Keep off cos under IBC, go after promoters

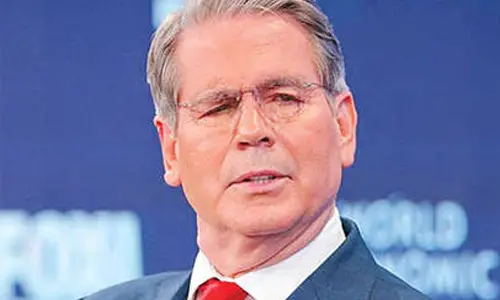

State Bank chairman Rajnish Kumar on Tuesday said the Enforcement Directorate and other central law enforcement agencies should restrict to attaching personal assets while investigating a promoter and keep off the company which is under the insolvency process.

Mumbai: State Bank chairman Rajnish Kumar on Tuesday said the Enforcement Directorate and other central law enforcement agencies should restrict to attaching personal assets while investigating a promoter and keep off the company which is under the insolvency process.

Speaking a day after NCLAT asked the ED to release the attached properties of Bhushan Power & Steel, which is being taken over by JSW Steel, Kumar asserted the lenders' first right of taking charge of an asset of its bank-financed and said no one should dispute the same.

"Any action which ED or any other central authority has to take, they can take with the existing promoters and attach their personal assets leaving their companies away," he said, speaking at a Bloomberg event here.

Kumar said the agencies should follow this rule especially in case of companies which are undergoing bankruptcy process, as new suitors are "not fools" to risk their money.

"The person acquiring a company cannot be subjected to any harassment by any agencies and I am sure that will be guaranteed now," Kumar said, adding as per the spirit of the bankruptcy code, an acquirer needs a "clean asset".

It can be noted that over the weekend ED had attached assets worth Rs 4,025 crore while probing money laundering linked to an alleged bank loan fraud against the BPSL promoters.

This was challenged by JSW Steel at the NCLAT, which on Monday had slammed the ED, saying the bankruptcy code would fail if the agency functioned like this and ordered the property be released.

JSW Steel had won the bid to buy company for Rs 19,700 crore. Kumar said the Supreme Court judgment on Essar Steel should address much of the worries which are leading to legal tangles in the nascent bankruptcy laws.

He said there will not be any more consolidations once the number of state-run lenders gets down to 12, and private sector lenders should also acquire smaller rivals.

Meanwhile, Kumar also said since public private partnership model has not succeeded, a new model needs to emerge, and the government cannot continue to take the financial burden on projects.

If required, we bankers should be willing to take pains in the short-term as a new model emerges, he added. "I am not saying all was well or is well with the behaviour of promoters.

There are issues and they are coming out. Take a large power plant for instance. We need a promoter with means to put it and run it. How many promoters are left with the capability to bring in equity and invest today?"

He said large companies and those big mid-size ones have utilised only 31 per cent of their working capital limits, while smaller companies have utilised 70 per cent.

There has been a 15 per cent increase in term loans for the bank on a year-on-year basis, as there is lot of appetite for credit, he said.