&O series recorded a positive start as both the key indices recorded long addition. Bank Nifty gained one per cent with 6.9 per cent surge in Open Interest (OI) and Nifty up by 0.3 per cent with OI rising by 1.5 per cent.

The rollover data holds 72 per cent roll into August F&O series for Nifty and 76 per cent for Bank Nifty, while Nifty futures roll is at 74 per cent as against the previous three-month average of 73 per cent.

"After six consecutive sessions of fall and throbbing July series, Indian markets started August series on a positive note, supported by short covering in auto, PSU bank and pharma sectors.

The options Open Interest concentration is at the 11,400 strike calls with the highest Open Interest of above 16 lakh shares.

Among Put options, the 11,200 strike taking the total Open Interest to 21 lakh shares, with the highest Open Interest among Put options," observes Dhirender Singh Bisht, senior research analyst (derivatives) at SMC Global Securities Ltd.

The post-Budget drop in broad-based NSE index is likely to pause near 11,200-11,000 level. The recovery from lower levels is expected in the long series of August.

July F&O series concluded on July 25 on negative note as Nifty fell five per cent, biggest drop since October 2018, and Bank Nifty eased seven per cent.

July series witnessed liquidation of long positions, while Open Interest (OI) eased to Rs 1.29 lakh crore as against Rs 1.37 lakh crore as on June futures and options (F&O) expiry day. This is pointing to undercurrent weakness in the market.

Considering the F&O data, Nifty is likely to move in the range of 11,000-11,600, observe derivatives analysts. For the week ended July 26, 2019, BSE Sensex shed 454.22 points or 1.18 per cent and closed at 37,882.79 points from previous week's close of 38.337.01 points.

NSE Nifty fell 134.95 points or 1.18 per cent to end the week at 11,284.30 points as against 11,419.25 points on July 19.

Halting the six-session losing streak, the market benchmark indices recouped losses marginally on Friday as finance and banking stocks supported the recovery. Nifty is closer to 200-DMA of 11,130 level.

"On higher side, however, 11,300-11,350 zone will act as immediate resistance for Nifty. After a steep fall from 11,650 till 11,250 levels, we expect markets to consolidate in broader range of 11,200-11,350 before taking another decisive move," forecasts Bisht.

Since Put writers are active adding OI at 11,200 strike, this may act as strong support for Nifty.

"Put-Call ratio of OI for the week closed at 1.50, which indicates OTM Put writing. From derivative front, 11,200 level should act as a strong support for Nifty moving forward as Put writers were seen adding Open Interest in 11,200 strike," maintained Bisht.

OI in Nifty futures on July expiry session was at Rs20,200 crore as against OI of Rs 22,800 crore on June expiry day. Cost of rollover was about 50 basis points (bps).

The market volatility increased from 11.5 per cent to 14.5 per cent, when the Nifty declined from 11,700 to 11,230. However, volatility has again declined below 13 per cent and it also signals towards no major correction expected in the index.

"The Implied Volatility of calls closed at 12.08 per cent, while that for Put options closed at 12.39 per cent. The Nifty VIX for the week closed at 12.64 per cent and is expected to remain sideways," added Bisht.

Bank Nifty

Registering a net fall of 445.05 points or 1.49 per cent, the NSE banking index closed at 29,325.30 points as against 29,770.35 points.

According to ICICI Direct.com, the Bank Nifty remained largely choppy for the July series as it has corrected from 31,500 to 28,800.

The correction was on the back of long liquidation. The Bank Nifty started the August series with lower OI base indicating lack of short participation.

Since the current price ratio of Bank Nifty-Nifty slipped below 2.60 level, analysts forecast that buying interest can accelerate pace once the index manages to end above 29,500. Then the ratio may move towards 2.65 level.