IT stocks may trigger downtrend despite improving fundamentals

Unnervedand rattled by the impact of AI on major IT companies, weak earnings and rising geopolitical tensions in Middle East; the Indian benchmarks indices erased some of their recent gains during the week ended.

The Sensex declined 953.64 points, or 1.14 per cent, to close at 82,626.76, while the Nifty shed 222.6 points, or 0.86 per cent, to end at 25,471.10. Mixed trend was seen in the broader market. The BSE Smallcap index rose 0.8 per cent and the Nifty Midcap index fell 0.4 per cent during the week.

Reversing their buying trend in the last fortnight, FIIs sold equities worth Rs 4,019.09 crore during the week. In contrast, DIIs extended support to the market, with net purchases of Rs 6,883.81 crore. During the week, TCS recorded the steepest erosion in market capitalisation, followed by Infosys, HDFC Bank, and Reliance Industries.

On the other hand, State Bank of India, Bajaj Finance, and Larsen & Toubro witnessed an increase in their market capitalisation. The Indian rupee ended marginally higher for the second consecutive week, closing at 90.64 per dollar. A phase of consolidation appears likely before a renewed attempt toward 91.80–92.50 say forex watchers.

A notable release during the week was the first retail inflation data under the newly revised CPI series, which came in at a benign level at 2.75 per cent YoY which is within the RBI’s 2-6 per cent target band. This has reinforced overall macro resilience, contained inflation in a “Goldilocks” phase with strong growth and fiscal discipline, and policy flexibility for the RBI to potentially maintain a prolonged pause on rate.

Market sentiment has strengthened after the fiscally prudent and growth-oriented Union Budget and the India–US trade agreement but mounting fears over AI led disruption over IT sector dampened the sentiment for at least near term say market players. It is pertinent to observe that IT services firms are the indispensable “plumbers of the tech world” and their dividend yields have now hit levels last seen only during the global financial crisis and COVID-19.

The real impact of the ‘Anthropic shock’ on the IT sector is yet to be ascertained. Panic selling in IT stocks at this stage may not be a good idea. Contrarians can attempt position trade buying from current levels. The US military is preparing for the possibility of sustained, weeks-long operations against Iran if US President Donald Trump authorises military action, signalling the risk of a far more serious escalation between the two countries.

For Indian markets, such global cues carry added weight, particularly amid volatile Foreign Portfolio Investor (FPI) flows. With global equity markets swinging sharply on rate expectations, geopolitical risks and shifting sector narratives; long-term investors should stick to fundamentals, focusing on cash generation and resisting the urge to follow market fashion. Over time, patience and value-driven discipline continue to be the most reliable drivers of sustainable returns.

Do your homework before making a decision. Once you’ve made a decision, make sure to re-evaluate your portfolio on a timely basis. A wise holding today may not be a wise one in the future.

FUTURES & OPTIONS / SECTOR WATCH

Markets got spooked by the AI Jitters which kept the IT sector under pressure as concerns over AI-driven disruption continued to weigh on investor sentiment. Selling pressure intensified toward the latter half, dragging the index to an intra-week low of 25,444 before settling near the lower end of the range. The price action over the past several weeks resembles a mild distribution phase near the recent highs. In the derivatives segment, the significant Call open interest for Nifty was observed at the 26,000 and 25,600 strikes level whereas notable Put open interest was concentrated at the 25,000 and 25,500 strikes. For Bank Nifty, significant Call open interest was seen at the 60,500 strike with substantial Put open interest at the 60,000 strike. Implied volatility (IV) for Nifty’s Call options settled at 10.10 per cent while Put options concluded at 11.05 per cent. The India VIX, a key indicator of market volatility concluded the week at 11.72 per cent. The Put-Call Ratio Open Interest (PCR OI) stood at 1.11 for the week. For the coming week, the markets are likely to see a cautious and potentially volatile start given the rise in VIX and the index closing near its weekly low. Immediate resistance levels are placed at 25,728 (20-week MA) and 26,000. Key supports come in at 25100. Even though the index is still trading above the 25,250–25,200 zone which is seen as a key support area; only a decisive move back above 25,800–26,000 would negate the immediate weakness.

Stocks looking good are Apollo Hospitals, Bharti Airtel, Bajaj Finance, Crompton, Torrent Power and Unominda. Stocks looking weak are BDL, BHEL, Canara Bank, IREDA, LIC Hsg and RVNL.

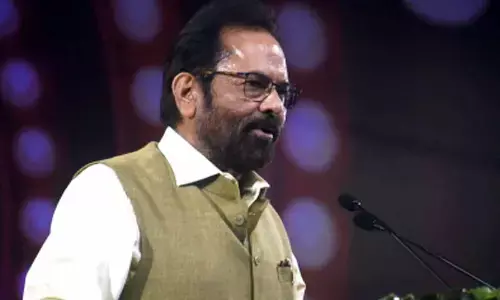

(The author is a senior maket analyst and former vice-chairman, Andhra Pradesh State Planning Board)