Hyderabad sees highest capital flows of $384 mn

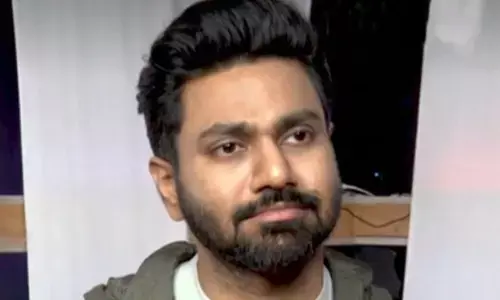

Prashant Thakur, Director and Head – Research, Anarock

Institutional investments in realty up 21% in Jan-Mar qtr at $922 mn

Hyderabad witnessed the highest capital flows of $384 million, accounting for a 42 per cent share of investments during the first quarter of 2021 as per a recent report by a leading real estate consulting firm.

Institutional investments in real estate rose 21 per cent in January -March period of this year at $922 million but inflow of funds may be impacted in this quarter due to spurt in cases of Covid-19 infections, according to JLL.

Mumbai accounted for 21 per cent share of investments with $193 million deployed in its office and residential segments, supported by the reduction in stamp duty introduced by the State Government of Maharashtra.

Recently, Knight Frank India came out with a report mentioning that private equity investment in real estate jumped over 16-fold in January-March 2021 to $3.24 billion as several deals spilled over from the last year.

According to property consultant JLL India, institutional flow of funds includes investments by family offices, foreign corporate groups, foreign banks, proprietary books, pension funds, private equity, real estate fund-cum-developers, foreign funded NBFCs and sovereign wealth funds. It also includes anchor investors in REITs.

"Institutional investments continued the momentum during the first quarter (January-March) of 2021, registering 21 per cent growth in volumes at $922 million, indicating sustained investor interest in India's real estate market," JLL said in a statement. The consultant attributed the rise in institutional investments to increased activity from funds and closed development stage deals.

"However, the pandemic surge during the second half of March 2021 is expected to delay the investment pipeline in the second quarter," it cautioned. Among asset classes, institutional investments in residential segments fell to $58 million in January-March 2021 from $74 million in the year ago period. But, the inflow of funds in office market grew to $864 million from $505 million.

Recently, Anarock said that private equity investment in real estate rose 19 per cent during the last fiscal year to $6.27 billion despite the Covid-19 pandemic.