OI bases signal narrow-range trading

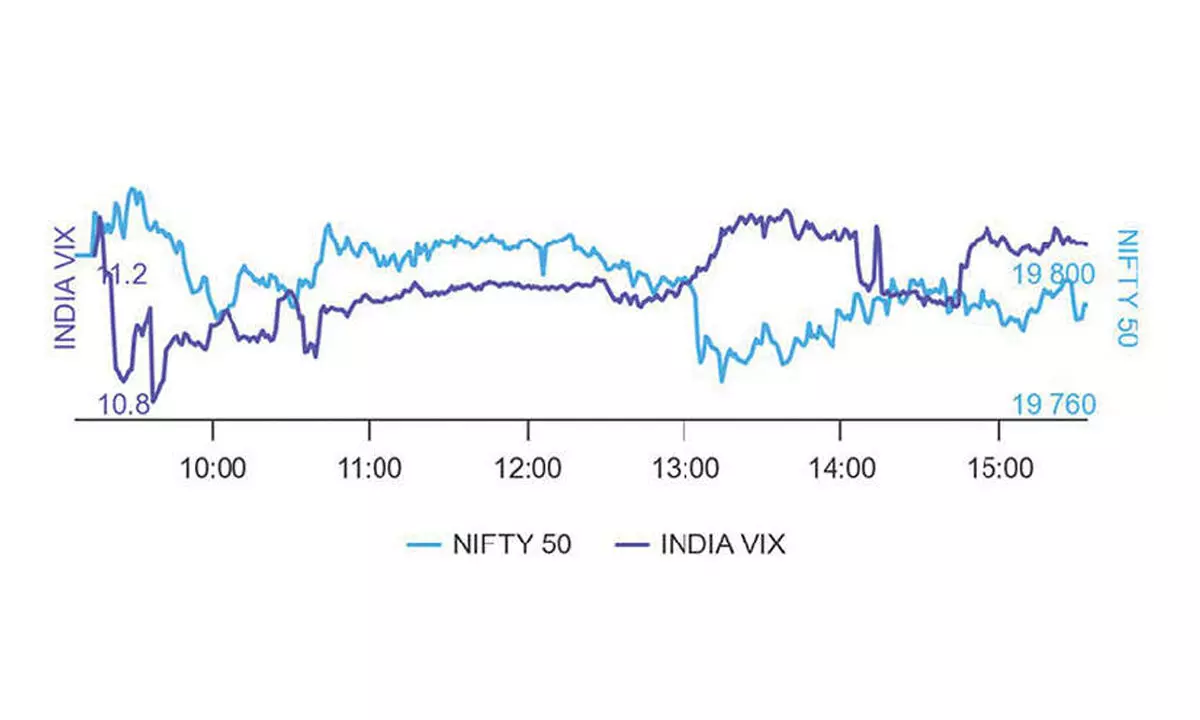

India VIX rose 0.13 per cent to 11.33 level; Put-Call Ratio of OI at 0.99 signals undercurrent moderate bullish bias

The 19,900CE strike has highest Call OI followed by 20,000/ 19,800/ 20,200/ 20,300/19,850/20,400 strikes, while 19,900/19,800/19,850/ 20,400/20,150 strikes recorded reasonable addition of Call OI.

And on the Put side, maximum Put OI is seen at 19,800/ 19,000/ 19,200/ 19,300/ 19,400/ 19,600/ 19,500/ 19,700 strikes. Further, 19,600/ 19,400/ 19,000/19,800 strikes witnessed moderate build-up of Put OI. Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “Nifty maximum Call Open Interest concentrated is at strikes 19,800 and 19,900 points, whereas on Put side, the highest Open Interest is at strikes of 19,800 and 19,500.”

The narrowing gap between resistance and support levels is indicating limited range trading for the truncated week ahead (Nov 28-Dec 1). And the market is closed on Monday for Guru Nanak jayanti. “In the week gone by, both Nifty and Bank Nifty indices managed to close with minor gains, indicating a market characterized by cautious optimism. The trading sessions witnessed a prevailing theme of narrow-range movements, reflecting a lack of decisive momentum. The subdued volatility suggests a cautious approach among investors, possibly awaiting clearer signals for a sustained trend. Last week we saw the PSU banks sector facing headwinds, emerging as a major laggard. On the positive side, realty, metal and oil & gas sectors displayed notable strength,” observes Bsiht.

On the weekly front, the BSE benchmark climbed 175.31 points or 0.26 per cent, and the Nifty advanced 62.9 points or 0.31 per cent.

BSE Sensex closed the week ended November 24, 2023, at 65,970.04, a net recovery of 175.31 points or 0.26 per cent, from the previous week’s (October 17) closing of 65,794.73 points. During the week, NSE Nifty too advanced 62.9 points or 0.31 per cent to 19,794.70 points from 19,731.80 points a week ago.

Bisht forecasts: “Nifty is continuously trading around 19,800 level, which is now a key level. Given the prevailing narrow-range trading, investors may exercise caution and remain adaptable to changing market. In the upcoming week, Nifty may test 19,600 level on the downside, while on the upside, it may test the 20,000 level.”

India VIX rose 0.13 per cent to 11.33 level. “Implied Volatility for Nifty’s Call options settled at 9.48 per cent, while Put options concluded at 10.65 per cent. The India VIX, a key indicator of market volatility, concluded the week at 11.32 per cent. The Put-Call Ratio of Open Interest stood at 0.99 for the week,” said Bisth.

Bank Nifty

NSE’s banking index closed the week at 43,769.10 points, higher by 185.14 points or 0.42 per cent from the previous week’s closing of 43,583.96 points. “In Bank Nifty, the highest Call Open Interest noted at strikes of 44,000 and 44,500 whereas the highest Put Open Interest concentrated at strikes of 43,500 and 43,000,” remarked Bisht.

The 44,000 level is a key resistance for Bank Nifty and above which it may gallop further upwards. the support level is at 43,500 points.